In today’s GST-driven business environment, accurate invoicing is not just a good practice – it’s a legal requirement. Every business, whether a manufacturer, trader, retailer, or service provider, must issue the right type of document for every transaction. Doing so ensures compliance with tax laws, helps maintain transparent records, and avoids penalties or legal complications.

Among the most commonly used GST documents are Tax Invoices and Bills of Supply. At first glance, they might look similar, but their purposes, legal requirements, and applicability differ significantly. Understanding these differences is essential for any business that wants to remain GST-compliant and run operations smoothly.

In this detailed guide, we will cover:

- What is a Tax Invoice?

- What is a Bill of Supply?

- The key differences between the two.

- When to use each type of document.

- Common mistakes to avoid for 100% GST compliance.

Additionally, we’ll show you how VyapaarKHATA – an intuitive and powerful invoicing and accounting solution – helps MSMEs and SMEs in India create GST and Non-GST invoices effortlessly, manage inventory, track expenses, and stay compliant with minimal effort.

Before we dive into the details, let’s understand why these documents exist in the first place. Under the Goods and Services Tax (GST) regime in India, the government has defined specific types of documents for different types of transactions. The two primary ones are:

- Tax Invoice – Issued for taxable supplies of goods or services.

- Bill of Supply – Issued for exempt supplies or by composition scheme dealers.

What is a Tax Invoice?

A Tax Invoice is a legally recognized document under the Goods and Services Tax (GST) law in India. It is issued by a GST-registered supplier when supplying taxable goods or services. This document is crucial because it serves as the primary proof of a taxable transaction and enables the recipient to claim Input Tax Credit (ITC) against the tax paid.

According to GST rules, a tax invoice must be issued before or at the time of removal of goods for supply or within 30 days of providing services. It must contain all mandatory details prescribed under the GST Act.

Purpose of a Tax Invoice

- Acts as an official record of a taxable transaction between a supplier and recipient.

- Provides all details of goods or services sold, including applicable GST rates and amount.

- Enables the buyer to claim Input Tax Credit (ITC), reducing their overall tax liability.

- Helps in maintaining proper compliance and accounting records as per GST law.

Who Must Issue a Tax Invoice?

- Regular Taxpayers registered under GST.

- Exporters who supply goods/services with payment of tax.

- Service Providers operating under the normal GST scheme.

- Any business making taxable supplies of goods or services within India.

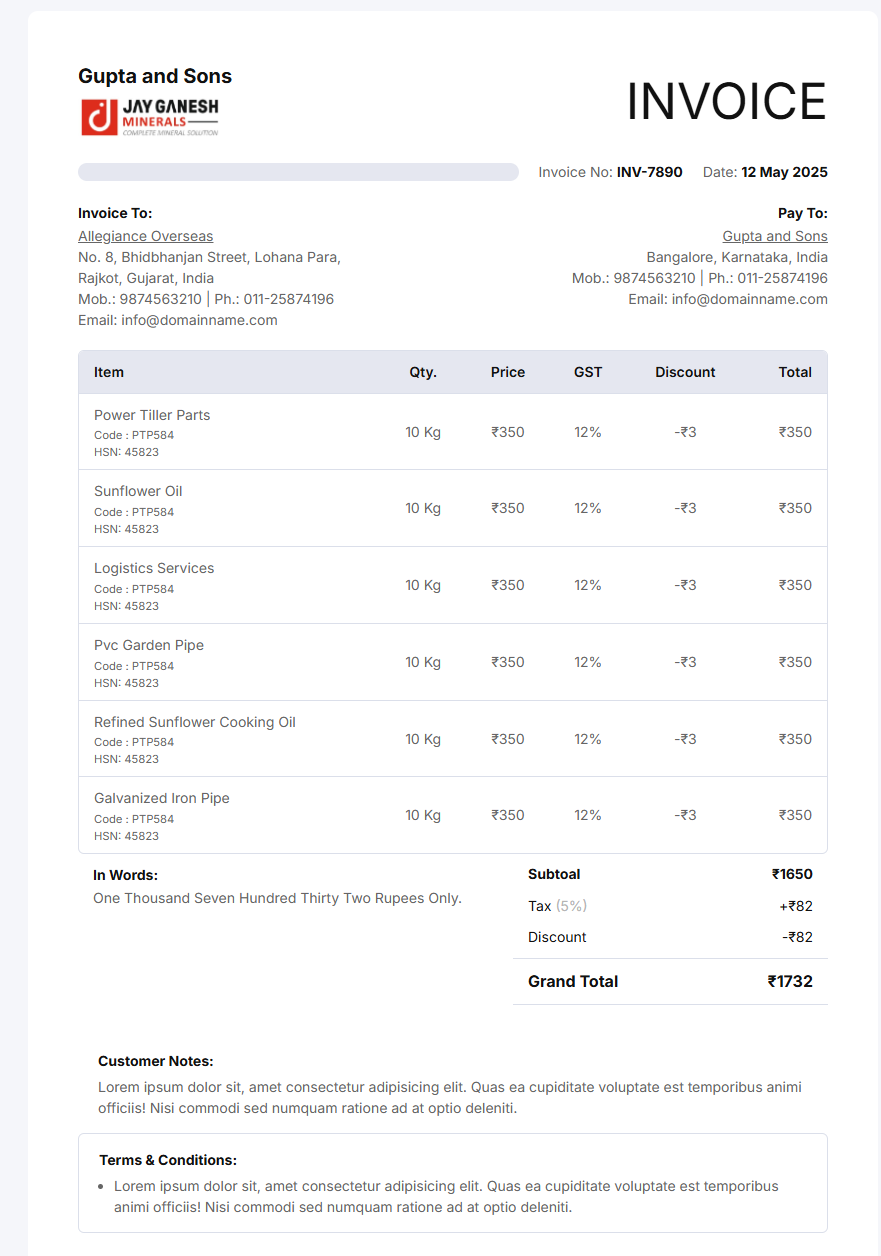

Mandatory Contents of a Tax Invoice

- Supplier’s Name, Address, and GSTIN.

- Unique Invoice Number and Date of Issue.

- Recipient’s Name, Address, and GSTIN (if registered).

- Description of goods or services supplied.

- HSN Code for goods or SAC Code for services.

- Quantity and unit price (for goods).

- Taxable Value of supply and applicable GST rate (CGST, SGST, IGST).

- Total amount of tax charged.

- Place of Supply and State code (important for determining IGST or CGST+SGST).

- Signature or Digital Signature of the supplier or authorized representative.

Example: If you sell Rs 10,000 worth of goods at 18% GST, the tax invoice must show:

• Taxable value = Rs 10,000

• CGST = Rs 900

• SGST = Rs 900

• Total Invoice Value = Rs 11,800

Best invoice formate for:

What is a Bill of Supply?

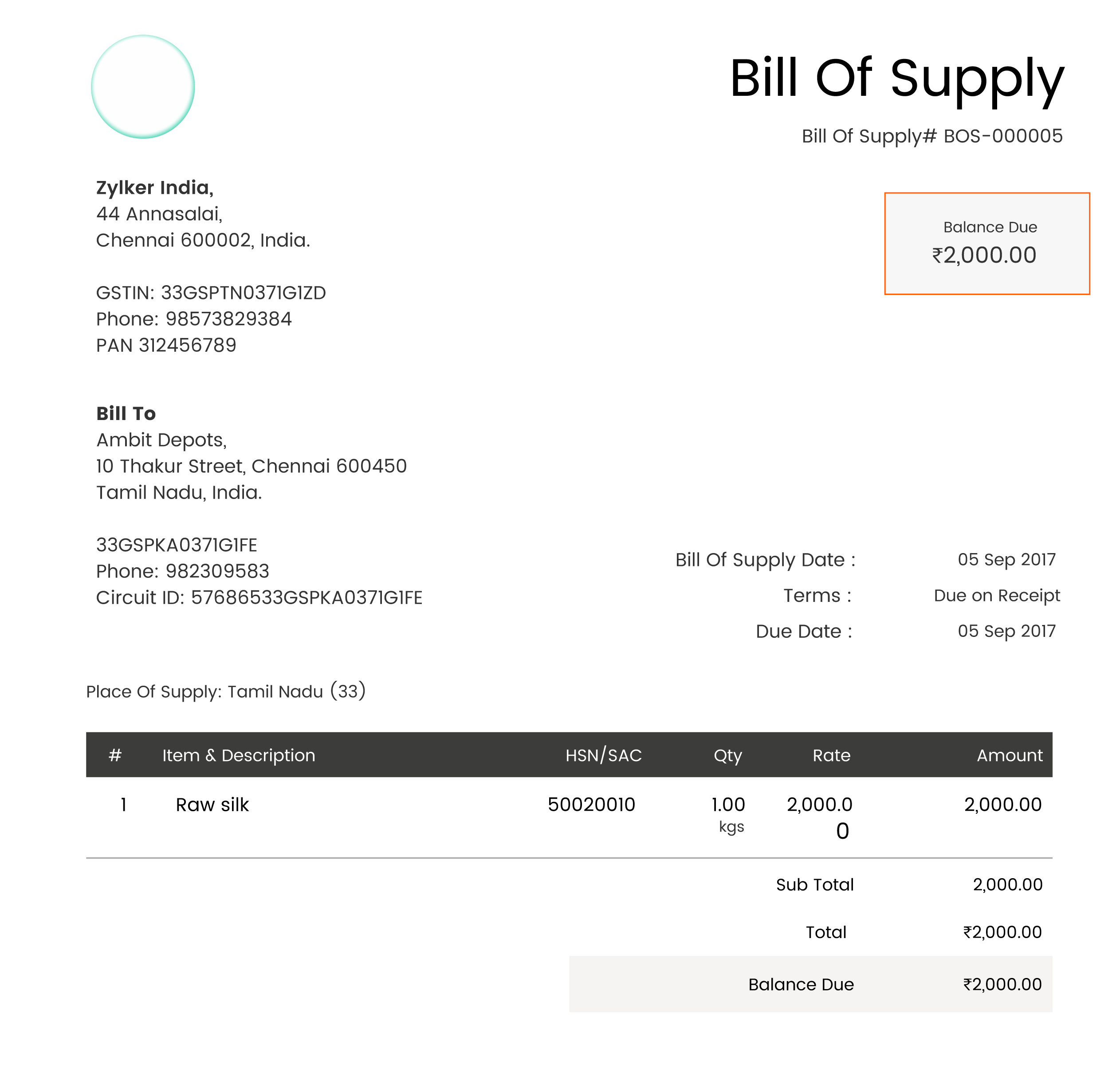

A Bill of Supply is another type of document recognized under GST law, but it is issued in cases where the supplier cannot charge tax on the invoice. This could happen because the goods or services supplied are exempt from GST, or the supplier is registered under the Composition Scheme (where they pay a fixed tax rate on turnover without collecting tax from customers).

Unlike a tax invoice, a bill of supply does not include any tax amount or tax breakdown. It is primarily used for compliance and record-keeping purposes in non-taxable or composition scenarios.

Who Issues a Bill of Supply?

- Suppliers of exempt goods or services (e.g., fresh fruits, vegetables, educational services, healthcare).

- Composition Scheme Dealers under GST, who cannot charge tax on their invoices.

- Exporters supplying goods or services without payment of tax under LUT (Letter of Undertaking) or Bond.

Mandatory Contents of a Bill of Supply

- Supplier’s Name, Address, and GSTIN.

- Unique Bill Number and Date of Issue.

- Recipient’s details (Name, Address, and GSTIN if registered).

- Complete Description of goods/services supplied.

- Value of supply (no tax details).

- Signature or Digital Signature of the supplier or authorized person.

Example: If you are a composition dealer selling goods worth Rs 10,000, your Bill of Supply will only show:

• Description of goods = Rs 10,000

• Total amount payable = Rs 10,000

• (No tax details included)

Key Differences Between Tax Invoice and Bill of Supply

While both Tax Invoice and Bill of Supply are important under the GST regime, they serve different purposes and have distinct features. Below is a detailed comparison based on key aspects like purpose, applicability, tax component, and compliance requirements.

| Basis of Difference | Tax Invoice | Bill of Supply |

|---|---|---|

| Purpose | Issued for taxable supplies of goods or services. Enables claiming Input Tax Credit (ITC). | Issued for exempt supplies or by composition scheme dealers. Does not allow ITC. |

| Tax Component | Includes GST details (CGST, SGST, IGST) and the applicable rate. | Does not include any GST details. |

| Input Tax Credit (ITC) | Recipient can claim ITC based on this invoice. | Recipient cannot claim ITC as no tax is charged. |

| Applicability | Applicable to all regular GST taxpayers making taxable supplies. | Applicable to exempt suppliers, composition dealers, and exporters under LUT/Bond. |

| Mandatory Details | Supplier and recipient details, GSTIN, HSN/SAC codes, tax rates, taxable value, place of supply, signature. | Supplier and recipient details, description of goods/services, value of supply, signature. No tax details. |

| Relevance for GST Filing | Must be reported in GSTR-1 and GSTR-3B as part of outward supplies. | Also reported in GST returns but without tax details. |

In short, a Tax Invoice is mandatory when GST is applicable and ITC can be claimed, while a Bill of Supply is used when no GST is charged. Issuing the correct document ensures compliance with GST law and helps avoid penalties.

When to Use Each Document?

- Tax Invoice: For taxable supplies, exports with tax.

- Bill of Supply: For exempt supplies, composition dealers, exports without tax.

Common Mistakes and Compliance Tips

- Issuing the wrong document type → Leads to penalties.

- Missing mandatory details like GSTIN, HSN code.

- Incorrect serial numbering.

- Wrong tax calculation.

How VyapaarKHATA Makes Invoicing Simple for Indian Businesses

Managing multiple invoices, tax rules, and compliance requirements can be overwhelming, especially for MSMEs and SMEs. That’s where VyapaarKHATA steps in as your trusted invoicing and accounting partner.

Key Features of VyapaarKHATA:

- Create GST & Non-GST Invoices and Bills in seconds.

- Send invoices via Email or WhatsApp instantly.

- Manage customer contacts and suppliers effortlessly.

- Inventory and Purchase Management.

- Expense Management for better control.

At VyapaarKHATA, we aim to provide the most affordable invoicing solution for Indian SMEs, empowering 63 million businesses to go digital.

The difference between a Tax Invoice and a Bill of Supply lies in whether GST is applicable or not. Choosing the right document ensures compliance and avoids penalties.

Simplify this process with VyapaarKHATA – the best solution for invoicing, billing, inventory, and expense management.

Start your journey towards hassle-free invoicing today with VyapaarKHATA!