In the evolving business landscape, especially in service-driven industries, cash flow consistency and predictable income are crucial for survival. Whether you’re a freelancer, a marketing agency, a consultant, or a software developer, managing payments effectively can mean the difference between smooth operations and constant stress.

This is where retainer invoices come in.

A retainer invoice is a document businesses send to clients requesting advance payment for future or ongoing work. It’s not just a billing format — it’s a financial strategy that ensures:

- You’re paid upfront,

- Your client commits to a defined work period,

- Your cash flow remains stable throughout the contract term.

Unlike traditional invoices, which are sent after the work is completed, retainer invoices are issued before or at the start of a service engagement.

For example, a digital marketing firm might charge a monthly retainer of ?50,000 for social media management. The firm issues a retainer invoice at the beginning of the month — securing funds to allocate resources and plan tasks efficiently.

What Exactly is a Retainer Invoice?

A retainer invoice is a billing document requesting advance payment or deposit from a client to cover part or all of future services.

The payment received through a retainer invoice is typically treated as “unearned income” until services are delivered — at which point it becomes recognized as “earned revenue.”

Key Characteristics of a Retainer Invoice

- Issued in Advance: Sent before work begins.

- Represents Commitment: It secures both parties — the client commits payment, and the business commits resources.

- Adjustable or Refundable: Depending on agreement terms, the retainer may be adjusted against the final bill or refunded if unused.

- Legally Binding: When linked with a retainer contract, it serves as an official record of advance payment.

Example:

ABC Consultants issues a retainer invoice of Rs 1,00,000 to XYZ Pvt Ltd for a three-month consulting engagement. This advance covers the first phase of the project and will be adjusted in the final invoice.

The Purpose of Retainer Invoices

A retainer invoice serves several strategic and financial purposes:

a. Cash Flow Stability

It ensures predictable monthly or quarterly income, helping businesses plan resources, salaries, and expenses more effectively.

b. Client Commitment

Clients who pay retainers are more likely to stay engaged and honor project timelines. This reduces the risk of last-minute cancellations or unpaid work.

c. Simplified Billing

Instead of generating multiple invoices for small milestones, businesses can raise one retainer invoice and adjust future work accordingly.

d. Professionalism

It portrays your business as structured, reliable, and organized—traits that enhance trust among clients.

Common Scenarios Where Retainer Invoices Are Used

Retainers are increasingly popular across various industries. Below are examples of where retainer invoices are most commonly applied:

| Industry | Typical Retainer Model | Example |

|---|---|---|

| Digital Marketing | Monthly fee for ongoing marketing, SEO, or content services. | Rs 40,000/month retainer for SEO management. |

| Legal Services | Clients pay upfront to have legal counsel available on demand. | Rs 1,00,000 annual retainer for advisory services. |

| Consulting | Strategic advisory or project supervision on recurring basis. | Rs 75,000 per quarter for management consulting. |

| IT & Software Maintenance | Monthly or annual retainers for system upkeep or updates. | Rs 60,000/year for server maintenance. |

| Creative Agencies | Regular graphic design, ad creation, or media services. | Rs 25,000/month creative retainer. |

| Construction / Architecture | Advance payments for project design or site supervision. | 20% advance retainer on project cost. |

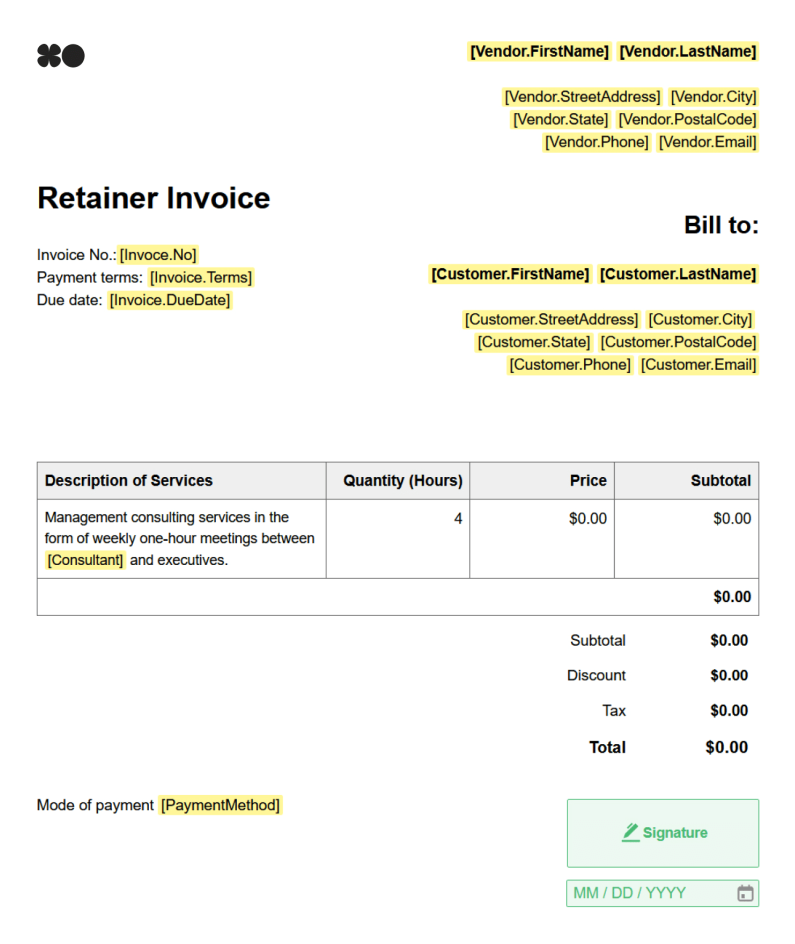

Key Components of a Professional Retainer Invoice

A retainer invoice should clearly communicate the purpose of the payment and how it will be used. It must also be legally compliant and client-friendly.

Here are the essential elements to include:

1. Business Information

- Company name, address, logo

- GSTIN, PAN, and contact details

2. Client Information

- Name, address, contact info, and GST details (if applicable)

3. Invoice Number and Date

Each retainer invoice should have a unique, sequential invoice number for tracking.

4. Description

Include a clear line item stating the purpose — e.g. “Retainer Fee for December 2025 – Social Media Management Services.”

5. Retainer Amount

Mention the exact amount requested as advance payment.

6. Applicable Taxes

Include GST or other statutory taxes as per government norms.

7. Payment Terms

State when and how the payment is due (e.g., “Due within 7 days of issue”).

8. Adjustment or Refund Policy

Explain how the retainer will be adjusted against future invoices or refunded (if applicable).

9. Signature or Authorization

Include a signatory name or digital signature to authenticate the invoice.

10. Notes or Terms

Add notes such as:

“This retainer fee will be adjusted against the final project invoice upon completion.”

Retainer Invoice vs Standard Invoice

| Aspect | Retainer Invoice | Standard Invoice |

|---|---|---|

| Timing | Issued before or during project | Issued after work completion |

| Purpose | Request advance payment | Request payment for delivered work |

| Accounting Type | Liability (Unearned revenue) | Income (Earned revenue) |

| Refundability | Sometimes refundable | Not refundable |

| Frequency | Periodic (monthly/quarterly) | One-time per job |

| Common Use Case | Ongoing services | Completed projects or product sales |

This distinction is crucial for compliance and accurate bookkeeping — and VyaaparKhata automates this differentiation, preventing accounting errors.

The Accounting Perspective: Recording Retainers Properly

How Retainers Appear in Financial Records

When you receive a retainer payment, it is not immediately considered income. Instead, it’s booked as:

Unearned Revenue (Liability)

Once you deliver the corresponding service, it is moved to:

Service Revenue (Income)

Example in Practice

- Receive Retainer Payment

- Debit: Cash/Bank ?50,000

- Credit: Unearned Income ?50,000

- After Service Delivery

- Debit: Unearned Income ?50,000

- Credit: Service Revenue ?50,000

VyaaparKhata streamlines this process by automatically updating your income records when you link a retainer invoice with a final service invoice.

Step-by-Step Guide: How to Create a Retainer Invoice Using VyaaparKhata

Here’s a practical workflow for creating and managing retainer invoices efficiently:

Step 1: Define the Retainer Agreement

Before invoicing, outline:

- Scope of work

- Retainer amount

- Payment schedule (monthly/quarterly)

- Adjustment and refund policies

- Validity period

You can attach this document within VyaaparKhata for reference.

Step 2: Create a New Invoice

- Open VyaaparKhata Dashboard

- Click on Create Invoice → Select Retainer/Advance Invoice Type

- Choose your client profile or create a new one.

Step 3: Add Invoice Details

- Enter the retainer amount

- Add a clear description (“Advance Retainer for Q1 2026 Marketing Services”)

- Apply GST automatically using the integrated tax module.

Step 4: Include Adjustment Terms

In the notes section, mention:

“This retainer will be adjusted against future invoices under this contract.”

Step 5: Add Payment Instructions

Include:

- UPI ID, Bank Account Details, or Payment Link

- Optional digital signature

Step 6: Save and Share

Download the PDF or send directly to the client via WhatsApp or Email from within the platform.

Step 7: Track and Adjust

Once the final invoice is generated, you can easily link and deduct the retainer amount from the total bill — VyaaparKhata will automatically reflect this adjustment in reports.

Types of Retainer Arrangements and Invoice Formats

| Type | Purpose | Typical Example |

|---|---|---|

| Fixed Retainer | A set monthly/quarterly fee for ongoing services. | ?30,000/month for legal advisory. |

| Project-Based Retainer | Advance payment for a one-time project. | 25% upfront before website development begins. |

| Hourly Retainer | Advance block of hours paid in bulk. | 40 hours @ ?1,000/hour = ?40,000 retainer. |

| Evergreen Retainer | Automatically renewing recurring payment. | Monthly software maintenance on autopay. |

| Hybrid Retainer | Combination of fixed and variable charges. | ?25,000 monthly + performance-based bonus. |

VyaaparKhata allows saving multiple retainer templates so you can choose the right format instantly.

GST Compliance and Legal Considerations

Retainer invoices in India fall under advance payments, which means GST must be charged at the time of payment receipt (for registered businesses).

GST Guidelines:

- A Tax Invoice or Receipt Voucher must be issued when the advance is received.

- GST liability arises on receipt of advance (except for exempt services).

- When the final invoice is issued, GST already paid on the retainer is adjusted.

VyaaparKhata’s GST module automatically applies:

- Correct tax codes,

- Valid HSN/SAC codes,

- And maintains compliance with GST return formats (GSTR-1, GSTR-3B).

This helps eliminate manual filing errors and saves hours of administrative work.

Advantages of Using Retainer Invoices

For Businesses

- Predictable monthly revenue

- Better cash flow planning

- Client retention through long-term contracts

- Reduced payment delays

- Easier project scheduling and resource allocation

For Clients

- Priority access to services

- Fixed monthly/annual cost predictability

- Simplified financial planning

- Reduced administrative burden of frequent billing

Common Mistakes to Avoid in Retainer Invoicing

- No written agreement — Always pair your retainer invoice with a signed retainer contract.

- Not mentioning adjustment policy — Leads to confusion or disputes.

- Mixing retainer and service charges — Keep advance and delivery invoices separate.

- Incorrect GST handling — Ensure compliance by using software like VyaaparKhata.

- Manual tracking — Paper or Excel records often lead to mismatch; automation is key.

- Ignoring accounting entries — Advance must be recorded as liability, not income.

How VyaaparKhata Simplifies the Entire Process

VyaaparKhata is more than just an invoicing tool — it’s a complete business management solution built for Indian SMEs, freelancers, and agencies.

Key Features That Make Retainer Invoicing Effortless:

Retainer & Advance Invoice Templates

Professionally designed formats for one-click invoice creation.

Automated Adjustment System

Easily offset retainers against future invoices — without manual calculation.

Integrated Stock & Service Management

Track both tangible stock and service-based billing under one platform.

GST & E-Invoice Compliance

Generate GST-ready invoices with valid QR codes and IRN numbers automatically.

Recurring Invoice Automation

Perfect for monthly retainers — generate invoices automatically on set dates.

Real-Time Payment Tracking

See which invoices are paid, partially paid, or pending at a glance.

Expense & Report Dashboard

Monitor your revenue flow, liabilities, and retainer adjustments through detailed analytics.

Retainer Invoice Example Format (India)

Invoice Title: Retainer Invoice – January 2026

Invoice No: VK-RET-2026-001

Date: 01-Jan-2026

Client Name: M/s GlobalTech Pvt. Ltd.

Description: Advance Retainer for Monthly Digital Marketing Services (January 2026)

Amount (Excl. GST): ?50,000

GST @18%: ?9,000

Total: ?59,000

Payment Terms: Due within 7 days

Notes:

This amount represents an advance retainer for ongoing marketing services. The retainer will be adjusted against the final invoice for January 2026.

Generated by VyaaparKhata (Invoice + Stock Management Software)

Building Trust and Stability Through Retainers

Retainer invoices are more than an administrative tool—they’re a strategic foundation for building long-term, trusted business relationships. They guarantee predictable revenue, reduce administrative complexity, and ensure mutual commitment between client and provider.

By using VyaaparKhata, you can:

- Create accurate, compliant retainer invoices in minutes,

- Automatically adjust advance payments,

- Manage inventory or service billing,

- Stay 100% GST-compliant, and

- Gain real-time visibility into your financial performance.

Whether you’re a freelancer, agency, or enterprise, VyaaparKhata transforms invoicing from a time-consuming task into an organized, automated system — empowering you to focus on what matters most: delivering value and growing your business.