As e-commerce continues to boom, more individuals and businesses are selling online than ever before. Whether you're an independent seller on Shopify, a vendor on Amazon, or running a small Instagram-based business, one thing remains constant—invoicing is essential. It’s not just about maintaining records; invoicing plays a vital role in financial transparency, customer trust, and tax compliance.

What is an E-commerce Invoice?

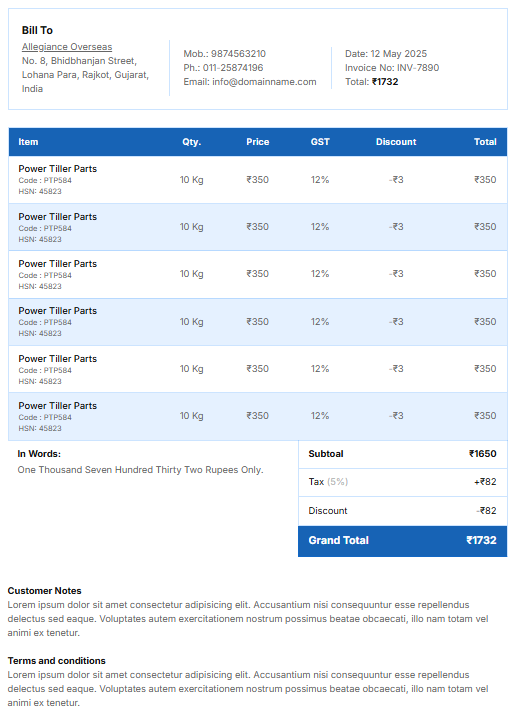

An e-commerce invoice is a legal document that provides a record of the sale between a seller and a buyer. It includes key details about the product or service sold, the price, taxes, and payment terms.

Unlike traditional retail invoices, e-commerce invoices are typically digital and are often auto-generated at the time of order placement or shipping.

In many countries, invoicing is not just good business practice—it’s a legal requirement for tax and accounting purposes.

Key Components of a Standard E-commerce Invoice

A well-structured e-commerce invoice not only serves as a record of the transaction but also ensures legal compliance, aids in smooth returns and refunds, and enhances the professionalism of your business. Below is a detailed breakdown of each critical component that should be included in a standard e-commerce invoice:

1. Seller Details (Supplier Information)

- Registered Business Name: As per legal or tax documents

- Business Address: Full postal address including city, state, and pin code

- Contact Information: Email, customer care number, website URL

- Business Registration Number: GSTIN in India, VAT ID in the EU, etc.

- Company Logo: (Optional but recommended)

Why it's important: Confirms the legitimacy of the seller and is mandatory for tax and compliance verification.

2. Buyer Information (Customer Details)

- Full Name: Of the customer or business

- Shipping and Billing Address

- Contact Number and Email Address

- GSTIN or VAT ID: If provided by the buyer

Why it's important: Ensures correct delivery and legal documentation, especially for business purchases.

3. Invoice Number

- Unique and Sequential Number: e.g., INV/2025/00123

Why it's important: Essential for tracking, auditing, and tax filing.

4. Date of Issue

- Invoice Generation Date

- Date of Supply: Optional, if different from the invoice date

Why it's important: Determines tax period and compliance.

5. Product Details

- Product/Service Name and Description

- HSN/SAC Code: For tax classification

- Quantity, Unit Price, and Total Line Amount

- SKU/Product Code: For inventory management

Why it's important: Provides clarity and aids in inventory and return processes.

6. Tax Breakdown

- Type of Tax: GST, VAT, CGST, SGST, etc.

- Applicable Rate (%)

- Tax Amount (per item and total)

Why it's important: Ensures tax compliance and eligibility for input tax credits.

7. Shipping Charges

- Shipping Fee: Listed separately

- Tax on Shipping: If applicable

Why it's important: Transparency in total cost calculation.

8. Total Amount Payable

- Subtotal (before tax)

- Total Tax Amount

- Shipping Charges

- Discounts: If any

- Grand Total (in numbers and words)

Why it's important: Avoids payment confusion and provides clarity.

9. Payment Details

- Mode of Payment: UPI, credit card, COD, etc.

- Payment Status: Paid, unpaid, partial, refunded

- Transaction ID or Reference Number

- Bank Details: For manual transfers, if applicable

Why it's important: Helps track payments and supports financial reconciliation.

10. Return and Refund Terms

- Return Window: e.g., 7 or 30 days

- Conditions for Return: Unused, original packaging, etc.

- Refund Timeline: After return is verified

- Support Contact: Email/phone for return queries

Why it's important: Builds customer trust and reduces disputes.

11. Additional Notes (Optional)

- “Thank you for shopping with us!”

- “Goods once sold will not be refunded.”

- Installation or usage instructions (if applicable)

Why it's important: Adds a personalized or informative touch.

Pro Tip: Use invoicing software that auto-generates these components and integrates with your e-commerce platform to reduce errors and save time.

Invoicing for Different Selling Channels with Vyapaar Khata

Efficient invoicing is crucial for online sellers, especially when selling across multiple platforms. Whether you're running your own website or selling on social media, here's how to manage invoicing effectively — and how tools like Vyapaar Khata can simplify the process.

1. Your Own E-commerce Website

- You have full control over the invoicing process.

- Use built-in invoice templates or integrate with accounting plugins.

- Use Vyapaar Khata to generate GST-compliant, professional invoices in just a few clicks.

- Automate invoice generation for every order, reducing manual work.

Tip: Use Vyapaar Khata’s real-time syncing to auto-track orders and send digital invoices via email or WhatsApp.

2. Online Marketplaces (Amazon, Flipkart, Etsy, etc.)

- Marketplaces typically auto-generate invoices, but you still need to reconcile these invoices with your own books.

- Maintain accurate records for GST and tax compliance in India.

- Use Vyapaar Khata to consolidate all invoices from different platforms into one dashboard.

Why Vyapaar Khata Helps: Easily import order reports and convert them into structured, exportable invoices for accounting.

3. Social Media Selling (WhatsApp, Instagram, Facebook)

- Use Vyapaar Khata to create quick, shareable invoices.

- Send invoices as PDFs via WhatsApp, email, or SMS instantly.

- Track payments, pending orders, and due invoices without switching apps.

No more spreadsheets: Vyapaar Khata is a better alternative to Excel/Google Sheets for small sellers on social platforms.

Tools & Software for E-commerce Invoicing

Modern tools like Vyapaar Khata, Zoho Books, QuickBooks, and Tally can:

- Automate invoice creation, payment tracking, and GST compliance.

- Generate professional, multi-format invoices (digital and printable).

- Integrate with your e-commerce platforms and payment gateways.

Look for features like:

- Multi-channel support

- Auto tax calculation

- Inventory linking

- Mobile accessibility

Vyapaar Khata Advantage: Easy for beginners, yet powerful enough for scaling businesses.

Common Challenges & Smart Solutions

| Challenge | Solution |

|---|---|

| Incorrect tax calculation | Use GST-compliant software like Vyapaar Khata with auto tax detection. |

| Managing bulk orders | Enable batch invoicing or bulk import/export features. |

| International invoicing | Choose tools with multi-currency and customs support. |

| Missing/duplicate invoices | Activate auto-numbering and regular cloud backup. |

| Handling returns/refunds | Issue credit/debit notes within Vyapaar Khata and keep ledgers updated. |

Best Practices for E-commerce Invoicing

- Automate invoicing for every order — avoid missed entries.

- Customize invoices with your logo, brand colors, and terms.

- Include clear tax information and refund/return policies.

- Organize invoices by month, platform, or customer for easy tracking.

- Reconcile regularly with payment and accounting data.

- Use professional formatting — clean layout builds trust with buyers.

FAQs on E-commerce Invoicing

Q1. Do I need to issue an invoice for every order?

Yes. It ensures tax compliance and better bookkeeping, even for small orders.

Q2. Can I issue only digital invoices?

Yes. Digital invoices are widely accepted, as long as they meet legal guidelines.

Q3. What if a customer cancels or returns an item?

Issue a credit note using Vyapaar Khata and update your accounts accordingly.

Q4. What if a buyer requests a GST invoice?

If you're GST-registered, you're legally required to provide a compliant invoice.

Q5. How do I invoice international customers?

Mention currency, apply relevant taxes, and ensure export documentation is in place.

Final Thoughts: Take Control with Vyapaar Khata

Invoicing isn't just paperwork — it's the foundation of your e-commerce business. Whether you're a solo seller or managing hundreds of orders daily, accurate invoicing ensures:

- Compliance with tax laws

- Smooth return and refund processes

- Professional customer experience

Start today with Vyapaar Khata — create, share, and manage invoices effortlessly across all your online selling platforms.

- Audit your current invoicing system

- Download Vyapaar Khata App

- Grow your online business with confidence