In every business that involves the movement of goods—whether it's manufacturing, trading, or service—documentation is crucial for tracking, compliance, and transparency. One such essential document is the Delivery Challan or Delivery Note. Though often confused with a tax invoice, a delivery challan serves a distinct purpose in the movement of goods without an actual sale.

In this blog, we’ll explore what a delivery challan is, its legal format under GST, and when and why businesses are required to issue it.

What Is a Delivery Challan or Delivery Note?

A Delivery Challan is a commercial document issued during the transportation of goods in situations where a tax invoice is not required. It is also referred to as a delivery note and is often used in logistics, warehousing, and inventory movements.

Purpose of a Delivery Challan

- To document the transfer of goods from one place to another.

- To support goods sent for job work, sample testing, or inter-branch movement.

- To comply with GST laws in non-taxable movements.

It is governed under Rule 55 of the CGST Rules, which specifies when and how delivery challans must be used.

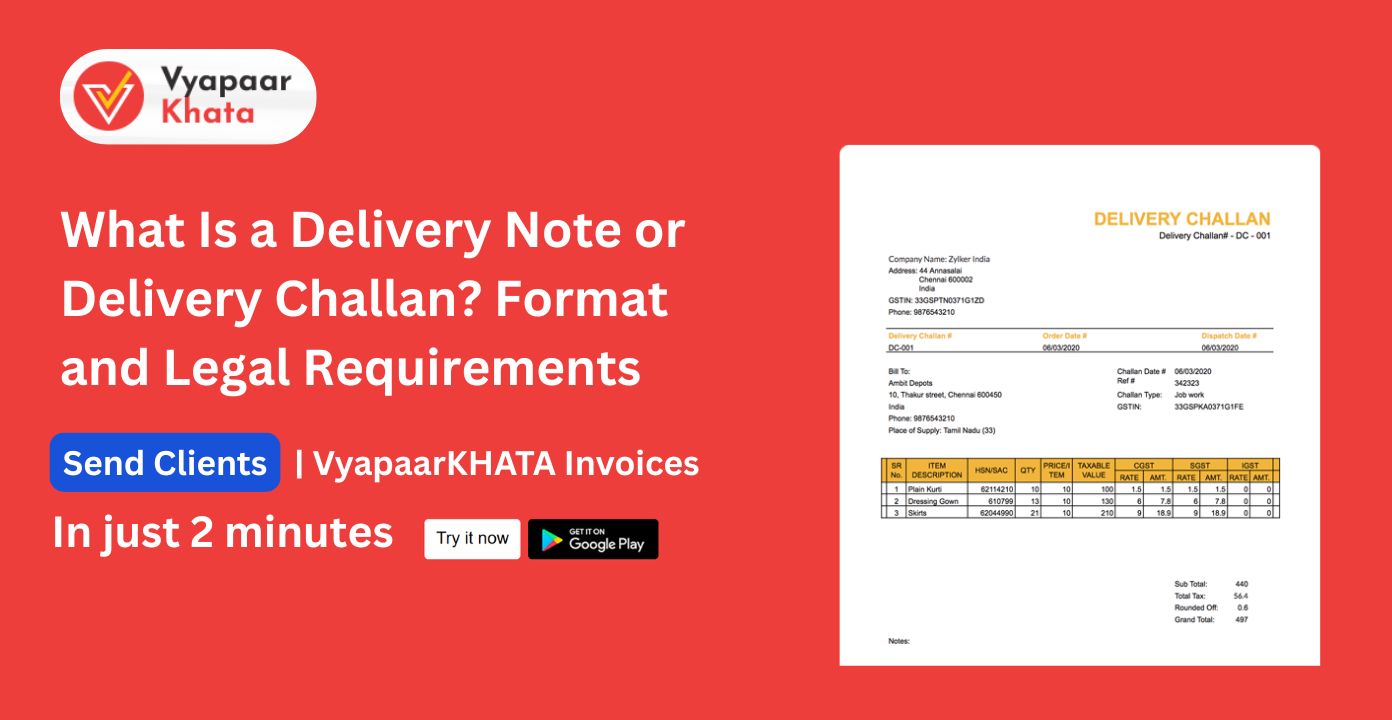

Key Components and Format of a Delivery Challan

To ensure compliance with GST regulations and maintain professionalism, a delivery challan must include the following details:

Essential Fields in a Delivery Challan

- Supplier’s Name, Address, and GSTIN

- Delivery Challan Number (unique and sequential)

- Date of Issue

- Consignee’s Name, Address, and GSTIN

- Description of Goods

- HSN Code

- Quantity (Actual or Estimated)

- Tax details, if applicable

- Place of Supply (if inter-state)

- Signature of Authorized Person

Sample Delivery Challan Format

| Delivery Challan | |

|---|---|

| Challan No.: | DC/00123 |

| Date: | 04-Aug-2025 |

| Supplier Name: | ABC Traders |

| Supplier GSTIN: | 27ABCDE1234F1Z5 |

| Consignee: | XYZ Industries |

| Consignee GSTIN: | 27XYZDE5678G1Z2 |

| Description of Goods: | Steel Rods |

| HSN Code: | 7215 |

| Quantity: | 1000 Kg |

| Tax (If applicable): | GST 18% |

| Authorized Signature: | __________________ |

Types of Delivery Challans

There are different types of delivery challans depending on the nature of the goods movement.

Types of Delivery Challans

There are different types of delivery challans depending on the nature of goods movement:

| Type of Movement | Purpose | Challan Required? |

|---|---|---|

| Job Work | Sending raw material to a job worker | Yes |

| Sale on Approval | Goods sent for customer approval | Yes |

| Branch Transfer | From one branch to another | Yes |

| Exhibition or Testing | Goods sent temporarily | Yes |

| Liquid Gas | Quantity unknown at dispatch | Yes |

Legal Validity Under GST

- Under Rule 55 of the CGST Rules, delivery challans are legally valid for moving goods without an invoice under specific conditions.

When Allowed

When quantity of supply is unknown

Goods sent for job work

Non-supply purposes (repair, testing, demonstration)

Mandatory Triplicate Copies

Original – for the recipient

Duplicate – for the transporter

Triplicate – retained by the supplier

E-Way Bill with Challan

Yes, you can generate an e-way bill using delivery challan details when goods are transported without a tax invoice.

Difference Between Delivery Challan and Tax Invoice

Difference Between Delivery Challan and Tax Invoice

| Feature | Delivery Challan | Tax Invoice |

|---|---|---|

| Used for | Movement without sale | Sale of goods/services |

| Tax Component | Optional | Mandatory |

| GST Return | Not required for B2B return | Required |

| Legal Replacement | Temporary | Permanent |

| Signature | Mandatory | Mandatory |

When Is a Delivery Challan Required?

Here are common scenarios where issuing a delivery note is a legal and commercial requirement:

- Goods sent for job work (Rule 45 of CGST Rules)

- Goods moved on approval basis (Section 31(7) of CGST Act)

- Branch-to-branch transfers without sale

- Exhibition, repairs, or demonstration

- Transport of goods where quantity is undetermined

- Delivery of liquid gas or materials for which invoice can't be issued at the time of dispatch

GST Compliance for Delivery Challans

- Must contain all details as per Rule 55(1)

- Should be serially numbered and date-stamped

- Must be issued in triplicate

- Tax can be optionally mentioned; however, if it's included, it must be correctly shown

- Delivery challan should be stored for audit purposes for 6 years

How to Create a Delivery Challan Digitally?

For small and large businesses alike, generating delivery challans digitally improves accuracy and compliance. Here’s how:

Popular Methods

- VyaaparKhata, Tally ERP, Zoho Books, Busy Accounting – all support delivery challan modules

- Excel/Word templates – good for small traders

- Custom ERP Systems – for manufacturing, eCommerce and retail

- GST Portal – allows e-way bill generation using delivery challan details

Frequently Asked Questions (FAQs)

Q1. Can I issue a delivery challan without a GSTIN?

A: Yes, but only for exempted or non-GST supplies.

Q2. Can a delivery challan be converted into a tax invoice?

A: Yes. Once goods are approved or sold, a proper tax invoice must be issued referencing the delivery challan.

Q3. Is e-way bill compulsory for delivery challan?

A: Yes, if the consignment value exceeds Rs 50,000 or falls under e-way bill rules.

Q4. How long can goods be moved with only a delivery challan?

A: There’s no fixed limit, but it must align with the nature of transaction—like 1 year for job work.

The delivery challan is not just a logistics document—it's a crucial component of GST-compliant trade in India. Whether you’re sending goods for job work or moving inventory across warehouses, maintaining a properly formatted and legally valid delivery challan ensures smooth operations and audit readiness.

Businesses should integrate delivery challans into their accounting workflow using digital tools, and stay updated with GST amendments to remain fully compliant.