In the world of business, accuracy in billing and financial documentation is paramount. Among the many financial documents used in accounting and transactions, debit invoices play a vital role. While many are familiar with standard invoices and credit notes, debit invoices are often less understood, yet they are just as essential for maintaining transparent and accurate business records.

This comprehensive guide explains everything you need to know about debit invoices — from what they are, their components, and when to use them, to their accounting treatment and compliance requirements.

Every business transaction involving the sale of goods or services typically includes an invoice — a document that outlines the transaction's details and cost. But what happens when there’s a need to adjust the amount billed after the original invoice has been issued?

That’s where debit invoices come into play. They help sellers correct underbilled amounts or include additional charges that were not previously billed. Understanding how and when to use debit invoices is crucial for accurate financial reporting and smooth business operations.

What is a Debit Invoice?

A debit invoice, also referred to as a debit note, is a document issued by a seller to a buyer to indicate an increase in the amount payable. This usually happens when the seller realizes that the buyer was undercharged or when additional goods or services were provided after the initial invoice.

Example:

If a company initially invoiced a client for Rs10,000 but later realized that an extra Rs2,000 worth of services were rendered, they would issue a debit invoice for Rs2,000. This serves as a formal request for the additional payment.

Debit Invoice vs. Debit Note

While the terms are often used interchangeably, in practice:

- A debit invoice is used in sales transactions, issued by the seller.

- A debit note can also be initiated by the buyer in certain contexts (e.g., to return goods).

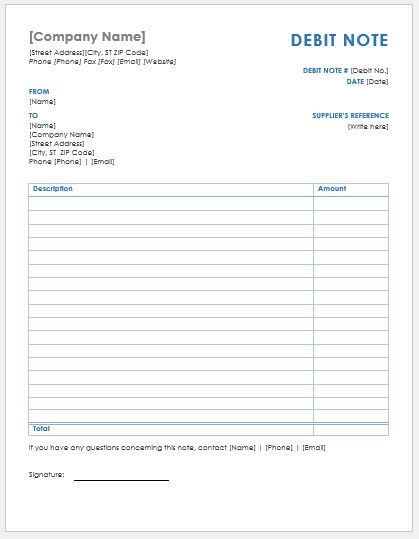

Key Components of a Debit Invoice

A debit invoice typically contains the following information:

- Invoice Number – A unique reference number for tracking.

- Date of Issue – The date the debit invoice is created.

- Seller and Buyer Details – Names, addresses, GSTIN (if applicable), and contact information.

- Description of Goods/Services – Clearly stating what the debit is for.

- Reason for Issuance – Explanation for the additional charge.

- Original Invoice Reference – Linking it to the original invoice number.

- Amount Debited – The revised or additional amount.

- Total Payable – Updated total payable after the debit.

A professional and accurate debit invoice ensures clarity and avoids disputes or confusion.

Purpose of a Debit Invoice

The main purpose of a debit invoice is to correct or adjust a previous transaction. It serves as an official communication between the seller and buyer, outlining the need to increase the payable amount due to legitimate business reasons. Below are common purposes:

1. Correcting Underbilling

If an error resulted in undercharging the buyer in the original invoice, a debit invoice helps rectify the discrepancy.

2. Charging for Additional Services

Sometimes, services or goods are delivered post the original invoice. A debit invoice ensures those are billed accordingly.

3. Inclusion of Additional Charges

Includes extra costs such as:

- Freight or shipping

- Packing

- Extended warranty

- Taxes omitted earlier

4. Adjustment Due to Change in Terms

Sometimes, price changes occur after issuing the initial invoice due to:

- Fluctuations in raw material prices

- Changes in scope of service

5. Tax Compliance

If required by law, a debit invoice can help businesses correct and report accurate values for GST/VAT purposes.

When to Issue a Debit Invoice

1. Price Revision

If the cost of a product or service increases after the original billing, a debit invoice adjusts the payable amount.

2. Additional Quantities

When the buyer receives more products or avails more services than initially invoiced.

3. Omitted Charges

Accidental omission of any service or tax amount in the original invoice.

4. Post-Sale Services

Sometimes businesses provide installation, maintenance, or consultancy after the initial sale — all of which can be billed via a debit invoice.

5. Industry-Specific Scenarios

Industries like logistics, event management, and consultancy often need to issue debit invoices for scope expansions, miscellaneous expenses, or project overruns.

How Debit Invoices Differ from Other Financial Documents

1. Debit Invoice vs. Credit Invoice

- Debit Invoice: Increases the payable amount (issued by seller).

- Credit Invoice: Decreases the payable amount (e.g., refund, discount).

2. Debit Invoice vs. Proforma Invoice

- Debit Invoice: A post-sale adjustment to a real transaction.

- Proforma Invoice: A pre-sale document — not a demand for payment.

3. Debit Invoice vs. Purchase Order

- Debit Invoice: Issued by the seller.

- Purchase Order: Issued by the buyer to initiate a purchase.

Accounting Treatment of Debit Invoices

Correctly accounting for debit invoices is essential for transparent financial records and compliance.

For the Seller:

- Accounts Receivable increases by the debit amount.

- A debit entry is made to the customer's account.

- A credit entry is made to revenue or sales (or related account).

For the Buyer:

- The buyer updates their accounts payable.

- A credit entry is made to the seller’s account.

- A debit entry is made to the expense or inventory account.

Example Journal Entry for Seller:

Accounts Receivable A/C Dr. Rs2,000

To Revenue A/C Rs2,000

(Being additional service charges debited to customer)

Integration with Tax Systems:

- For GST/VAT registered entities, debit invoices may need to be reported in tax filings.

- The seller may be liable to pay additional GST on the debit amount.

- The buyer can claim additional input tax credit, if applicable.

Legal and Compliance Considerations

1. GST/Tax Requirements

In countries like India, debit notes/invoices must:

- Be reported in GSTR-1 by the supplier.

- Match the original invoice.

- Include applicable GST rate, HSN/SAC codes, etc.

2. Retention of Documents

According to most tax laws:

- Invoices and debit invoices must be retained for 5 to 7 years.

- Must be available for audit or inspection by tax authorities.

3. Timely Issuance

Laws may define the time window within which a debit invoice can be issued — often within the same financial year or tax period.

4. Buyer Consent

Although not always legally required, it's good business practice to inform or get consent from the buyer before issuing a debit invoice.

Common Mistakes to Avoid

1. Issuing Duplicates

Sending multiple debit invoices for the same undercharge can confuse the buyer and damage the relationship.

2. Lack of Justification

Failing to explain the reason behind the debit invoice can lead to disputes or rejection by the buyer.

3. Inaccurate Linking

Always refer to the original invoice to maintain a clear audit trail.

4. Incorrect Tax Treatment

Applying incorrect GST/VAT can lead to penalties during audits.

5. Late Issuance

Delays in issuing debit invoices might lead to tax mismatches or non-payment by buyers.

Debit invoices are an essential part of professional and transparent business dealings. Whether it's to correct an error, add additional charges, or comply with tax laws, issuing debit invoices ensures that businesses maintain accuracy in financial documentation.

Here’s a quick recap of what you should keep in mind:

- Use debit invoices to increase amounts due on previously issued invoices.

- Always include a clear explanation and reference the original invoice.

- Stay compliant with legal and tax requirements.

- Avoid common pitfalls such as duplicate issuance or incorrect tax handling.

By integrating debit invoices into your accounting and invoicing process thoughtfully, you not only enhance financial transparency but also foster better trust with clients and regulatory bodies.

Need Help With Invoice Management or Accounting Automation?

Consider using accounting software that automates the creation and tracking of debit invoices, ensuring compliance, accuracy, and faster reconciliation.