E-invoicing is now standard in over 60 countries worldwide, reflecting a global shift toward digital tax compliance. In India, the GST e-invoice system was launched in October 2020 for large B2B suppliers and has been expanded over time. For example, the implementation threshold was gradually lowered (from Rs 500 crore to ?5 crore turnover) so that by mid-2023 all businesses with annual sales above ?5?Cr were required to generate e-invoices. Recently, the GST Council approved a voluntary pilot for extending e-invoicing to B2C (business-to-consumer) transactions from September 2024. This means that consumer-facing sales – such as retail or e-commerce bills – will begin to be reported electronically in the same way B2B invoices are.

What is B2C E-Invoicing?

B2C e-invoicing refers to the electronic invoicing requirement under GST for supplies made directly to end consumers. In practice, it means a business selling to a non-registered person must report each taxable invoice to the government’s e-invoice portal (Invoice Registration Portal, or IRP) for authentication. Upon reporting, the IRP validates the invoice and returns a unique Invoice Reference Number (IRN) along with a QR code for that invoice. In effect, every validated B2C invoice becomes a digital record with an IRN and QR code on it. (In contrast, under the current rules only B2B invoices needed IRP submission, while B2C sales were simply printed on paper.) For example, if a restaurant or store uses B2C e-invoicing, it would generate the customer’s bill as usual but then electronically submit the invoice data to the IRP. The IRP would check the data and provide back an IRN/QR, which the business then includes on the final invoice given to the consumer.

Vyapaarkhata is a leading platform that empowers businesses with digital invoicing and management solutions tailored for both B2C and B2B operations. By leveraging Vyapaarkhata, companies can simplify their financial and operational workflows while ensuring GST compliance. Key benefits include:

- Seamless B2C & B2B Invoicing: Generate accurate electronic invoices for both consumer and business transactions.

- GST Compliance Simplified: Automate e-invoice reporting to meet regulatory requirements effortlessly.

- Integrated Business Management: Manage sales, inventory, and accounts in a single platform.

- Time & Cost Efficiency: Reduce manual work and save operational costs with automation.

- Real-Time Reporting & Analytics: Access insights to make informed business decisions.

Benefits of B2C E-Invoicing

Moving B2C sales into the e-invoicing system offers several advantages for businesses, customers, and tax authorities:

- Enhanced Compliance and Transparency: By digitally recording all consumer invoices, the tax department gains real-time visibility of retail sales. This helps plug revenue leaks and reduces tax evasion, since “all B2C sales are accurately reported in real time”.

- Fraud Prevention: E-invoices are authenticated and signed by the government portal, making it much harder to generate fake or tampered invoices. Standardizing invoices across businesses also “reduces cases of invoice manipulation”.

- Efficiency and Cost Savings: Automation cuts out much manual work. With electronic invoicing, businesses no longer need to enter data manually into tax returns or worry about lost invoices. It also saves paper and printing costs, yielding “environmental friendliness” and “cost efficiency”.

- Consumer Confidence: Customers receive a verified invoice (with IRN/QR), which they can trust. The GST Council noted that B2C e-invoicing would allow retail customers to verify their invoices in the GST system, building trust.

- Streamlined Reporting: Since e-invoice data is shared with GST returns automatically, businesses can reconcile sales faster. The system essentially “standardises” billing and pre-populates return forms, reducing errors and saving time.

For example, a national grocery chain that issues thousands of bills per day could feed those invoices straight into its accounting software and automatically submit them to the IRP. This would eliminate manual GSTR-1 filing of B2C sales and ensure every sale is captured by the tax system.

Who Needs to Implement B2C E-Invoicing?

Currently, B2C e-invoicing is pilot phase and voluntary, so only select businesses are involved. The GST Council has indicated that the pilot will cover certain large or tech-focused industries in specified states. In practice, this likely means:

- Large Retail Chains and Organised Retailers: Supermarkets, department stores and fast-moving consumer goods (FMCG) companies with high sales volumes are prime candidates. They already issue huge numbers of bills daily and have the resources to upgrade systems.

- E-Commerce and Tech-Driven Businesses: Online marketplaces, quick-commerce (instant delivery apps), and other digital service providers are expected to be included early. Sectors like e-commerce, online gaming and digital content (OIDAR services) have been specifically mentioned as likely participants.

- Voluntary Participants: Any business (in pilot states/sectors) can opt in. Even if turnover is below ?5?Cr, companies interested in digital compliance may choose to join voluntarily.

Importantly, small shops and services are not being targeted in the initial rollout. No fixed turnover threshold for B2C e-invoicing has yet been announced; the pilot will start with “large-sized businesses that have good tech-support”. Over time, once proven, the mandate may widen. Ultimately, if the program becomes fully mandated, any business above the general e-invoicing turnover threshold (currently ?5?Cr) making consumer sales could be required to comply.

Key Components of a B2C E-Invoice

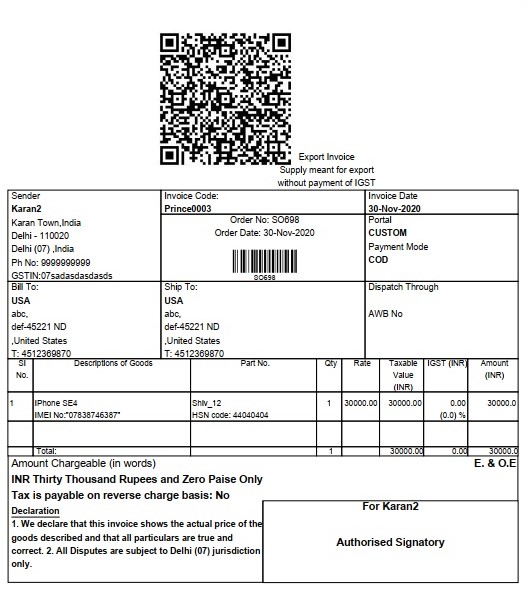

A B2C e-invoice contains essentially the same data as a regular GST invoice, but in a structured electronic format. According to the GST e-invoice schema, an e-invoice includes about 30 mandatory fields organized into sections: basic invoice details, supplier information, recipient information, item (line) details, and document totals. Key components are:

- Invoice Header: Invoice number (as assigned by the seller), invoice date/time, type of document (tax invoice), and place of supply.

- Supplier Details: The seller’s GSTIN, name, address and other legal information.

- Buyer/Recipient Details: For B2C invoices, the buyer is usually unregistered, so this section often contains minimal info (e.g. just the buyer’s name or simply “Consumer”).

- Item Line Details: For each product/service sold, the invoice lists description, quantity, unit price, HSN/SAC code, total taxable value, etc.

- Tax Details: Break-up of taxes for each line (CGST, SGST, IGST rates and amounts) and any cess, plus the total taxable value.

- Document Totals: The overall taxable value, total tax amount, and grand total (invoice value) including taxes.

After a business submits these details to the IRP, the portal verifies them and generates two critical outputs: a unique Invoice Reference Number (IRN) (a 64-character hash) and a digitally signed QR code. These are appended to the e-invoice. The final B2C e-invoice issued to the consumer must include the IRN and QR code (usually printed on it or sent via email). As EDICOM notes, the IRN is “generated and signed by the IRP” and the QR code allows offline validation of the invoice. In short, a compliant B2C e-invoice is a JSON file containing the GST invoice data, and it is accompanied by the official IRP signature (IRN/QR) that certifies its authenticity.

How B2C E-Invoicing Works

In practice, implementing B2C e-invoicing involves these steps:

Registration on an IRP: The business (if not already an e-invoice user) must register on one of the government-authorized Invoice Registration Portals (IRPs) or through a GST Suvidha Provider (GSP).

Invoice Generation: The business continues to generate invoices for consumer sales using its existing billing/POS/ERP system. For example, a retail store’s POS machine will print a regular invoice to the customer as usual.

Data Submission: Each invoice’s data is then electronically submitted to the IRP. The data must be in the prescribed JSON format (INV-01 schema). Companies can do this in real time (as each sale happens) or in a batch (e.g. end of day), but timely reporting is required. Direct integration (API) with the IRP is recommended to automate this process.

IRP Validation: The IRP checks the submitted invoice data (validates GSTIN, checks for duplicate invoices, ensures mandatory fields are present, etc.). If the invoice passes validation, the IRP “authenticates” it.

IRN & QR Issuance: Upon successful validation, the IRP returns a signed e-invoice back to the business with a unique IRN and a QR code. This e-invoice is now official.

Invoice Delivery: The business then issues the certified e-invoice (with IRN/QR) to the consumer. This can be a printed invoice or an emailed/PDF invoice that includes the QR code for authenticity. (It is expected that the government will set a deadline for issuing this to the consumer – for instance, within 48 hours of the sale.)

Sharing with GSTN: Behind the scenes, the IRP forwards the invoice details to the GST Network (GSTN) and NIC for inclusion in the taxpayer’s GST returns. This means the invoice data auto-populates the return forms and any related e-way bills.

For example, imagine a clothing retailer using B2C e-invoicing. At the cash counter, a bill is generated and then an API call automatically sends the invoice details to the IRP. The IRP checks it and sends back IRN/QR, which the cashier prints on the bill. Meanwhile, the GST return data is being updated in the background. This seamless loop ensures one invoice transaction covers billing, tax filing, and audit trail.

Compliance Requirements

As of now, B2C e-invoicing is not yet mandatory; it’s only being introduced as a voluntary pilot. Businesses participating in the pilot must still follow the existing e-invoice schema and integration process. In practice, compliance means: registering on an IRP, reporting each eligible invoice in JSON form, and affixing the IRN/QR on the consumer invoice.

Currently, no official notification has defined turnover thresholds or full rules for B2C e-invoicing. Taxpayers should watch for updates from the Central Board of Indirect Taxes & Customs (CBIC). (For the time being, B2C invoices remain exempt from e-invoicing, although large suppliers must generate a dynamic QR code on their B2C invoices under existing GST law.) Once the scheme becomes mandatory, non-compliance (e.g. failing to report a covered invoice) is likely to incur penalties similar to those in the B2B e-invoice system.

For businesses, the immediate requirement is to prepare their systems. This means ensuring their accounting/ERP software can output invoice data in the prescribed format and connect to an IRP. It also means collecting any additional data on customer invoices that the schema may require. (For example, under current GST rules, invoices above ?50,000 to unregistered buyers must include buyer name and address – those details would need to go into the e-invoice data.) At minimum, a participating business must complete registration with an IRP and test its invoice submissions as specified by the pilot program.

Integration with Accounting and ERP Systems

Successful B2C e-invoicing depends on tight integration between business software and the government portals. Fortunately, most accounting and ERP systems in India have already added e-invoicing functionality or plug-ins. For instance, popular platforms like Tally, SAP, Zoho, QuickBooks and others now offer modules or extensions to generate e-invoices. These systems can format the invoice data into the required JSON and transmit it to the IRP via secure API calls.

Technically, data can be transferred to the IRP in several ways. As one provider notes, invoice data from ERPs, billing systems or point-of-sale software can be sent through two-way APIs, SFTP transfers, or even spreadsheet (CSV) uploads. In practice, a medium-sized company might use an integrated solution where every invoice created in their ERP is automatically posted to the IRP. Some IRPs also offer user portals or desktop tools where a business can manually upload invoice files.

The key is to achieve real-time (or near real-time) reporting so that the process doesn’t delay billing. ClearTax advises that direct API integration “ensur[es] minimal business disruption and near real-time processing” of invoices. In other words, once set up, issuing an e-invoice should be as seamless as emailing a copy to the customer. For businesses without in-house IT, third-party service providers (known as GSPs or IRP portals) can handle the integration.

Challenges in Implementing B2C E-Invoicing

Introducing B2C e-invoicing comes with practical hurdles that businesses must navigate:

Technology and Infrastructure: Retailers need reliable internet connectivity and robust IT systems to handle the data volume. Ensuring 24/7 uptime (so every invoice can be reported immediately) may require server upgrades or cloud services. Smaller shops in areas with weak connectivity could find real-time reporting difficult.

Systems Integration: Legacy billing or ERP software might require significant customization to meet the e-invoice JSON schema. Businesses must map all their invoice fields to the GST format. If a company uses multiple sources (store POS, online sales, mobile app), merging this data can be complex. Without proper automation, staff might have to key in invoice data twice – once for billing and once for e-invoicing.

Data Accuracy: The IRP enforces strict validation. Any errors (duplicate invoice numbers, wrong GSTIN, incorrect HSN codes, tax miscalculations, etc.) will cause rejections. Taxpayers must “accurately validate and authenticate” each field before uploading to avoid disruptions. Building validation checks into the system is therefore crucial, as a single mistake can invalidate an invoice.

Operational Workflow Changes: Capturing extra data for e-invoices may slow down sales processes initially. For example, if a cashier must wait for a QR code to print at the end of every sale, queues could form during peak hours. Staff need training on new procedures (e.g., issuing invoices only after IRP confirmation).

Cost and Investment: Upgrading software, training employees, and maintaining integration can be expensive. Mid-sized businesses may struggle with the upfront costs of e-invoicing software or subscription fees for GSP services. However, these costs should be weighed against the long-term benefits of faster compliance and reduced penalties.

Despite these challenges, many tax experts believe that automation and planning can mitigate most issues. Early adopters who build robust e-invoicing processes will find it much easier to comply when the system is fully rolled out.

Future of B2C E-Invoicing in India

The GST Council’s roadmap suggests a phased expansion of B2C e-invoicing. As noted above, there will be a pilot in 2024–25 followed by voluntary rollout to more businesses in 2025–26, and full mandatory compliance by 2026–27 if the pilot is successful. In other words, within a couple of years, most businesses above the e-invoice turnover threshold may have to report consumer invoices electronically.

Looking ahead, wide adoption of B2C e-invoicing could be transformative. Experts expect that it will “enhance tax compliance, reduce fraud, and improve invoice traceability”. With every retail sale logged in real time, the government could analyze consumer spending patterns more quickly and accurately. This could also pave the way for linked digital services: for example, integration with digital payment platforms or government apps where consumers verify purchases via the QR code.

For businesses, the future means that digital invoicing will eventually be the norm even for small consumer sales. Companies that invest early in integrated billing and ERP solutions will gain a head start. Small and mid-sized enterprises (SMEs) should keep an eye on regulatory updates and consider upgrading their accounting systems or partnering with e-invoicing solution providers. Doing so will turn this challenge into an opportunity for streamlining operations and earning consumer trust.

Ultimately, B2C e-invoicing represents a major step in India’s digital tax infrastructure. As one analysis puts it, if fully implemented the system will “reshape the way businesses issue consumer invoices across India”. With careful preparation – updating IT systems, training staff, and aligning accounting practices – Indian businesses can adapt smoothly. By embracing e-invoicing, they not only ensure GST compliance but also contribute to a more transparent, efficient marketplace.

Sources: Official GST Council recommendations and CBIC notifications (via fiscal and regulatory updates); expert analyses and industry guides (ClearTax and Sovos) on B2C e-invoicing in India; government e-invoice schema documentation; and news articles outlining the implementation timeline. Each section of this guide is supported by these sources for accuracy and completeness.