Goods and Services Tax (GST) has streamlined indirect taxation in India, making compliance and documentation highly structured. A GST invoice is one of the most important documents under GST law because it serves as legal evidence of a transaction, helps track Input Tax Credit (ITC), and ensures smooth tax filing. To make an invoice valid under GST, businesses must follow specific rules, including mandatory terms and conditions prescribed by the Central Goods and Services Tax Act (CGST Act), 2017, and GST Rules.

This blog provides a detailed, fact-based breakdown of GST invoice terms and conditions in India.

What Is a GST Invoice?

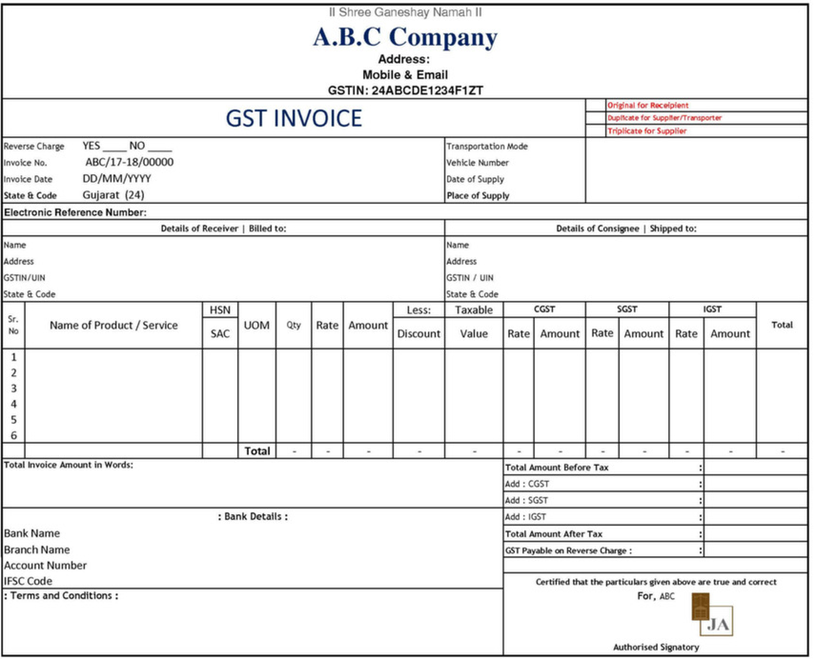

A GST invoice is a tax document issued by a supplier to the buyer when goods or services are supplied. It contains details like supplier and recipient information, GSTIN, HSN/SAC codes, tax rate, tax amount, and total value.

- For Goods: Issued at or before delivery/removal.

- For Services: Issued within 30 days of supply (45 days for banking & financial institutions).

Legal Provisions for GST Invoice

The rules for GST invoices are governed by:

- Section 31 of the CGST Act, 2017

- Rule 46 of the CGST Rules, 2017

These prescribe the required particulars and format for a valid GST invoice.

Mandatory Terms and Conditions in GST Invoice

1. Supplier & Recipient Details

- Supplier’s Name, Address & GSTIN must be clearly mentioned.

- Recipient’s Name, Address & GSTIN (if registered) is mandatory if the value exceeds ?50,000.

Fact: For unregistered buyers (like retail customers), only buyer’s name and address are required if the invoice exceeds ?50,000.

2. Unique Invoice Number

- Must be consecutive, unique for each FY, and alphanumeric.

- Should not repeat across financial years.

3. Date of Issue

- Invoice date is crucial for ITC and GST return filing.

- Time of supply rules are linked with invoice issuance.

4. HSN/SAC Code of Goods/Services

- HSN Code for goods and SAC Code for services must be mentioned.

- Exemptions: Businesses with turnover up to ?5 crore can mention only 4-digit HSN; above ?5 crore must mention 6-digit HSN.

5. Description & Quantity

- Clear description of goods/services.

- Quantity with unit (for goods).

- Value of supply before tax.

6. Tax Details (GST Breakdown)

Invoice must clearly state:

- Taxable value

- Rate of GST (CGST, SGST/UTGST, IGST, Cess)

- Amount of tax separately

Example:

- Item Value: ?10,000

- CGST @ 9%: ?900

- SGST @ 9%: ?900

- Total Invoice Value = ?11,800

7. Place of Supply (PoS)

- Determines whether transaction is intra-state (CGST+SGST) or inter-state (IGST).

- Must include state name and code.

8. Reverse Charge Applicability

- Invoice must specify whether tax is payable under Reverse Charge Mechanism (RCM).

9. Signature & Authentication

- Physical or digital signature of supplier/authorized person.

- For e-invoices, IRN (Invoice Reference Number) and QR Code generated by GST portal act as authentication.

10. Additional Conditions (Optional but Recommended)

Businesses often add custom terms and conditions for clarity and compliance:

- Payment terms (advance, credit period, late fee).

- Warranty and return policies.

- E-way bill number (for movement of goods above ?50,000).

- Legal disclaimers (e.g., “Input Tax Credit available subject to GST provisions”).

Types of GST Invoices and Their Conditions

| Type of Document | Applicability | Key Conditions |

|---|---|---|

| Tax Invoice | For taxable supply | Mandatory GST details |

| Bill of Supply | For exempt supply / composition scheme | No tax charged, GSTIN mentioned |

| Receipt Voucher | For advance received | Must state tax rate and amount |

| Refund Voucher | When advance refunded | Link with earlier receipt voucher |

| Debit/Credit Note | For corrections in tax value | Must reference original invoice |

| E-Invoice | Mandatory for turnover > ?5 crore | Generated through GST IRP portal |

Penalties for Incorrect or Missing Invoice Terms

Non-compliance with GST invoice conditions may attract:

- Penalty of ?25,000 under Section 122 of CGST Act.

- Loss of Input Tax Credit (ITC) for recipient if invoice is invalid.

- Additional interest/penalty during GST audit.

A GST invoice is more than just a bill—it is a legally enforceable document that ensures tax compliance, smooth credit flow, and transparency in trade. By adhering to the mandatory GST invoice terms and conditions, businesses can avoid penalties, maintain credibility, and ensure hassle-free GST return filing.

For SMEs, startups, and large enterprises, it’s crucial to adopt proper GST-compliant invoicing software that automatically incorporates all legal requirements and prevents errors.