In today’s fast-paced business world, the way we manage invoices is evolving rapidly. While many businesses still rely on traditional paper invoices, a growing number are embracing digital solutions. But which method is better for your organization—digital or paper invoices? In this blog, we’ll compare the two options to help you make an informed decision.

Some of the Factors that keep you comparing Digital or Paper Invoices

1. Cost

Paper Invoices

- Incur costs for paper, printing, envelopes, and postage.

- Require physical storage space for filing and archiving.

- Often involve manual labor for processing and handling.

Digital Invoices

- Minimal to no cost for creating and sending invoices electronically.

- No need for physical storage—documents are stored in the cloud or on servers.

- Automation reduces the need for manual labor.

Winner: Digital invoices save money in the long run.

2. Speed and Efficiency

Paper Invoices

- Delivery depends on postal services, which can be slow.

- Manual entry can cause delays and errors.

- Approval and payment cycles take longer.

Digital Invoices

- Instant delivery via email or accounting software.

- Automation streamlines approval and payment processes.

- Easier tracking and reporting.

Winner: Digital invoices offer superior speed and efficiency.

3. Environmental Impact

Paper Invoices

- Use paper, ink, and fuel for transportation.

- Contribute to deforestation and carbon emissions.

Digital Invoices

- Virtually paperless and environmentally friendly.

- Help businesses reduce their carbon footprint.

Winner: Digital invoices are more sustainable.

4. Security and Accuracy

Paper Invoices

- Risk of physical loss, damage, or theft.

- Prone to human error during manual processing.

Digital Invoices

- Encrypted storage and secure transmission.

- Built-in error checks and audit trails.

Easier to back up and retrieve.

Winner: Digital invoices provide enhanced security and accuracy.

5. Customer Preferences

Paper Invoices

- Some customers, especially in traditional industries, may prefer paper.

- Can serve as a tangible record for certain clients.

Digital Invoices

- Increasingly preferred by modern businesses and tech-savvy customers.

- Easier to manage and integrate with digital accounting systems.

Winner: It depends—offering both options can improve customer satisfaction.

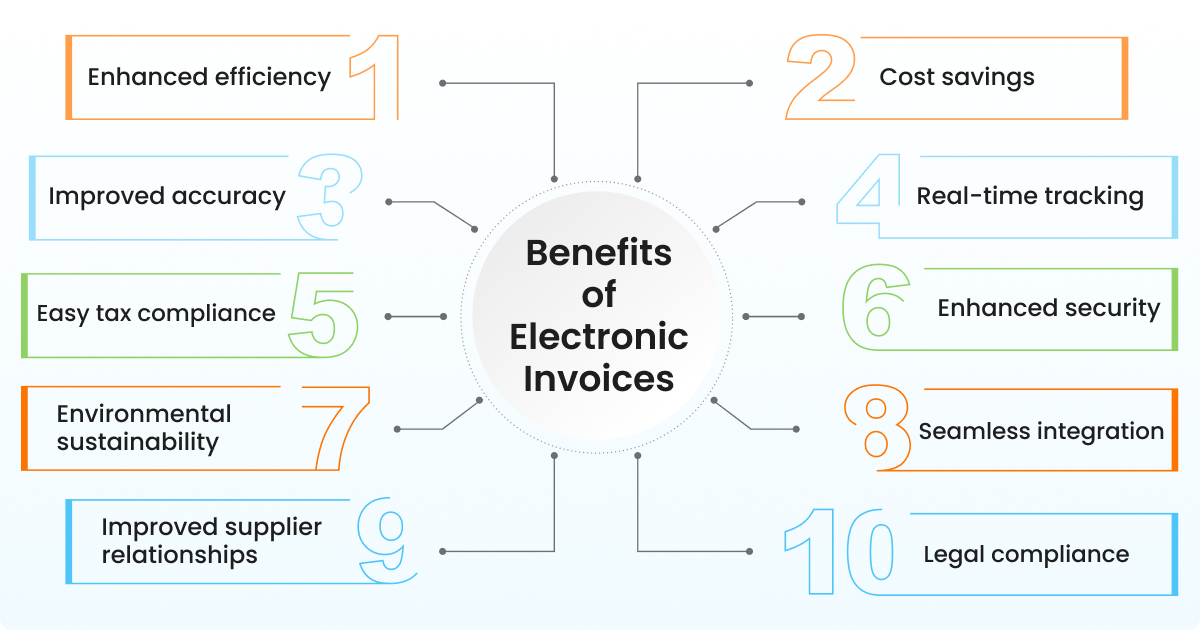

Benefits of Digital or Electronic Invoice

- Enhanced Efficiency

- Automates invoice generation, delivery, and processing—saving time and reducing manual work.

- Cost Savings

- Cuts costs associated with paper, printing, postage, and storage.

- Improved Accuracy

- Minimizes manual errors through automated data entry and validation.

- Real-Time Tracking

- Provides real-time visibility into invoice status (sent, received, approved, paid).

- Easy Tax Compliance

- Simplifies tax reporting and ensures alignment with regulatory requirements (GST, VAT, etc.).

- Enhanced Security

- Safeguards sensitive financial data with encryption, secure transmission, and controlled access.

- Environmental Sustainability

- Reduces paper usage and carbon footprint—supporting corporate sustainability initiatives.

- Seamless Integration

- Integrates with ERP, accounting, and payment systems for a streamlined workflow.

- Improved Supplier Relationships

- Faster and more transparent processes strengthen trust and collaboration with suppliers.

- Legal Compliance

- Ensures adherence to local and international e-invoicing mandates and standards.

Which Invoice is Better?

For most businesses today, digital invoices offer more advantages—lower costs, greater efficiency, better security, and a smaller environmental footprint. However, certain industries and customer segments still value paper invoices for their tangibility and familiarity.

- The best approach? Adopt a flexible strategy:

- Prioritize digital invoicing for speed and sustainability.

- Offer paper invoices when required by specific customers or legal obligations.

By finding the right balance, your business can streamline operations while meeting diverse customer needs.

FAQs Related to Invoice

What is an electronic invoice (e-invoice)?

An electronic invoice (e-invoice) is a digital version of a traditional paper invoice. It is generated, sent, received, and stored electronically, streamlining the entire invoicing process.

How does electronic invoicing improve efficiency?

Electronic invoicing automates key tasks such as data entry, delivery, tracking, and compliance. This saves time, reduces manual work, and speeds up the payment cycle.

Is electronic invoicing secure?

Yes. E-invoicing solutions use encryption, secure transmission channels, and controlled access to ensure that sensitive financial data is protected throughout the invoicing process.

How does e-invoicing help with tax compliance?

E-invoices are automatically validated for tax regulations (such as GST or VAT). They also provide an audit trail and easy reporting, which helps businesses comply with legal requirements.

Why should businesses switch to electronic invoicing?

Businesses benefit from cost savings, improved accuracy, real-time tracking, enhanced security, environmental sustainability, and seamless integration with other systems—all of which help improve cash flow and strengthen supplier relationships.