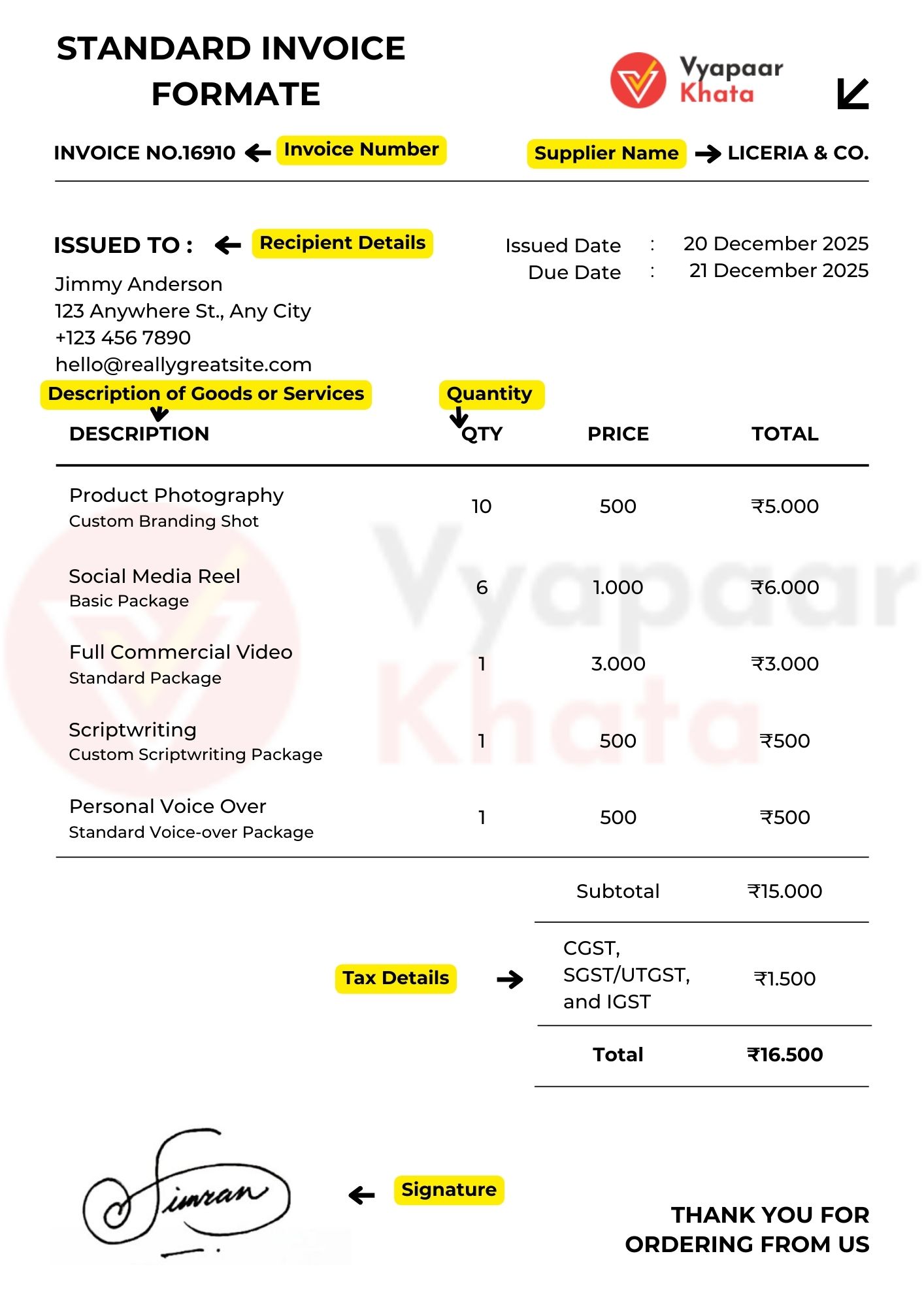

For Indian SMEs and freelancers, a proper invoice is not just a bill – it’s a legal document under GST law. A GST-compliant invoice must clearly itemize the sale and tax details so customers can claim input credits. It typically includes basic header information (invoice number and date), seller and buyer details, an itemized list of goods/services, tax breakdown, and a final total. Each section serves a purpose: tracking the invoice (Invoice No.), identifying parties (with GSTIN and address), describing what was sold (with quantity, HSN/SAC codes, prices), calculating taxes (CGST/SGST or IGST), and stating payment terms.

For example, Indian rules require invoices to show the supplier’s name, address and GSTIN, the recipient’s name, address and GSTIN (if registered), a description of items with HSN/SAC codes, quantities and unit prices, the taxable value, all GST rates and amounts, and the total payable. Payment terms (due date, credit days) and the seller’s signature can be added as optional fields. Some templates also include shipping/delivery addresses and the place of supply for inter-state sales. A clear, GST-compliant format ensures timely payment and smooth tax compliance.

- Invoice Number & Date: A unique serial number and issue date help track the transaction. For GST, invoice numbers must be unique each financial year (e.g. “INV2025-0001”).

- Seller (Supplier) Details: Name, business address, state and GSTIN of the seller. This identifies who issued the invoice.

- Buyer (Recipient) Details: Name, billing/shipping address, and GSTIN of the customer (if registered). This shows who is buying and their location.

- Itemized Products/Services: Each line lists a good or service with a brief description, quantity, unit (pcs/kg/etc.), unit price, and HSN (for goods) or SAC (for services) code. This breakdown makes the sale transparent.

- Taxable Amount: For each line or the total, show the taxable value (sum before tax).

- Tax Details: Display the applicable GST rates and amounts (CGST and SGST for intra-state sales, or IGST for inter-state) for each taxable amount.

- Total Amount: Sum up the taxable value and taxes to get the grand total payable.

- Payment Terms & Notes: (Optional) Any conditions or due date for payment. Under GST, terms aren’t mandatory, but including them (e.g. “Due in 30 days”) helps clarify expectations.

- Signature/Authentication: (Optional) The supplier’s signature or digital stamp adds validity, though e-invoicing systems now often use secure QR codes or digital verification.

Including all these fields is crucial. Invoices are the primary proof of sale and tax collected – they must clearly state what was sold, how much, and how taxes were applied. In India, missing mandatory information can lead to compliance issues or make it harder for the buyer to claim input tax credit.

Why Automating Invoices Matters for Indian SMEs

Manually typing and sending invoices can be slow and error-prone. Modern digital invoicing tools automate these tasks, making billing much faster and more accurate. For example, a mobile invoicing app shows all invoices (paid, unpaid, overdue) in one dashboard and lets you tap “Create” to issue a new invoice instantly. This on-the-go capability speeds up billing and cash flow – one study notes that using an automated system “frees up your schedule for more critical tasks and accelerates the payment process”. Because the app fills in stored data (product prices, customer details, tax rates) automatically, there are fewer mistakes than with manual entry. Overall, automating invoices reduces errors and saves time: businesses cut manual work, avoid calculation errors, and get paid faster.

Figure: A modern invoicing app lets you view all invoices and create new ones on the go. Many platforms even let you send invoices via email, SMS or messaging apps like WhatsApp. For instance, QuickBooks reports that “sending invoices over WhatsApp… can help you get paid faster by meeting customers where they’re at”. Similarly, Our VyapaarKHATA tools help you can send a completed invoice as a PDF or link through WhatsApp, email, or SMS. By delivering invoices instantly to your customer’s phone or inbox, you cut down follow-up time and speed up collections. In a nutshell, digital invoicing streamlines the process: you generate GST-compliant invoices in seconds and dispatch them to clients with one click.

How VyapaarKHATA Simplifies Invoicing

VyapaarKHATA is built for Indian entrepreneurs, packing all the above benefits into an easy app. It streamlines key tasks so you can focus on your business:

Efficient Customer Management: Instead of repeatedly entering buyer details, VyapaarKHATA lets you save each customer’s information (contact, GSTIN, address) in one place. This unifies your records and cuts manual entry. As quoting experts note, organizing client and product data into a single system “saves time [and] reduces the risk of errors”. With customer profiles ready, you pick a name and generate an invoice or quote immediately.

Integrated Quotation Workflow: Freelancers and SMEs often send price quotes before invoicing. VyapaarKHATA lets you create professional quotations and convert them to invoices without retyping data. Good quote-management software “streamlines and automates the quote process… saving time, reducing errors”. In practice, you can send an estimate in seconds, then once the client agrees, hit a button to turn that quote into a GST invoice – eliminating duplicated work and miscalculations.

Figure: VyapaarKHATA’s mobile interface (Android) shows all invoices by status, with a clear “+ Create” button for new bills.

Multi-Channel Invoice Delivery: VyapaarKHATA supports emailing invoices, downloading them as PDFs, and even sending them via WhatsApp. Invoicing studies show that giving customers their bill through familiar channels cuts delays. For example, you can email a PDF invoice directly from the app or share it on WhatsApp with one tap. Clients get the invoice link on their phone, which many find more convenient than paper. This broad reach means faster acknowledgment and payment: as QuickBooks notes, reaching customers on WhatsApp “can help you get paid faster”.

User-Friendly, Mobile-Friendly Interface: The app is designed to be intuitive, even if you’re not an accountant. Its clean layout (as shown above) highlights crucial information and actions. According to industry guides, a “user-friendly interface [and] intuitive navigation… reduce the learning curve”. In practice, new users of VyapaarKHATA find it easy to navigate between Invoices, Estimates, and Reports. Large buttons and logical menus mean you don’t waste time figuring out where to click. Because it works fully on mobile and desktop, you can manage billing from the road or the office with minimal training.

Realtime Sync and Reports: (If needed) All your invoice data syncs instantly between your phone and any computer. The app automatically updates statuses and calculates totals/taxes, giving you live cash-flow insights. Automated invoicing platforms like VyapaarKHATA thus “decrease risk of errors” and “enhance overall efficiency” in bookkeeping. You can run sales or tax reports anytime, making filing GST returns or reviewing finances effortless.

By combining these features, VyapaarKHATA turns invoicing from a chore into a smooth task. What used to take hours of form-filling can be done in minutes, with the certainty that all GST fields are correct. Many small businesses that adopt such tools report fewer late payments and clearer books, because invoices go out promptly and accurately

Get Started Today

Ready to streamline your billing? VyapaarKHATA Login offers all the above in a simple, Indian-centric app. You can try VyapaarKHATA free or request a personalized demo to see how it works with your business. Sign up now and start creating professional, GST-compliant invoices in minutes – so you can get paid faster and grow your business.