The Goods and Services Tax (GST) is a unified indirect tax system implemented in India to simplify taxation across goods and services. Under GST, businesses must comply with specific rules related to invoicing, tax payment, return filing, and movement of goods. Proper documentation plays a vital role in ensuring transparency, traceability, and legal compliance throughout the supply chain.

Importance of Understanding Transport and Taxation Documents

GST compliance involves multiple documents such as invoices, e-way bills, delivery challans, and bills of supply. Each document serves a distinct legal and operational purpose. Understanding these documents helps businesses avoid penalties, prevent delays during transit, ensure smooth audits, and maintain accurate financial records.

Why Businesses Often Confuse E-Way Bill and Invoice

Many businesses confuse the e-way bill with an invoice because both are related to the movement of goods. However, an invoice is a tax document used for billing and taxation, while an e-way bill is a transport document required for tracking goods during transit. Lack of clarity between their purposes often leads to compliance errors and logistical issues.

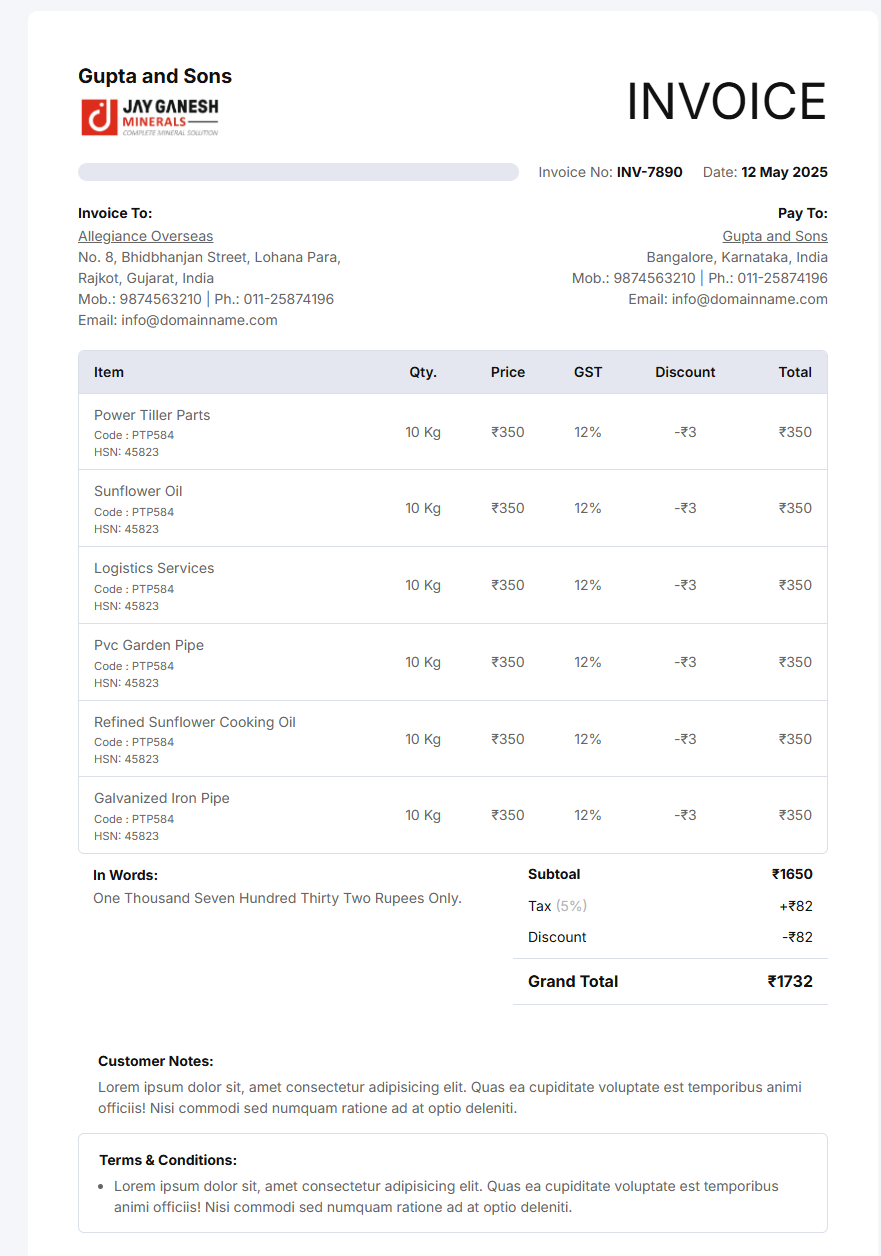

What Is an Invoice?

An invoice under GST is a legal document issued by a registered supplier to a buyer, detailing the supply of goods or services. It includes essential information such as supplier and recipient details, GSTIN, invoice number, taxable value, applicable GST rates, and tax amounts. A tax invoice is mandatory for charging and collecting GST.

Purpose of an Invoice in Business Transactions

The primary purpose of an invoice is to:

- Record the sale of goods or services

- Enable the collection of GST from the buyer

- Serve as proof of transaction for accounting and auditing

- Allow the buyer to claim Input Tax Credit (ITC)

Invoices form the backbone of GST compliance and financial documentation.

Key Parties Involved

- Supplier: The registered person who issues the invoice and collects GST

- Buyer/Recipient: The person or business receiving goods or services and paying GST

Both parties rely on the invoice for taxation, accounting, and legal verification.

Types of Invoices Under GST

Tax Invoice

A tax invoice is issued by a GST-registered supplier when taxable goods or services are supplied. It contains GST details and allows the recipient to claim Input Tax Credit. This is the most commonly used invoice under GST.

Bill of Supply

A bill of supply is issued when the supplier deals in exempt goods or services or is registered under the Composition Scheme. Since no GST is charged, tax details are not included, and the recipient cannot claim ITC.

Proforma Invoice

A proforma invoice is a preliminary document issued before the actual supply of goods or services. It provides an estimated cost and terms of sale but does not have legal validity for tax payment or ITC claims.

Debit and Credit Notes

- Debit Note: Issued when the taxable value or tax charged in the original invoice is less than required

- Credit Note: Issued when excess tax is charged or goods are returned

Both documents help correct invoice values and adjust GST liabilities as per GST laws.

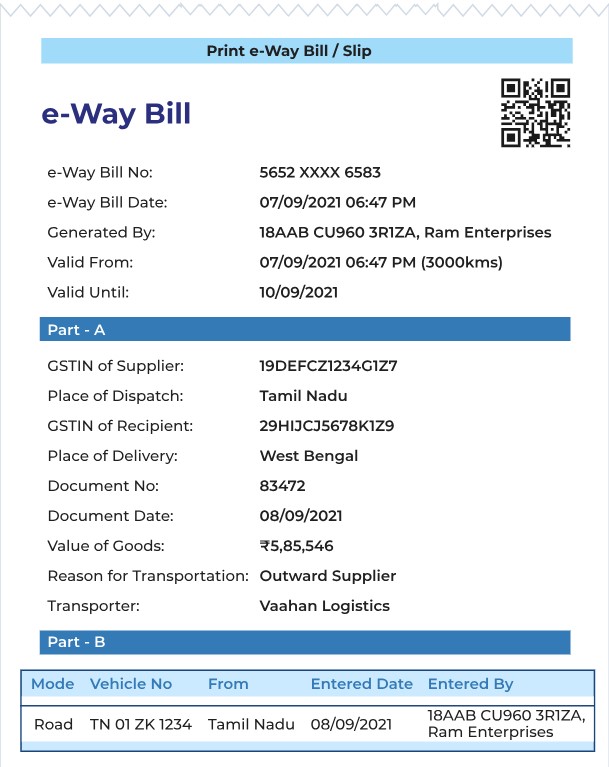

What Is an E-Way Bill?

An E-Way Bill is an electronically generated document required under the GST regime for the movement of goods. As per GST rules, it must be generated on the official e-way bill portal before transporting goods when the value of the consignment exceeds the prescribed limit. The e-way bill contains details of the supplier, recipient, transporter, goods, and vehicle.

Purpose of E-Way Bill in Goods Transportation

The primary purpose of an e-way bill is to track the movement of goods and prevent tax evasion. It enables tax authorities to monitor inter-state and intra-state transportation in real time. The e-way bill also ensures that goods being transported are backed by valid tax documents, reducing illegal movement and ensuring compliance during transit checks.

Applicability Threshold and Legal Requirement

An e-way bill is mandatory when the consignment value exceeds ?50,000 for the movement of goods. It applies to both inter-state and intra-state transport, depending on state-specific rules. The e-way bill must be generated by the supplier, recipient, or transporter before the movement of goods begins. Non-compliance can lead to penalties, seizure of goods, and delays in transportation.

Types of E-Way Bills

Regular E-Way Bill (Form EWB-01)

The Regular E-Way Bill, generated in Form EWB-01, is issued for the movement of a single consignment. It includes two parts:

- Part A: Details of supplier, recipient, invoice, and goods

- Part B: Transport details such as vehicle number or transporter ID

This form is mandatory for most routine goods transportation under GST.

Consolidated E-Way Bill (Form EWB-02)

A Consolidated E-Way Bill, generated in Form EWB-02, is used when multiple consignments are transported in a single vehicle. It allows the transporter to combine multiple individual e-way bills into one document for ease of movement and compliance. This simplifies logistics management and reduces paperwork during transit.

E-Way Bill vs Invoice

| Parameter | E-Way Bill | Invoice |

|---|---|---|

| Definition | An electronic document required under GST for tracking the movement of goods during transportation | A legal tax document issued for the supply of goods or services |

| Governing Law | Rule 138 of the CGST Rules, 2017 | Section 31 of the CGST Act, 2017 |

| Primary Purpose | To monitor and regulate the movement of goods and prevent tax evasion | To record sales, levy GST, and enable tax compliance |

| Nature of Document | Transport document | Tax and accounting document |

| When Issued | Before commencement of goods movement | At the time of supply of goods or services |

| Mandatory Threshold | Required when consignment value exceeds ?50,000 (subject to state rules) | Mandatory for all taxable supplies made by a GST-registered person |

| Applicable To | Movement of goods only | Supply of goods and services |

| Issued By | Supplier, recipient, or transporter | Supplier of goods or services |

| Legal Validity Without Other Document | Not valid alone; must be supported by invoice or delivery challan | Legally valid even without an e-way bill (for accounting purposes) |

| GST Calculation | Does not calculate or charge GST | Contains GST rate, taxable value, and tax amount |

| Input Tax Credit (ITC) | Cannot be used to claim ITC | Mandatory document for claiming ITC |

| Transport Details | Mandatory vehicle or transporter details required | Transport details are optional |

| Use During Transit | Must be carried (physically or electronically) during transportation | Copy may accompany goods but is not a transport mandate |

| Validity Period | Limited validity based on distance traveled | No validity expiry |

| Amendment Allowed | Limited amendments allowed before movement | Can be revised through debit or credit notes |

| Penalty for Non-Compliance | Goods detention, penalty, and seizure possible | Penalties for incorrect or non-issuance under GST |

| Portal Generated | Generated on the GST E-Way Bill portal | Generated by the supplier’s accounting or billing system |

| Audit & Assessment Role | Used mainly for movement verification | Used for tax audits, returns, and financial records |

| Common Example | Transporting goods worth Rs 1,00,000 from Delhi to Jaipur | Selling goods worth Rs 1,00,000 with applicable GST |

Key Takeaway

An invoice establishes a taxable transaction, while an e-way bill ensures the legal movement of goods. Both documents serve different purposes but often work together to ensure complete GST compliance.

When Is an Invoice Required Without an E-Way Bill?

In certain situations, an invoice is mandatory under GST even though an e-way bill is not required. These cases generally arise when goods movement does not meet the e-way bill applicability conditions or falls under specific exemptions.

Goods Value Below Threshold

When the consignment value is below Rs 50,000, an e-way bill is not mandatory. However, if the transaction involves a taxable supply, the supplier must still issue a valid tax invoice. This is common in small-value sales where GST is applicable but transportation documentation is relaxed.

Exempted Goods

For goods that are exempt from GST, a tax invoice or bill of supply may be issued without generating an e-way bill. Since GST is not levied, the e-way bill requirement may not apply, especially when the goods are listed as exempt under GST notifications.

Short-Distance Transportation

In certain states, short-distance movement of goods within a specified local area is exempt from e-way bill generation. Even in such cases, an invoice is required to record the sale and maintain proper accounting and compliance.

Specific GST Exemptions

GST law provides exemptions for specific categories of goods, modes of transport, and types of movement, such as transportation by non-motorized conveyance or movement within port or airport areas. In these situations, issuing an invoice remains necessary, while an e-way bill may not be required.

When Is an E-Way Bill Required Without an Invoice?

There are scenarios where goods are transported without a sale taking place. In such cases, an e-way bill is required even though a tax invoice is not issued. Instead, a delivery challan supports the movement.

Job Work Movement

When goods are sent to or returned from a job worker for processing, testing, or repair, an e-way bill is mandatory if the value exceeds the prescribed limit. Since there is no sale involved, a delivery challan is issued instead of an invoice.

Goods Sent for Approval

Goods transported on an approval basis—where the buyer has the option to accept or reject the goods—require an e-way bill for movement. An invoice is issued only after the buyer approves the goods; until then, the movement is supported by a delivery challan.

Transfers Between Branches

Stock transfers between branches, depots, or warehouses of the same business, especially across states, require an e-way bill. Although there is no immediate sale, the movement of goods must be tracked. Depending on GST applicability, a delivery challan or tax invoice may be issued.

Non-Supply Movements

Certain movements such as goods sent for exhibitions, demonstrations, repairs, or returns do not qualify as supply under GST. Even without an invoice, an e-way bill may be required to legally transport the goods, supported by appropriate documentation.

Compliance Insight

Understanding when an invoice or e-way bill is required independently helps businesses avoid penalties, reduce transit delays, and maintain accurate GST records.

Legal Importance of E-Way Bill and Invoice

Both the invoice and the e-way bill are legally significant documents under GST. They play a critical role in audits, inspections, and tax credit eligibility.

Role During GST Audits

During GST audits, tax authorities verify invoices to confirm the accuracy of taxable value, GST rates, and tax payments. E-way bills are cross-checked with invoices to ensure that goods movement matches reported sales. Any inconsistency may trigger scrutiny, demand notices, or penalties.

Use in Inspections and Compliance Checks

At checkpoints or during mobile inspections, officials examine e-way bills to verify the legitimacy of goods in transit. Invoices support the e-way bill by confirming ownership, value, and tax liability. Absence or mismatch of these documents can result in immediate detention of goods.

Impact on ITC (Input Tax Credit)

A valid tax invoice is mandatory for claiming Input Tax Credit. If the invoice details do not match the e-way bill data or GST returns, ITC claims may be denied or reversed. Proper documentation ensures seamless credit flow and avoids disputes during assessments.

Common Mistakes Businesses Make

Despite clear GST rules, businesses often make avoidable errors related to invoices and e-way bills, leading to compliance issues.

Generating E-Way Bill Without Correct Invoice Details

Many businesses generate e-way bills using incorrect invoice numbers, dates, or taxable values. Such discrepancies raise red flags during inspections and audits.

Incorrect GSTIN or HSN Codes

Errors in GSTIN or HSN codes on invoices or e-way bills can result in incorrect tax classification and reporting. This may lead to denial of ITC or additional tax demands.

Expired E-Way Bills During Transit

Delays in transportation often cause e-way bills to expire before goods reach their destination. Transporting goods with an expired e-way bill is a violation and attracts penalties.

Mismatch Between Invoice and E-Way Bill Data

Differences in quantity, value, or product description between the invoice and e-way bill can lead to detention of goods and compliance notices.

Penalties for Non-Compliance

Failure to comply with GST documentation requirements can result in financial penalties and operational disruptions.

Penalties for Missing or Incorrect Invoice

Issuing an incorrect invoice or failing to issue one can attract penalties under GST law. Authorities may impose fines, demand unpaid tax with interest, and initiate compliance proceedings.

Penalties for E-Way Bill Violations

Non-generation, incorrect generation, or use of an expired e-way bill can lead to monetary penalties per consignment. Repeated violations may also increase scrutiny from tax authorities.

Detention and Seizure of Goods

In serious cases of non-compliance, GST officers have the authority to detain or seize goods and vehicles in transit. Release is permitted only after payment of applicable tax, penalty, and compliance formalities, causing delays and financial losses to businesses.

Compliance Tip

Maintaining accuracy and consistency between invoices and e-way bills is essential to avoid penalties and ensure smooth business operations under GST.

Best Practices for Businesses

Following best practices helps businesses minimize GST risks, avoid penalties, and ensure smooth movement of goods.

Automation Through GST Software

Using GST-compliant accounting and billing software reduces manual errors in invoice and e-way bill generation. Automation ensures accurate GSTIN validation, HSN codes, tax calculations, and real-time e-way bill integration, improving overall compliance efficiency.

Proper Documentation Before Dispatch

Before dispatching goods, businesses should ensure that all mandatory documents—invoice, e-way bill, or delivery challan—are correctly prepared and verified. Cross-checking details such as invoice number, value, quantity, and vehicle details helps avoid transit issues.

Regular Compliance Audits

Conducting internal GST compliance audits at regular intervals helps identify mismatches between invoices, e-way bills, and GST returns. Early detection of errors allows timely corrections and reduces the risk of notices or penalties.

Staff Training on GST Documentation

Training staff involved in billing, logistics, and dispatch operations is crucial. Employees should understand when and how to generate invoices and e-way bills, validity rules, and compliance requirements to prevent operational mistakes.

FAQs on E-Way Bill and Invoice

Is an Invoice Mandatory for Every E-Way Bill?

No, an invoice is not mandatory in all cases. For non-supply movements such as job work, stock transfers, or goods sent for approval, an e-way bill can be generated based on a delivery challan instead of an invoice.

Can One Invoice Have Multiple E-Way Bills?

Yes, multiple e-way bills can be generated for a single invoice if goods are transported in parts or using different vehicles. Each movement must be supported by a valid e-way bill referencing the same invoice.

What Happens If Goods Move Without an E-Way Bill?

If goods are transported without a mandatory e-way bill, authorities may detain or seize the goods and vehicle. Penalties and tax payments may be required for release, leading to delays and additional costs.

Can an E-Way Bill Be Generated After Dispatch?

No, an e-way bill must be generated before the commencement of goods movement. Generating it after dispatch is considered non-compliance and may attract penalties if detected during transit.

Final Compliance Insight

Adopting best practices and understanding common GST scenarios related to invoices and e-way bills enables businesses to stay compliant, reduce risk, and maintain smooth logistics operations.