Accurate valuation is the backbone of international trade. Every cross-border transaction relies on precise value declaration to determine customs duties, taxes, foreign exchange compliance, and trade incentives. Even a small valuation error can lead to penalties, shipment delays, or rejection by customs authorities.

Why FOB Value and Invoice Value Are Often Confused

FOB value and invoice value are closely related, which often leads to confusion among exporters and importers. While FOB value represents the cost of goods up to the port of export, invoice value may include additional costs like freight and insurance. Misunderstanding these terms can result in incorrect declarations.

Impact on Customs Duty, GST, Freight, and Compliance

The declared value directly affects:

- Customs duty calculation

- IGST on imports

- Freight cost assessment

- Export incentives such as MEIS/RODTEP

- RBI and DGFT reporting

Incorrect values can cause financial losses or regulatory scrutiny.

Who Should Understand This Difference

Understanding the difference between FOB value and invoice value is crucial for:

- Exporters and importers

- Chartered Accountants (CAs)

- Customs brokers

- Logistics and freight forwarding companies

- Trade compliance professionals

What Is FOB Value? (Free on Board Value)

FOB (Free on Board) value refers to the value of goods up to the point where they are loaded onto the vessel at the port of export. Under Incoterms, FOB means the seller is responsible for all costs and risks until the goods are placed on board the ship.

Once the goods cross the ship’s rail, ownership, risk, and responsibility transfer from the exporter to the importer.

Components Included in FOB Value

The FOB value includes all costs incurred by the exporter until shipment loading, such as:

- Cost of Goods

Manufacturing or procurement cost of the product. - Packing Charges

Export-worthy packaging, labeling, and palletization. - Inland Transportation

Cost of transporting goods from the factory or warehouse to the port. - Port Handling and Loading Charges

Terminal handling, port fees, and loading charges incurred before shipment.

Costs Excluded from FOB Value

FOB value does not include costs incurred after goods are loaded onto the vessel, such as:

- International ocean or air freight

- Marine insurance

- Destination port charges

- Customs clearance at destination

- Post-shipment logistics

These costs are borne by the importer.

FOB Value in Export Documentation

FOB value plays a critical role in export documentation:

- Shipping Bills

FOB value is mandatory for filing shipping bills with Indian Customs. - Export Incentives

Schemes like RODTEP and duty drawback are calculated on FOB value. - RBI and DGFT Compliance

FOB value is reported for foreign exchange realization and export performance monitoring in India.

What Is Invoice Value?

Invoice value is the total value mentioned in the commercial invoice issued by the exporter to the importer. It represents the amount payable by the buyer and may vary depending on the agreed Incoterms (FOB, CIF, C&F, etc.).

In simple terms, invoice value = FOB value + additional agreed costs.

Components Included in Invoice Value

Depending on the contract, invoice value may include:

- FOB Value

Base value of goods up to the port of export. - Freight Charges

International shipping cost, if exporter bears it. - Insurance Charges

Marine or transit insurance, if applicable. - Additional Fees or Adjustments

- Discounts

- Surcharges

- Documentation fees

- Special handling charges

Types of Invoice Value

Invoice value differs based on Incoterms:

- FOB Invoice Value

Invoice includes only FOB value. Freight and insurance are paid by the importer. - CIF Invoice Value (Cost, Insurance, Freight)

Invoice includes FOB value + freight + insurance. - C&F Invoice Value (Cost and Freight)

Invoice includes FOB value + freight, excluding insurance.

Each type directly impacts customs valuation and duty calculation.

Role of Invoice Value in Trade

Invoice value is central to international trade operations:

- Customs Authorities

Used as the base for customs valuation and duty assessment. - Duty and GST Calculation

Import duty and IGST are calculated on invoice value plus applicable charges. - Foreign Exchange Remittance

Banks use invoice value to approve and process outward or inward remittances under FEMA guidelines.

FOB Value vs Invoice Value

| Basis | FOB Value | Invoice Value |

|---|---|---|

| Scope | Up to port of export | Total billed amount |

| Includes Freight | No | Yes (if applicable) |

| Includes Insurance | No | Yes (if applicable) |

| Used For | Export reporting, incentives | Customs duty, payment |

| Importance | Export compliance | Import valuation |

Understanding the difference between FOB value and invoice value is essential for smooth international trade operations. While FOB value reflects the exporter’s responsibility up to shipment, invoice value represents the complete transaction amount. Correct valuation ensures compliance, avoids penalties, and helps businesses maintain transparent global trade practices.

Key Differences Between FOB Value and Invoice Value

Understanding the distinction between FOB value and invoice value helps avoid valuation errors, compliance issues, and unnecessary financial risks in international trade.

FOB Value vs Invoice Value

| Basis | FOB Value | Invoice Value |

|---|---|---|

| Meaning | Value of goods up to the port of export | Total value billed to the buyer |

| Cost Coverage | Goods cost + packing + inland transport + port charges | FOB value + freight + insurance + other agreed charges |

| Risk Transfer Point | When goods are loaded onto the vessel | Depends on Incoterms mentioned in invoice |

| Use in Customs Clearance | Used mainly for export documentation | Used for import customs duty calculation |

| Impact on Tax & Duty | Basis for export incentives | Basis for customs duty and IGST |

FOB Value vs Invoice Value in Simple Terms

Practical Trade Flow Explanation

- The exporter manufactures and packs goods

- Goods are transported to the port and loaded on the vessel

- Up to this point, the value is FOB value

- After loading, freight and insurance are added (if applicable)

- The final amount charged to the buyer becomes the invoice value

Who Pays What and When

- Exporter pays: Production, packing, inland transport, port charges

- Importer pays: Freight, insurance, destination charges (unless agreed otherwise)

FOB Value vs Invoice Value in Import & Export Transactions

From Exporter’s Perspective

Why FOB Value Is Critical for Exports

FOB value is the primary value declared in shipping bills and export documentation. It reflects the exporter’s actual contribution to the trade transaction.

Impact on Export Incentives and Declarations

- Export incentives like RODTEP and duty drawback are calculated on FOB value

- Incorrect FOB declaration may lead to incentive rejection

- FOB value is reported to DGFT and RBI for export performance tracking

From Importer’s Perspective

How Invoice Value Affects Landed Cost

Invoice value directly impacts the importer’s total landed cost, including:

- Customs duty

- IGST

- Port handling charges

- Final product pricing in the domestic market

Customs Valuation and Duty Calculation

Customs authorities rely on invoice value (usually CIF-based) to calculate import duties and taxes.

Impact on Logistics and Shipping

Freight Contracts and Insurance Responsibility

- Under FOB contracts, the importer arranges freight and insurance

- Under CIF contracts, the exporter manages shipping and insurance

Risk Management During Transit

Clear understanding of value and risk transfer avoids disputes during damage, loss, or delay of goods.

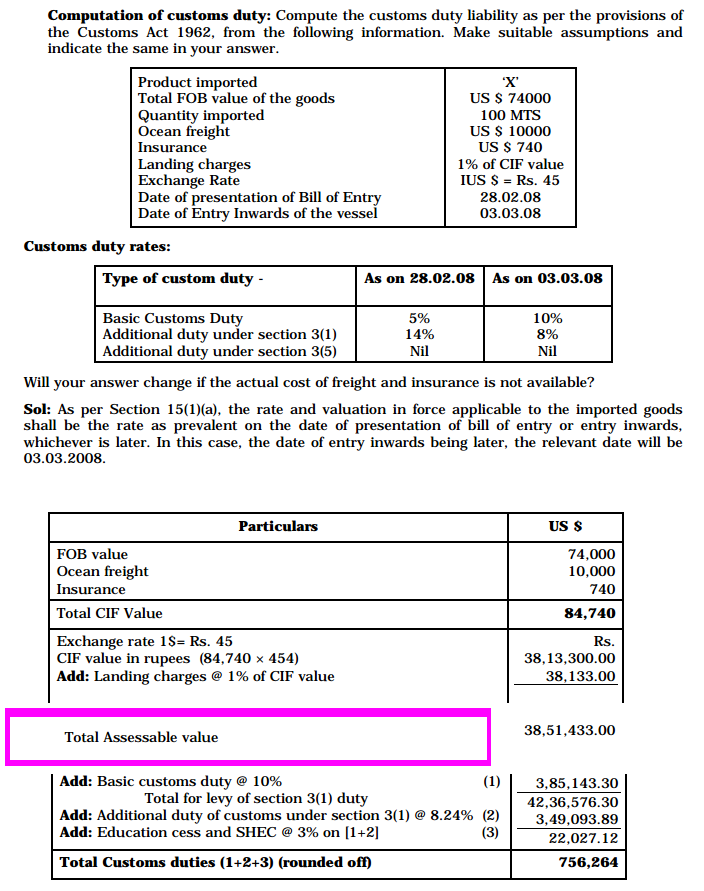

FOB Value vs Invoice Value for Customs and Taxation

Customs Duty Calculation

Which Value Customs Authorities Consider

- Imports: Customs generally consider CIF value

- Exports: FOB value is declared in shipping bills

FOB vs CIF Relevance

While FOB shows base export value, CIF determines actual import duty liability.

GST and IGST Implications

Role of Invoice Value in GST

Invoice value forms the basis for GST compliance, including:

- E-invoice generation

- GST returns

- Input tax credit claims

IGST on Imports and Exports

- Imports: IGST is levied on assessable value (invoice + duties)

- Exports: Zero-rated, but invoice value must match export records

RBI and FEMA Compliance

Importance of Accurate Invoice Value for Remittances

Banks use invoice value to approve foreign exchange transactions under FEMA.

Export Proceeds Realization

Mismatch between FOB value and invoice value may delay export proceeds realization and RBI reporting.

FOB Value vs Invoice Value (With Calculation)

Step-by-Step Numerical Example

| Cost Component | Amount (INR) |

|---|---|

| Cost of goods | 1,00,000 |

| Packing charges | 5,000 |

| Inland transport | 8,000 |

| Port & loading charges | 7,000 |

| FOB Value | 1,20,000 |

| International freight | 15,000 |

| Marine insurance | 5,000 |

| Invoice Value (CIF) | 1,40,000 |

Explanation

- FOB value ends at INR 1,20,000

- Invoice value includes freight and insurance

- Customs duty is calculated on invoice value (CIF)

Common Mistakes Exporters and Importers Make

- Confusing FOB value with CIF value

- Declaring incorrect FOB value in shipping bills

- Mismatch between commercial invoice and shipping documents

- Under-valuation or over-valuation leading to penalties

- Ignoring freight and insurance impact on invoice value

When to Use FOB Value vs Invoice Value

Use FOB Value When:

- Filing shipping bills

- Claiming export incentives

- Reporting exports to DGFT and RBI

Use Invoice Value When:

- Calculating customs duty

- Processing foreign exchange payments

- Determining landed cost

Situations Where Both Are Required

- Customs audits

- Trade disputes

- Financial reconciliation and compliance checks

FOB Value vs Invoice Value – FAQs

Is FOB value always lower than invoice value?

Yes, because invoice value may include freight and insurance.

Does invoice value include GST?

Invoice value may include GST for domestic compliance, but exports are zero-rated.

Which value is used for export incentives?

FOB value is used for calculating export incentives.

Can invoice value be higher than CIF value?

Yes, if additional charges or surcharges are included.

Summary of Key Differences

FOB value represents the exporter’s cost up to shipment, while invoice value reflects the total transaction amount between exporter and importer.

Why Understanding Both Values Is Crucial

Accurate valuation ensures smooth customs clearance, correct tax calculation, and full regulatory compliance.

Final Takeaway

Exporters should focus on FOB accuracy, while importers must understand invoice value impact. Clear knowledge of both ensures efficient, compliant, and profitable international trade.