Invoicing looks simple on the surface — you list what you did, send a total, and wait for payment. But for independent professionals, the details matter.

Freelancers and consultants often deliver similar outcomes — a report, a design, a strategy — yet their invoicing structures, legal requirements, and client expectations are very different.

This guide explains those key invoicing differences and shows how VyapaarKHATA, an Indian-made invoicing and billing software, helps both freelancers and consultants create professional, GST-compliant invoices with ease.

Quick Snapshot: Freelancer vs Consultant Invoicing

- Freelancer: Simple, task-based invoices — hourly or per-project, fast turnaround.

- Consultant: Structured invoices tied to retainers, milestones, or value-based fees with formal contracts.

Why the Difference Matters

Invoicing isn’t just about getting paid — it directly affects:

- Cash flow: Predictable income depends on clear invoicing.

- Professional image: Clients associate well-formatted invoices with credibility.

- Tax compliance: GST, TDS, and legal requirements depend on how you bill.

- Documentation: Proper invoices act as legal proof of service delivery.

Getting invoicing right saves time, prevents disputes, and ensures compliance.

Core Invoicing Differences Explained

A. Billing Model & Pricing

- Freelancers usually charge hourly or per project.

Example: Rs 1,000 per hour or Rs 15,000 per website. - Consultants charge retainers or value-based fees tied to milestones or outcomes.

Example: Rs 1,00,000 per quarter for strategy support.

This difference determines invoice structure and frequency — freelancers bill faster and more frequently, while consultants invoice at agreed project phases.

B. Invoice Complexity

- Freelancer Invoice: Simple — includes service description, rate, hours worked, tax (if applicable), and total.

- Consultant Invoice: Detailed — includes contract reference, milestones, retainer adjustments, phase details, and professional signature.

C. Payment Terms

- Freelancers: Short cycles (7–30 days). Some take advance payments before delivery.

- Consultants: Structured terms (30–90 days) or milestone-linked payments with retainers.

D. Legal & Tax Considerations (India-Specific)

- GST (Goods and Services Tax): Mandatory if turnover exceeds prescribed limits or when working with GST-registered clients.

- TDS (Tax Deducted at Source): Many companies deduct TDS when paying consultants.

- Record Keeping: Both freelancers and consultants must maintain copies of all invoices for accounting and tax filings.

E. Branding & Presentation

Consultants often use company-branded invoices with signatures and structured formats.

Freelancers can benefit by doing the same — tools like VyapaarKHATA allow customization with logos, business names, and professional color themes.

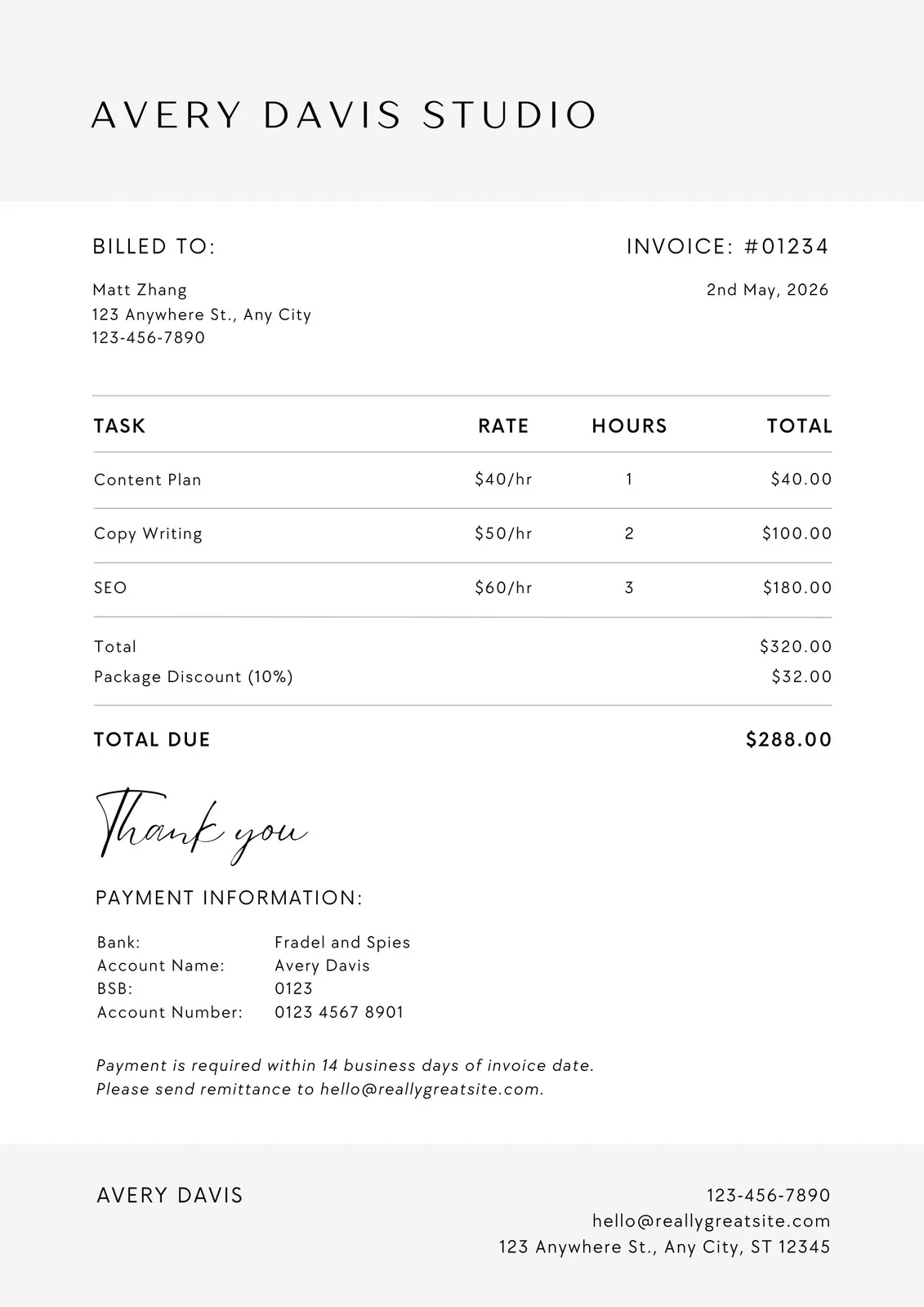

Sample Freelancer Invoice Format

Invoice No: FR-2025-045

Date: 7 Nov 2025

Bill To: ABC Startup Pvt. Ltd.

Description:

-

Blog Writing — 3 articles @ Rs 5,000 each = Rs 15,000

GST (18%): Rs 2,700

Total Payable: Rs 17,700

Payment Terms: Pay within 15 days.

Payment Mode: UPI / Bank Transfer.

Sample Consultant Invoice Format

Invoice No: CN-2025-009

Date: 7 Nov 2025

Contract Ref: STRAT-2025-001

Client: XYZ Enterprises Pvt. Ltd.

Description:

- Milestone 2: Market Analysis Report — Rs 1,50,000

Less Advance Received: Rs 45,000

GST (18% on Balance): Rs 18,900

Total Payable: Rs 1,23,900

Payment Terms: Due within 30 days.

Notes: Includes strategic consultation deliverables for Phase 2.

How VyapaarKHATA Simplifies Invoicing

VyapaarKHATA is a complete Indian invoicing and billing software designed for freelancers, consultants, and MSMEs.

It helps users create GST-ready invoices, manage clients, track payments, and share invoices instantly through WhatsApp or Email — all in one place.

Key Features

- GST & Non-GST Invoice Templates: Automatically calculates tax and generates government-compliant formats.

- Customizable Templates: Add logos, business names, and contract references to look professional.

- Instant Invoice Sharing: Send invoices via WhatsApp or email directly from the app.

- Client & Ledger Management: Store client contact info, invoice history, and track pending payments.

- Expense Tracking: Record expenses to get a full business overview.

- Multi-Device Access: Create invoices on mobile or web versions conveniently.

VyapaarKHATA is specifically designed for Indian service professionals, making it ideal for both small businesses and self-employed individuals.

Steps to Create a Freelancer Invoice in VyapaarKHATA

- Create Your Account and add business details — name, logo, GSTIN (if applicable).

- Add Client Details — name, contact, GSTIN, and address.

- Select Template — choose GST or non-GST depending on your registration.

- Enter Service Details — hours worked, rate, total, and applicable tax.

- Set Payment Terms — mention due date, notes, and advance (if any).

- Preview & Send Invoice — share via WhatsApp or Email directly from VyapaarKHATA.

Steps to Create Consultant Invoices (Retainer or Milestone Based)

- Set Up Contract Reference — mention contract or project number in invoice header.

- Use Milestone Billing — divide total fee into phases and invoice at each stage.

- Include Deliverables — describe scope of each milestone.

- Deduct Advance Payments — show adjustments clearly for transparency.

- Use Signature Section — include authorized signatory line for formality.

- Generate PDF & Share — instantly send through VyapaarKHATA for faster client processing.

Best Practices for Both Freelancers and Consultants

- Always use unique invoice numbers for easy tracking.

- Add clear payment terms and due dates.

- Maintain separate bank accounts for business transactions.

- Keep digital backups of all invoices and receipts.

- Mention TDS or GST separately to avoid confusion.

- Send payment reminders for overdue invoices.

Common Invoicing Mistakes to Avoid

- Forgetting to mention tax breakup (GST).

- Using vague descriptions like “services rendered.”

- Skipping advance or milestone adjustments.

- Sending unbranded, unnumbered invoices.

- Not following up on delayed payments.

Using VyapaarKHATA, these errors can be easily prevented with built-in templates and automatic calculations.

Practical Examples

Example 1 – Freelancer Designer:

Creates a ?10,000 invoice for a design project with 18% GST in VyapaarKHATA, sends it via WhatsApp, and gets UPI payment confirmation within the app — invoice marked as paid automatically.

Example 2 – Business Consultant:

Raises three milestone invoices for a client. Each invoice deducts prior advance payments and mentions contract reference — all tracked digitally through VyapaarKHATA’s ledger feature.

GST Registration and Compliance

Freelancers and consultants must register under GST if their annual turnover exceeds the threshold limit.

GST-compliant invoices include:

- Supplier & client details

- Invoice number & date

- HSN/SAC codes

- Tax rates & breakup

- Total payable amount

VyapaarKHATA offers ready-to-use GST templates, ensuring all mandatory details are auto-filled, reducing compliance errors.

Match Your Invoice to Your Business Model

Freelancers should prioritize simplicity and quick invoicing, while consultants need detailed, contract-linked invoices.

No matter your profession, VyapaarKHATA helps you:

- Create professional, branded invoices

- Automate GST & tax calculations

- Send invoices instantly

- Track payments effortlessly

- Stay compliant and organized

A professional invoice doesn’t just get you paid faster — it strengthens client trust and enhances your business reputation.

Q1. Can freelancers use VyapaarKHATA for invoicing?

Yes, it’s ideal for freelancers, small businesses, and independent professionals.

Q2. Does VyapaarKHATA support retainers and milestone billing?

Yes, you can adjust advances, track milestones, and generate detailed invoices easily.

Q3. Is VyapaarKHATA GST-compliant?

Yes, it includes ready GST and Non-GST invoice templates, ideal for all Indian businesses.

Q4. Can invoices be shared digitally?

Yes, you can share via Email, PDF, or WhatsApp in a few clicks.

Q5. Is VyapaarKHATA suitable for consultants working with corporate clients?

Absolutely. It supports detailed invoices with retainer contracts, professional signatures, and tax details.