In the fast-paced world of social media marketing, content creation, and digital strategy, getting paid promptly is just as important as delivering great results. Whether you’re a freelance social media manager, influencer, or agency owner, creating professional and transparent invoices ensures smooth financial operations and builds trust with your clients.

This guide walks you through everything you need to know about invoicing for social media services — from what an invoice should include, to tools, templates, and tips for faster payments.

Why Invoicing Matters in Social Media Services

Invoicing is not just a payment request — it’s a formal record of your business transaction. Here’s why it matters:

1. Professionalism

A well-designed invoice reflects your brand identity and creates a professional impression. It assures clients that they’re dealing with a credible service provider.

2. Transparency

An itemized invoice details exactly what services were provided, helping avoid confusion or disputes about charges.

3. Payment Assurance

Invoices establish a formal payment agreement, protecting you from delays or missed payments by setting clear due dates and terms.

4. Tax and Accounting Accuracy

Invoicing helps maintain accurate financial records, simplifying income tracking and tax filing for freelancers and agencies alike.

5. Scalability

As your client base grows, having a structured invoicing process allows you to manage multiple projects and payments effortlessly.

Understanding the Structure of a Social Media Invoice

A social media service invoice must be clear, complete, and compliant with financial and tax norms.

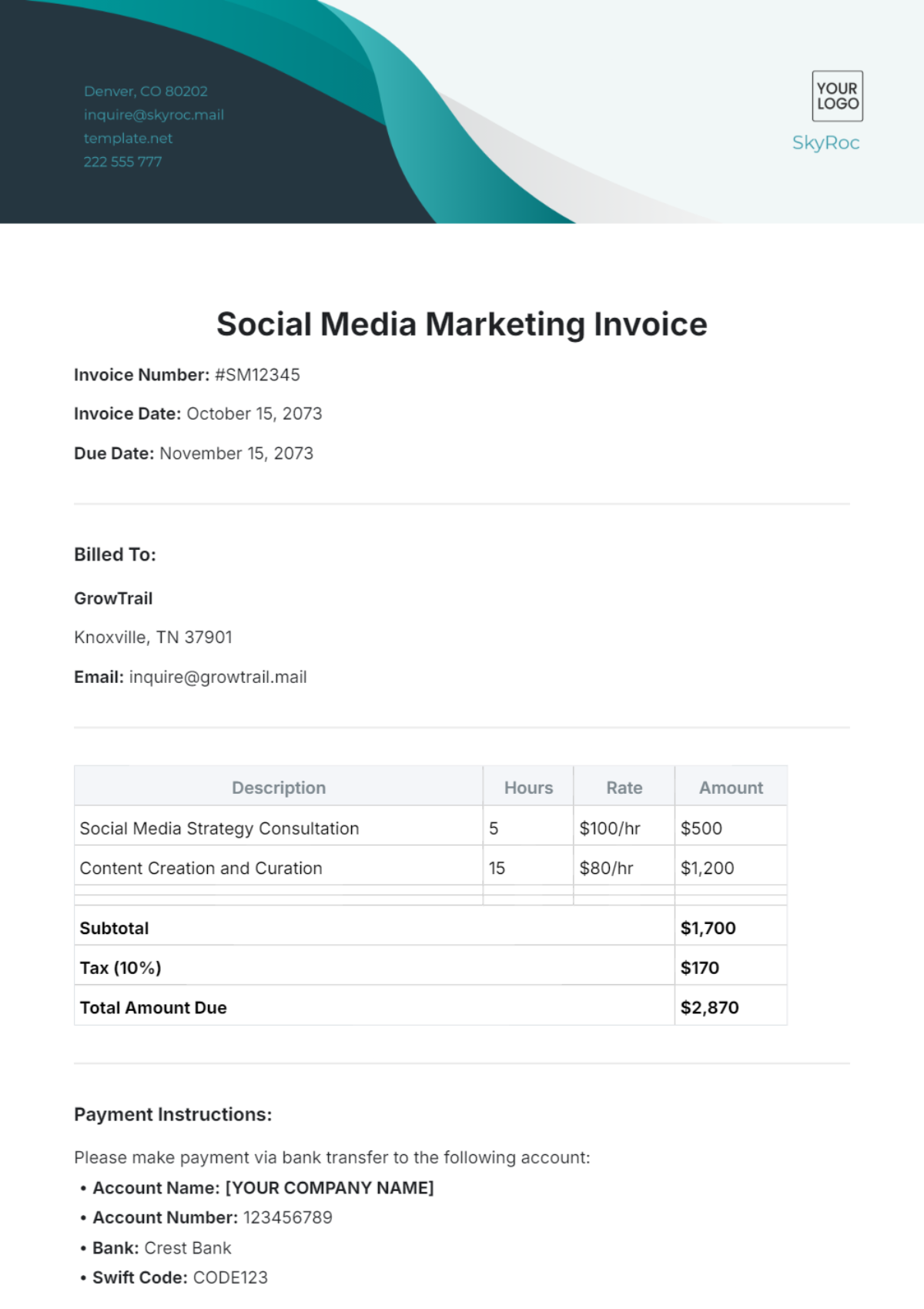

Essential Components of a Professional Invoice

- Header:

Include your business name, logo, and contact details for easy identification. - Client Information:

Add your client’s full name, company, address, and contact details. - Invoice Number & Date:

Use unique invoice numbers for each transaction to maintain organized records. - Service Description:

Clearly describe each task or deliverable, such as content creation, ad management, analytics, or campaign reporting. - Rates & Hours:

Specify hourly or package-based pricing. - Subtotal, Taxes, and Total Amount Due:

Include any applicable GST/VAT and the total payable amount. - Payment Terms:

Mention due date, accepted payment modes, and any penalties for late payments. - Notes or Thank-You Section:

End with a personalized note for a professional touch.

Example Line Items Table

| Service | Description | Hours/Qty | Rate | Total |

|---|---|---|---|---|

| Content Strategy | Monthly calendar planning and campaign design | 5 hrs | ?1000/hr | ?5000 |

| Ad Campaign Setup | Facebook & Instagram Ads Management | 1 package | ?12,000 | ?12,000 |

| Analytics & Reporting | Monthly performance insights | 1 | ?3000 | ?3000 |

Pricing Models for Social Media Professionals

Social media professionals use various pricing methods depending on project type and duration:

1. Hourly Billing

Ideal for short-term or consultation-based tasks such as ad setup or platform training.

Example: ?1000–?2500 per hour for content planning or consultation.

2. Monthly Retainer

A common model for ongoing work like account management, posting, and analytics.

Example: ?15,000–?60,000/month depending on scope and number of platforms.

3. Project-Based Pricing

Used for campaigns, audits, or one-time content projects.

Example: ?20,000–?1,00,000 per campaign based on duration and deliverables.

4. Performance-Based Pricing

Compensation linked to results — such as engagement rates or ad conversions.

Example: A base fee plus performance incentives (e.g., 5% of ad spend or leads generated).

Tip: Always attach a “Scope of Work” document or mention deliverables within your invoice to avoid miscommunication.

Taxes and Legal Considerations

Proper tax compliance enhances professionalism and avoids legal issues.

- GST/VAT:

In India, freelancers and agencies earning above ?20 lakh annually must register for GST. Include your GSTIN and mention applicable rates (18% for digital marketing services). - International Clients:

Mention currency clearly (e.g., USD, GBP), and ensure you account for PayPal or bank transfer fees. - Record Keeping:

Maintain digital records of all invoices for at least 5 years — essential during audits or for income verification. - Tax Invoices:

Include mandatory fields such as your tax number, client address, and total taxable value.

Tools & Software for Invoicing Social Media Services

Manual invoicing can become cumbersome as your client list grows. Using invoicing software simplifies billing, automates reminders, and reduces human error.

Popular Invoicing Tools

| Tool | Best For | Key Features |

|---|---|---|

| VyaaparKhata | Freelancers & small agencies | GST-ready invoicing, recurring bills, payment tracking |

| QuickBooks | Mid-sized digital agencies | Time tracking, tax reporting, and detailed client records |

| FreshBooks | Global freelancers | Automated reminders, expense tracking, online payments |

| Zoho Invoice | Growing teams | Custom templates, analytics, and multi-currency support |

Why Choose Invoicing Software

- Saves time through templates and automation.

- Reduces calculation errors.

- Helps track pending or overdue payments.

- Offers professional invoice formats.

- Integrates with accounting and client management systems.

VyaaparKhata, for instance, is designed for Indian businesses and freelancers — offering simple GST-compliant invoicing, expense tracking, and payment reminders all in one dashboard.

Tips for Effective Invoicing and Faster Payments

- Send invoices immediately after completing milestones or at month-end.

- Be detailed and transparent — list all deliverables clearly.

- Provide multiple payment methods (UPI, bank transfer, PayPal).

- Set clear payment terms (e.g., Net 15 or Net 30 days).

- Automate reminders for pending payments.

- Maintain professionalism in all communications.

- Follow up consistently — polite reminders show reliability.

Common Invoicing Mistakes to Avoid

- Missing invoice numbers or issue dates.

- Ignoring tax compliance or GST details.

- Vague service descriptions without quantifiable deliverables.

- Forgetting to mention payment terms or late fee policy.

- Sending editable invoice files instead of PDF format.

- Not tracking unpaid invoices or follow-ups.

Free & Editable Invoice Templates for Social Media Services

You can use pre-made templates to save time and maintain consistency. Recommended formats:

- Freelancer Social Media Manager Invoice:

Simple structure for individual professionals billing hourly or per project. - Agency Monthly Retainer Invoice:

Includes detailed service breakdowns for multiple clients. - Campaign-Based Invoice:

Suitable for influencers or marketers billing per campaign or deliverable.

(Tip: Use PDF or software-generated invoices from VyaaparKhata for better accuracy and branding.)

How to Get Paid Efficiently

To ensure a consistent cash flow:

- Attach direct payment links (Paytm, Razorpay, Stripe, etc.).

- Send invoices at predictable intervals (e.g., the 1st or 30th of every month).

- Maintain clear written communication with clients about payment timelines.

- Enable recurring billing for long-term retainers.

- Use software like VyaaparKhata to automate reminders and ledger updates for each client.

A strong invoicing process is a foundation for running a sustainable social media business. It not only helps you get paid on time but also keeps your operations transparent, tax-compliant, and professional.

Using an invoicing tool like VyaaparKhata simplifies the entire process — from creating GST-ready invoices to sending reminders and tracking payments automatically. Whether you’re a freelancer or an agency, adopting the right invoicing system helps you focus more on creativity and less on chasing payments.

FAQs

- What should be included in a social media services invoice?

Business and client details, service description, total amount, tax, payment terms, and invoice number. - How do I charge for social media management work?

You can charge hourly, monthly (retainer), or project-based depending on client needs. - What is the best invoicing app for freelancers?

Tools like VyaaparKhata, FreshBooks, and Zoho Invoice are popular among freelancers. - Can I include GST in my social media service invoice?

Yes. If registered under GST, include your GSTIN and apply 18% on taxable services. - How do I invoice international clients?

Mention currency, exchange rates, and include transaction details like PayPal or Wise payment options. - What’s the difference between a quote and an invoice?

A quote is an estimate sent before work begins; an invoice is a payment request after delivery. - How can I track if a client has paid?

Invoicing software like VyaaparKhata automatically updates payment status and pending dues. - Are digital invoices legally valid?

Yes, e-invoices or PDF invoices are legally valid if they contain all mandatory details. - Can I automate recurring invoices?

Yes. Use invoicing software to set automatic recurring billing for monthly retainers. - How do I handle late payments professionally?

Send gentle reminders, mention late fees in terms, and maintain a record of all communications.