Keeping a close eye on your income and expenses is one of the simplest yet most powerful steps toward financial stability. Whether you are managing personal finances or running a small business, understanding where your money comes from and where it goes is essential. Tracking your finances helps you avoid unnecessary debt, ensures you stay on top of bills, and allows you to save and invest wisely.

By consistently monitoring your cash flow, you can make informed decisions, uncover spending patterns you might have overlooked, and work toward both short-term and long-term financial goals. From budgeting efficiently to planning for emergencies, tracking income and expenses provides the clarity you need to take control of your financial life.

Understanding Income and Expenses

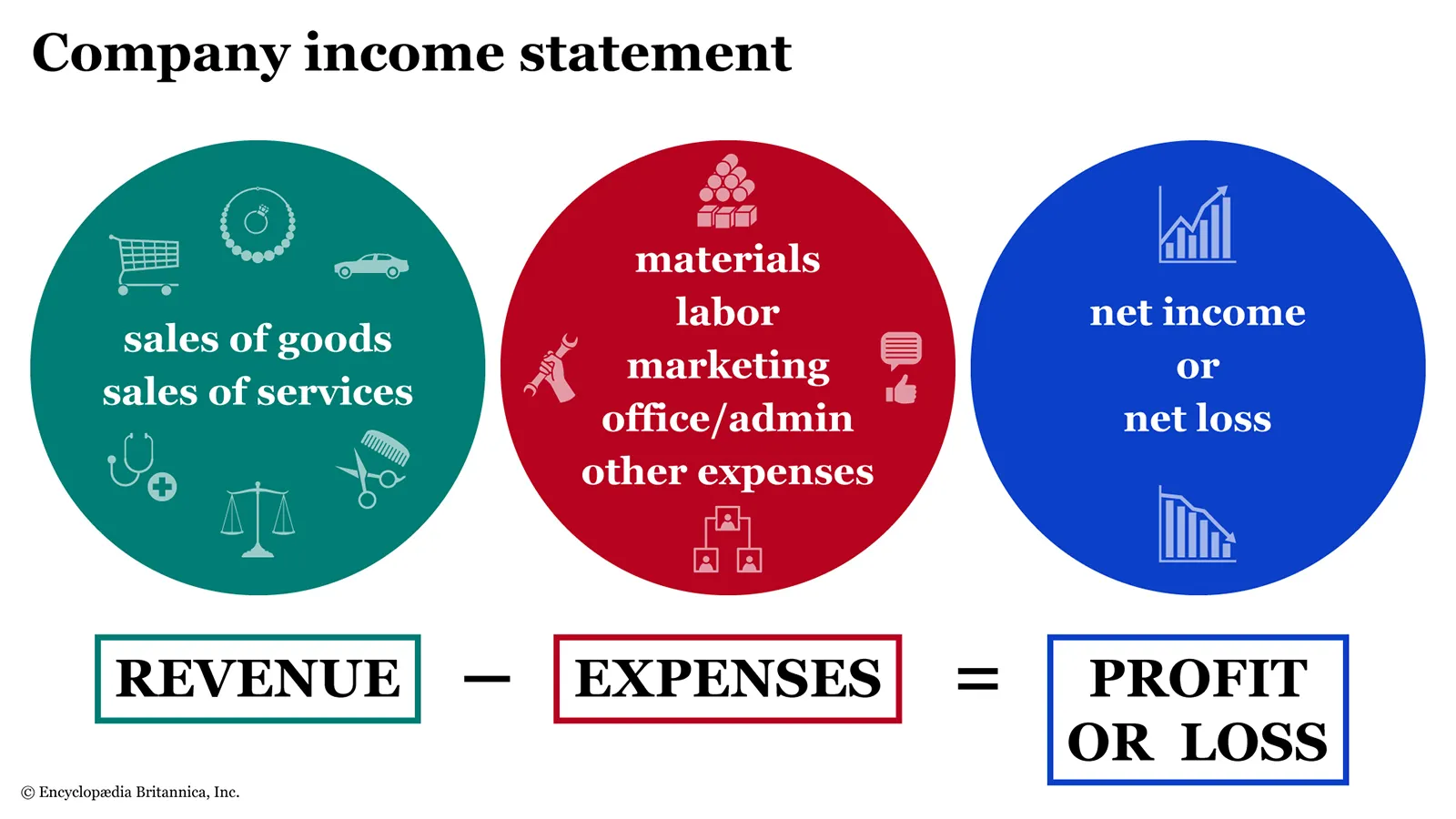

Before you can track effectively, you need to understand what exactly counts as income and expenses.

Income includes all the money you receive regularly or irregularly. This can be:

- Your salary or wages from a job.

- Revenue from a business or side hustle.

- Passive income, such as interest, dividends, or rental earnings.

Expenses are all the costs you incur in your daily life or business operations. They can be classified as:

- Fixed expenses: Costs that remain consistent, such as rent, mortgage, or subscriptions.

- Variable expenses: Costs that fluctuate, such as groceries, dining out, or fuel.

- Essential expenses: Necessities like utilities, food, and healthcare.

- Discretionary expenses: Non-essential spending, such as entertainment, travel, or luxury purchases.

Categorizing income and expenses is crucial because it allows you to see exactly where your money is coming from and going, helping you make smarter financial choices.

Benefits of Tracking Your Finances

Keeping track of your income and expenses is more than just an organizational task—it brings tangible benefits:

- Gain control over your money: Knowing exactly how much money you earn and spend helps you manage it effectively and avoid financial surprises.

- Prevent overspending and debt accumulation: Tracking allows you to identify areas where you might be spending unnecessarily, reducing the risk of falling into debt.

- Identify opportunities to save and invest: By analyzing spending patterns, you can find ways to cut costs and allocate funds toward savings or investments.

- Prepare for taxes and financial planning: Organized records make tax preparation easier and ensure you have accurate information for budgeting, investing, and financial goal setting.

Consistent tracking turns money management from a reactive task into a proactive strategy, giving you peace of mind and financial confidence.

Choose Your Tracking Method

There are multiple ways to track your finances, and the best method depends on your preferences and lifestyle. Broadly, tracking methods can be divided into manual and digital approaches.

A. Manual Methods

One traditional method is to use a notebook or ledger. This approach involves writing down all income and expenses daily or weekly.

Pros:

- Simplicity: No software or technical skills required.

- Personal control: You can customize categories and track exactly what you want.

Cons:

- Time-consuming: Recording each transaction manually can take effort.

- Prone to errors: Forgetting entries or miscalculating totals can lead to inaccuracies.

B. Digital Tools

Modern tools make financial tracking easier and more precise. Options include:

- Spreadsheet software: Programs like Excel or Google Sheets allow you to create customized tracking templates, calculate totals automatically, and generate charts.

- Budgeting apps: Apps such as YNAB, Mint, or PocketGuard can sync with your bank accounts, categorize transactions automatically, and provide insightful reports.

Pros:

- Automation: Calculations and reports are done automatically.

- Easy categorization: Digital tools can classify expenses and income into predefined categories.

- Visual reports: Charts and graphs help you understand spending patterns at a glance.

Cons:

- Learning curve: Some apps or spreadsheets require time to set up and understand.

- Device access: You need a smartphone or computer, and sometimes internet access, to use these tools effectively.

Steps to Track Expenses and Income

Tracking your finances can feel overwhelming at first, but breaking it down into simple, actionable steps makes it manageable. Follow these steps to ensure nothing slips through the cracks:

- Record all income sources

Start by listing every source of income. This includes your salary, freelance or consulting payments, dividends, interest from savings accounts, rental income, or any other money coming in. Make sure to record the exact amount and the date received. Accurate tracking of all income sources ensures you know exactly how much money is available for expenses and savings. - Track all expenses daily

The key to effective tracking is consistency. Record every expense, no matter how small, each day. This includes bills, groceries, dining, transportation, entertainment, subscriptions, or impulse purchases. Using a mobile app or spreadsheet can simplify this process and help you avoid forgetting cash expenses. - Categorize transactions

Organize your income and expenses into categories to understand where your money is going. Common expense categories include housing, utilities, groceries, transportation, healthcare, entertainment, and savings. Income can be categorized by salary, business, or passive sources. Categorization helps identify overspending areas and opportunities to save. - Review regularly

Set aside time weekly or monthly to review your records. Look for patterns in your spending, identify recurring costs, and assess if you are staying within budget. Regular reviews allow you to make adjustments before small issues become major financial problems. - Compare income vs. expenses

Finally, compare your total income to your total expenses. This step helps you determine whether you are saving, overspending, or living within your means. If expenses exceed income, identify categories where you can cut back. If you have a surplus, decide how much to allocate to savings, investments, or debt repayment.

Tips for Effective Tracking

To make tracking easier and more effective, consider these practical tips:

- Keep receipts or digital copies of transactions

Store receipts physically or use your phone to capture photos of them. Digital copies prevent loss and make future reconciliation easier. - Automate recurring payments and income

Automating bills, subscriptions, and income deposits reduces manual tracking effort and ensures you don’t miss due dates. - Set budget limits for each category

Define monthly or weekly spending limits for categories like groceries, entertainment, or dining out. This keeps your spending in check. - Use graphs or charts for visual understanding

Visualizing data through charts and graphs makes it easier to understand patterns and spot areas for improvement. - Regularly reconcile bank statements

Compare your records with bank statements to ensure accuracy and catch any errors or unauthorized transactions promptly.

Common Mistakes to Avoid

Even with the best intentions, many people make common mistakes that hinder effective tracking:

- Ignoring small or cash expenses

Tiny expenses, like a cup of coffee or snacks, can add up. Track everything to get a true picture of your finances. - Not updating records consistently

Delays in logging transactions create gaps in your financial picture. Make tracking a daily habit. - Overcomplicating tracking methods

Using overly complex systems can discourage consistent tracking. Stick to simple methods that work for you. - Forgetting to adjust categories as needs change

Your financial situation may change over time. Regularly review and update categories to reflect new expenses or income sources.

Advanced Tracking Strategies

Once you’re comfortable with basic tracking, consider these advanced strategies for deeper financial insight:

- Envelope budgeting or zero-based budgeting

Allocate every dollar of income to a specific purpose, ensuring nothing is left unplanned. Envelope budgeting uses physical or digital “envelopes” for each spending category. - Track net worth along with cash flow

Beyond income and expenses, monitoring assets, liabilities, and overall net worth provides a complete picture of your financial health. - Forecast future expenses

Anticipate upcoming large expenses like vacations, medical bills, or home repairs. Forecasting helps you plan and avoid surprises that could derail your budget.

Consistently tracking your income and expenses is one of the most effective ways to achieve financial stability. By following simple steps, using the right tools, and avoiding common pitfalls, you gain complete control over your money.

Start small—choose a tracking method that fits your lifestyle and gradually build the habit. Over time, this practice not only helps you manage day-to-day finances but also empowers you to save, invest, and achieve long-term financial goals.