In business and trade, pricing plays a very important role in buying and selling products or services. Terms like list price and invoice price are commonly used, but many people often confuse them or assume they mean the same thing. In reality, these two prices serve different purposes and are used at different stages of a transaction.

Understanding the difference between invoice price vs list price is important because it helps avoid pricing misunderstandings, billing disputes, and accounting errors. Knowing how each price works allows buyers to negotiate better, sellers to price products correctly, and accountants to maintain accurate financial records.

This blog is useful for buyers, sellers, traders, wholesalers, retailers, accountants, small businesses, manufacturers, and procurement teams. Whether you are placing orders, issuing bills, or reviewing financial documents, knowing these pricing terms can help you make informed business decisions.

What Is List Price?

The list price is the initial price of a product or service set by the seller. It is also known as the marked price, catalog price, or published price. This price is displayed publicly and does not include discounts, taxes, or negotiated reductions.

Purpose of List Price in Sales and Marketing

The main purpose of the list price is to act as a reference price. It helps sellers position their product in the market and gives buyers a starting point for comparison. Sellers often use list prices to show discounts later, making the deal appear more attractive to customers.

Common Industries Where List Price Is Used

List price is widely used in industries such as:

- Retail and wholesale trade

- Manufacturing and industrial supplies

- Automobiles and spare parts

- Electronics and consumer goods

- Real estate and property listings

In B2B trade, list prices are often shared in catalogs, quotations, brochures, and online product listings.

Examples of List Price in Real-World Scenarios

- A machine is advertised at a list price of Rs 1,00,000 in a product catalog.

- A mobile phone has a list price of Rs 25,000 on an e-commerce website before discounts.

- A wholesaler provides a price list showing list prices for different product grades.

In all these cases, the list price is not the final payable amount.

What Is Invoice Price?

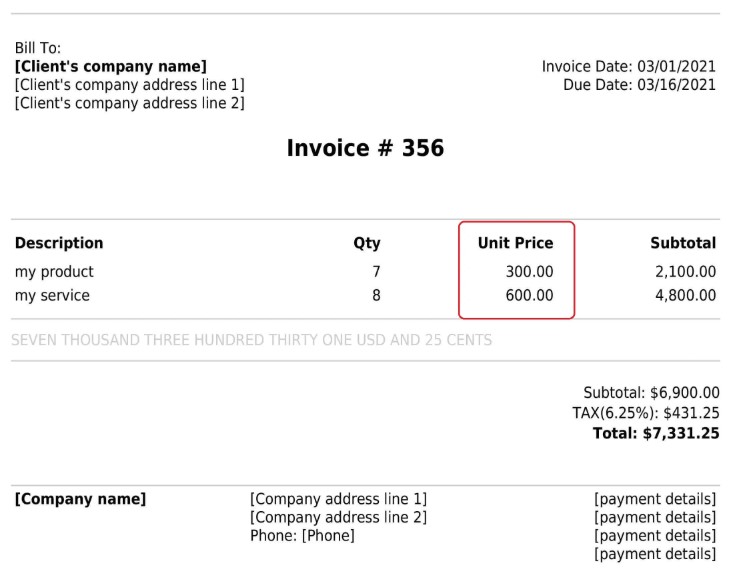

The invoice price is the final amount that the buyer must pay to the seller. It is mentioned on the invoice after all calculations, including discounts, taxes, freight charges, and other applicable costs.

Components Included in an Invoice Price

The invoice price may include:

- Basic product or service cost

- Trade or cash discounts

- GST, VAT, or other applicable taxes

- Packing and forwarding charges

- Transportation or shipping costs

- Insurance or handling charges

All these elements together determine the final invoice value.

How Invoice Price Is Calculated

Invoice price is calculated by starting with the agreed product price, subtracting any discounts, and then adding applicable taxes and additional charges. This price reflects the actual transaction value between the buyer and seller.

Examples of Invoice Price in Business Transactions

- A product with a list price of Rs 10,000 is sold at a 10% discount, plus 18% GST. The invoice price becomes higher than the discounted amount due to tax.

- A wholesaler issues an invoice including product cost, freight charges, and GST as the final payable amount.

- A supplier bills a retailer with item-wise pricing, tax breakup, and total invoice value.

In every transaction, the invoice price is the legally payable and recorded amount.

Invoice Price vs List Price

| Basis | List Price | Invoice Price |

|---|---|---|

| Meaning | The displayed or published price set by the seller | The final price charged to the buyer on the invoice |

| Includes discounts | No, discounts are not included | Yes, trade or cash discounts are applied |

| Includes taxes and fees | No taxes or additional charges included | Includes GST, freight, handling, and other fees |

| Final payable amount | Not the final amount | This is the exact amount payable by the buyer |

| Used for accounting and compliance | No | Yes, used for financial records and compliance |

| Legal relevance | Not legally binding for payment | Legally valid document for payment and audits |

This table clearly shows that list price is informational, while invoice price is transactional and legally important.

Why Invoice Price Is Usually Lower Than List Price

In most business transactions, the invoice price is lower than the list price due to several practical reasons.

Role of Trade Discounts

Sellers often offer trade discounts to wholesalers, distributors, or repeat buyers. These discounts reduce the list price before invoicing, resulting in a lower invoice price.

Negotiation and Bulk Purchase Benefits

Buyers purchasing in large quantities usually negotiate better rates. Bulk orders allow sellers to reduce per-unit costs, which is reflected in a lower invoice price.

Promotional Pricing Strategies

To increase sales, sellers may run promotions, seasonal offers, or special pricing for selected customers. These reductions are applied directly to the invoice.

Market Competition Factors

In competitive markets, sellers adjust prices to stay relevant. Even if the list price remains fixed, the invoice price may be lowered to match or beat competitors.

When Is List Price Used?

List price is mainly used before the actual sale takes place.

Price Display and Catalog Listings

List prices are shown in catalogs, brochures, websites, and price lists to inform customers about product value.

Initial Price Negotiations

During early discussions, buyers and sellers refer to the list price as a starting point for negotiation.

Marketing and Promotions

List prices help highlight discounts by showing how much a buyer saves compared to the original price.

Reference Pricing for Customers

Customers use list prices to compare products from different sellers and understand market pricing.

When Is Invoice Price Used?

Invoice price is used after the deal is finalized.

Final Billing and Payment

The invoice price is the amount the buyer must pay. It appears on the invoice issued by the seller.

Accounting and Bookkeeping

Businesses record invoice prices in their accounting systems for income, expenses, and profit calculation.

Tax Calculation and Compliance

GST, VAT, or other taxes are calculated based on the invoice price, making it essential for compliance.

Audit and Legal Records

Invoices serve as legal documents during audits, disputes, or financial verification processes.

Importance of Understanding the Difference for Businesses

Knowing the difference between invoice price and list price is crucial for smooth business operations.

Better Cost Control and Budgeting

Understanding the final invoice price helps businesses plan budgets accurately and avoid unexpected expenses.

Accurate Tax and GST Compliance

Since taxes are applied to the invoice price, correct understanding ensures proper tax filing and compliance.

Improved Negotiation Strategies

Buyers can negotiate discounts more effectively when they understand how list price converts into invoice price.

Avoiding Billing Disputes

Clear knowledge of pricing terms reduces confusion and prevents disputes between buyers and sellers.

Common Misconceptions About Invoice Price and List Price

Many businesses and buyers misunderstand pricing terms, which often leads to confusion. Let’s clear up some common misconceptions.

Are They Always Different?

No, invoice price and list price are not always different. In some cases, especially when no discounts or additional charges apply, the invoice price may be the same as the list price. However, this situation is less common in wholesale and B2B transactions.

Is List Price the Final Price?

This is one of the biggest misconceptions. List price is usually not the final price. It does not include discounts, taxes, or extra charges. The final payable amount is almost always the invoice price mentioned on the bill.

Can Invoice Price Change After Listing?

Yes, invoice price can change even if the list price remains the same. Changes may occur due to negotiated discounts, tax rate changes, freight costs, or promotional offers. The list price acts only as a reference, not a fixed payment amount.

FAQs on Invoice Price vs List Price

Is Invoice Price the Same as Selling Price?

Invoice price is generally considered the actual selling price, as it reflects the final agreed amount between buyer and seller after adjustments.

Can Invoice Price Be Higher Than List Price?

Yes, in some cases. If taxes, shipping charges, or handling fees are added to the base price, the invoice price can become higher than the list price.

Does Invoice Price Include GST or Tax?

Yes, invoice price usually includes GST, VAT, or other applicable taxes, which are clearly shown on the invoice.

Why Do Companies Still Show List Price?

Companies display list prices to provide transparency, enable price comparison, support marketing strategies, and serve as a reference point for discounts and negotiations.

Understanding the difference between invoice price and list price is essential for smooth and transparent business transactions. The list price serves as a reference or advertised price, while the invoice price represents the final payable amount after discounts, taxes, and additional charges.

For buyers, knowing this difference helps in better budgeting, negotiation, and avoiding billing confusion. For sellers, it ensures clear pricing communication, accurate invoicing, and strong customer trust.

Best practices for pricing clarity and transparency include:

- Clearly mentioning discounts and taxes

- Providing detailed invoices

- Educating customers about pricing terms

- Maintaining consistent and fair pricing policies

By using invoice price and list price correctly, businesses can build long-term relationships, reduce disputes, and maintain compliance with accounting and tax regulations.