Dealing with the Income Tax Department can be intimidating, especially when you receive an ITR notice. Whether it’s a simple intimation or a more complex demand, understanding what the notice means and how to respond is critical. This guide provides detailed steps, tips, and insights to handle ITR notices effectively and avoid unnecessary stress.

What is an ITR Notice?

An Income Tax Return (ITR) notice is a formal communication from the Income Tax Department (ITD). It can be issued for various reasons, including mismatches in your return, missing information, or discrepancies identified during assessment.

Not all notices imply wrongdoing. Some notices are merely informational, such as intimation under Section 143(1), which notifies taxpayers about tax adjustments made by the IT department. Others, such as reassessment notices under Section 148, require more careful action.

How ITR Notices Are Delivered

- E-filing portal: Most notices are now sent electronically.

- Email: Official communication from the IT department.

- Post: Physical notices may still be sent to your registered address.

Always verify that the notice is genuine by checking your PAN, assessment year, and notice number against official records.

Common Types of ITR Notices

Understanding the type of notice helps determine the right response. Here are the most common types:

- Intimation under Section 143(1)

- Issued when there is a discrepancy between the tax filed and the tax computed by the department.

- Example: Your TDS is not reflected properly in your ITR.

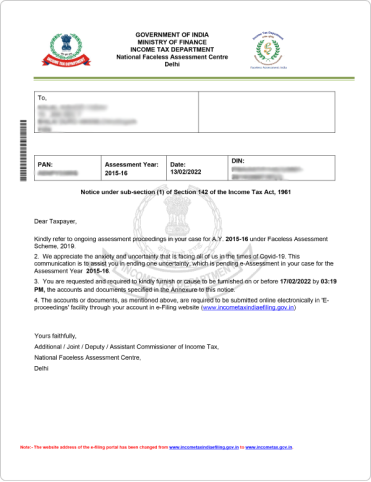

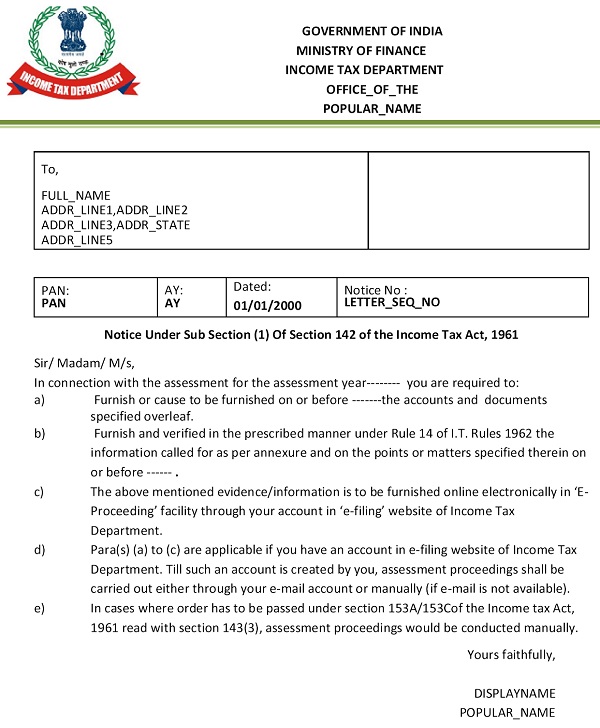

- Notice under Section 142(1)

- Requests additional information or clarifications regarding your return.

- Example: Providing details of exempt income not declared.

- Notice under Section 148

- Issued when the department believes some income has escaped assessment.

- Example: Undisclosed capital gains or high-value transactions.

- Notice under Section 156

- Demand notice for outstanding taxes, penalties, or interest.

- Example: Tax payable after adjustments in 143(1) intimation.

- Notice under Section 139(9)

- Issued when your ITR is defective.

- Example: Missing signatures, incorrect bank details, or computational errors.

Why ITR Notices Are Issued

The Income Tax Department issues notices for various reasons:

- Errors in filed returns: Calculation mistakes, incorrect income declaration, or missed deductions.

- Mismatch in TDS or income: Your Form 26AS may not match the filed ITR.

- High-value transactions flagged: Large deposits or investments can trigger scrutiny.

- Random scrutiny selection: Some taxpayers are selected for assessment randomly.

- Late or missing filing: Filing delays or missing returns attract notices.

Steps to Handle an ITR Notice

Receiving a notice can be stressful, but the right steps make it manageable:

- Verify authenticity: Ensure the notice is genuine by checking the PAN, notice number, and assessment year.

- Read carefully: Understand the reason for the notice. Pay attention to deadlines.

- Check your documents: Cross-verify your ITR, Form 26AS, and other financial documents.

- Respond on time: Avoid penalties or escalations by submitting a response within the given timeline.

- Seek professional help if needed: Tax professionals can guide complex responses or disputed assessments.

How to Respond to Different Types of Notices

Each notice type requires a specific response:

- Section 143(1) Intimation:

- If tax is due, pay it online.

- If incorrect, file rectification using Section 154.

- Section 142(1) Notice:

- Submit the requested documents or clarifications via the e-filing portal.

- Section 148 Notice:

- Review the assessment year and alleged escaped income.

- File a revised return or submit an explanation with supporting documents.

- Section 156 Demand Notice:

- Pay the due amount online.

- If disputed, raise an objection under Section 245 or appeal to CIT(A).

- Section 139(9) Defective Return Notice:

- Correct the mistakes in your return and submit it within the notice period.

Common Mistakes to Avoid

- Ignoring the notice or delaying the response.

- Providing incomplete or incorrect information.

- Panicking and submitting unsupported claims.

- Using unofficial channels to respond.

Tips for Smooth Communication with the IT Department

- Keep all tax-related documents organized, including Form 16, Form 26AS, bank statements, and investment proofs.

- Use the official Income Tax e-filing portal for responses.

- Maintain written records of all submissions.

- Respond promptly and professionally to avoid escalation.

When to Seek Professional Help

Professional guidance is recommended if:

- The notice involves scrutiny or reassessment.

- There is a high-value demand or penalty.

- Legal interpretation or appeals are required.

- You are unsure about how to respond accurately.

FAQs About ITR Notices

- How can I verify if an ITR notice is genuine?

Check the notice number, PAN, and assessment year against your e-filing account. - What is the time limit to respond to a notice?

Usually, 30 days from the date of receipt, but check the notice specifics. - Can I revise my return after receiving a notice?

Yes, in most cases, filing a revised return under Section 139(5) is allowed. - What happens if I ignore an ITR notice?

Ignoring may lead to penalties, interest, or forced assessment. - How do I track the status of my notice?

Use your Income Tax e-filing account under the ‘My Notices’ section.

Receiving an ITR notice doesn’t mean you are in trouble. The key is to understand the notice, respond correctly, and act within the prescribed timeline. Keeping records organized, using official channels, and seeking professional advice when needed ensures smooth communication with the Income Tax Department. Being proactive today can save you from complications tomorrow.