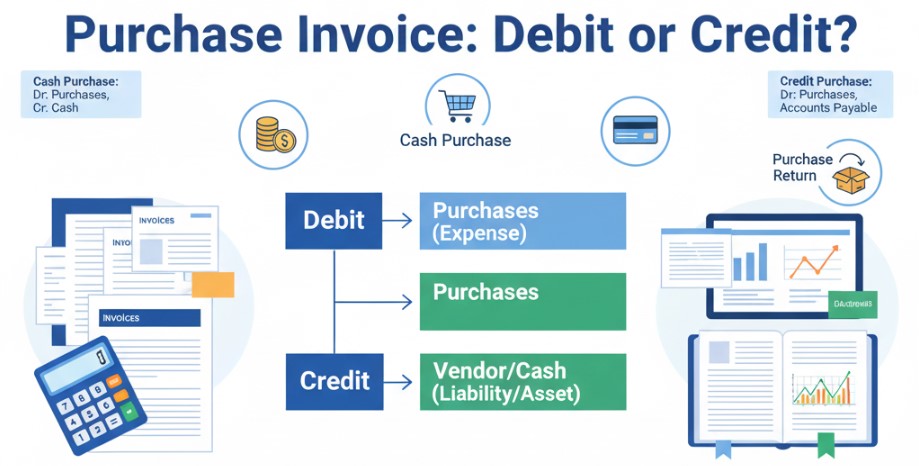

When businesses purchase goods or services, the supplier issues a purchase invoice. This invoice serves as proof of the transaction and becomes the basis for recording the expense in accounting books. However, one common confusion among business owners, accountants, and even students of commerce is whether a purchase invoice should be recorded as a debit or a credit.

The answer depends on how the transaction is structured — cash purchase, credit purchase, or return. Understanding the correct accounting treatment ensures accurate financial reporting, compliance with tax laws, and proper vendor reconciliation.

What is a Purchase Invoice?

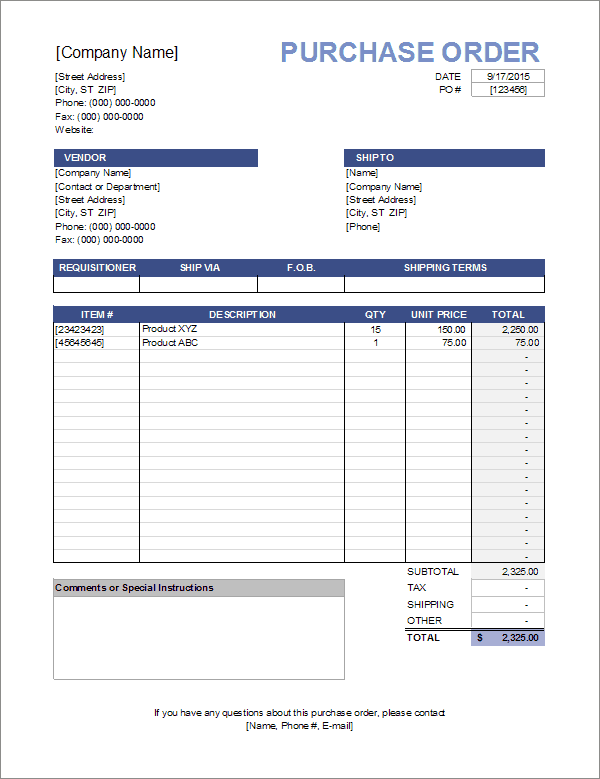

A purchase invoice is a commercial document issued by a seller to a buyer, stating the details of goods or services supplied, their quantity, price, and payment terms.

- Purpose: It acts as evidence of a purchase and an obligation for the buyer to make payment.

- Example: If a company buys raw materials worth Rs 50,000 on credit, the supplier issues a purchase invoice mentioning item details, GST, and due date.

- Difference from a Sales Invoice: For the seller, it is a sales invoice (credit to revenue). For the buyer, it is a purchase invoice (debit to expense).

Debit or Credit in Accounting Basics

To understand the treatment of a purchase invoice, let’s recall the golden rules of accounting:

- Assets (What you own): Increase → Debit | Decrease → Credit

- Liabilities (What you owe): Increase → Credit | Decrease → Debit

- Expenses/Losses: Always Debit

- Income/Gains: Always Credit

This framework helps determine whether purchases should be debited or credited.

Is a Purchase Invoice a Debit or Credit?

In standard double-entry accounting, the treatment is:

- Purchases → Debit (as it increases expense).

- Accounts Payable (Vendor) → Credit (as liability increases).

Example Journal Entry:

A company purchases office supplies worth Rs 20,000 on credit.

Purchases A/c Dr. Rs 20,000

To Accounts Payable (Vendor) Rs 20,000

Here, Purchases (expense) is debited and Vendor (liability) is credited.

So, a purchase invoice is primarily recorded as a debit entry in the purchases account, with a corresponding credit to either cash or accounts payable.

Case Scenarios for Better Understanding

a) Cash Purchase

If a business purchases goods worth Rs 10,000 in cash:

Purchases A/c Dr. Rs 10,000

To Cash A/c Rs 10,000

Purchases = Debit (expense) | Cash = Credit (asset reduced).

b) Credit Purchase

If goods worth Rs 50,000 are purchased on credit:

Purchases A/c Dr. Rs 50,000

To Vendor A/c Rs 50,000

Purchases = Debit (expense) | Vendor = Credit (liability).

c) Purchase Return (Debit Note Issued)

If goods worth Rs 5,000 are returned to the supplier:

Accounts Payable A/c Dr. Rs5,000

To Purchase Return A/c Rs 5,000

This reduces liability (debit to vendor) and reduces purchases (credit to returns).

Difference Between Debit Note & Credit Note in Purchases

- Debit Note (Issued by Buyer): When goods are returned, the buyer issues a debit note to reduce the supplier’s balance.

- Credit Note (Issued by Seller): The seller acknowledges the return by issuing a credit note to adjust the buyer’s account.

Example:

- Buyer purchases goods worth Rs 1,00,000.

- Returns defective goods worth Rs 20,000.

- Buyer issues a Debit Note, supplier issues a Credit Note.

Common Mistakes Businesses Make

- Treating purchase invoices as always debit or always credit – forgetting that payment mode changes the entry.

- Mixing up purchase returns with purchases – recording them as debits instead of credits.

- GST input credit errors – forgetting to record Input GST as a separate debit account.

- Example: Purchases Dr., Input GST Dr., To Vendor Cr.

Importance of Recording Purchases Correctly

- Accurate Financial Statements: Correct entries ensure purchases reflect in the Profit & Loss Account as expenses and creditors in the Balance Sheet as liabilities.

- Vendor Reconciliation: Helps match your books with supplier ledgers, avoiding disputes.

- Tax Compliance: Proper GST/VAT input credit recording ensures compliance and maximizes tax savings.

- Audit Readiness: Well-maintained purchase records make audits smooth and error-free.

FAQs

Q1. Is a purchase invoice always a debit?

Yes, purchases are generally debited because they represent an expense, but the corresponding entry can be credit to cash or vendor.

Q2. How do I record a purchase return?

By debiting the supplier (reducing liability) and crediting purchase return (reducing expense).

Q3. What if I wrongly record a purchase invoice as credit?

Your accounts will show incorrect liabilities/expenses, leading to misstated profit. Correction through reversal entry is necessary.

Q4. Does purchase invoice affect profit and loss or balance sheet?

Yes. Purchases affect Profit & Loss A/c (as expense) and corresponding entries affect Balance Sheet (cash or creditors).

A purchase invoice is recorded as a debit entry in purchases (expense account) because it represents goods or services acquired by the business. The corresponding credit entry depends on how payment is made — cash or credit. If goods are returned, a purchase return entry reverses the effect through debit and credit notes.

In short:

- Purchases → Debit

- Vendor or Cash → Credit

- Returns → Reverse treatment

By understanding these rules, businesses can maintain accurate books of accounts, comply with tax laws, and avoid costly mistakes in financial reporting.