In India’s GST framework, every transaction must be supported by proper documentation. A receipt voucher is one such essential document that is used when a registered person receives an advance payment against a future supply of goods or services. GST law mandates the issuance of a receipt voucher to ensure proper tax accounting of such advances.

The importance of a receipt voucher lies in its role in tracking advance payments and calculating GST even before the supply is made. Failure to issue it can result in non-compliance and penalties under GST laws.

What is a Receipt Voucher?

A receipt voucher is a document that a registered supplier must issue when they receive advance consideration for the supply of goods or services.

Definition under GST Law:

As per Section 31(3)(d) of the CGST Act, a registered person must issue a receipt voucher whenever an advance is received before the supply of goods or services.

Relevance in Transactions:

- Booking of events or services

- Advance payments in real estate or construction

- E-commerce transactions involving deposits

- Custom orders in manufacturing

Difference Between Receipt Voucher and Invoice:

| Aspect | Receipt Voucher | Invoice |

|---|---|---|

| When Issued | On receiving advance | At the time of supply |

| Purpose | Acknowledges advance payment | Demands payment after supply |

| GST Liability | GST becomes payable | Final GST liability is shown |

Legal Provisions and Applicability

The issuance of a receipt voucher is mandated under the following provisions:

- Section 31(3)(d) of CGST Act

- Rule 50 of CGST Rules

Applicability in B2B and B2C:

- B2B: Mandatory when advance is received.

- B2C: Required unless the supply is exempt.

Threshold and Registration:

Only GST-registered persons are required to issue receipt vouchers. Unregistered persons or suppliers of exempt goods/services are not bound by this requirement.

When to Issue a Receipt Voucher?

Scenarios:

- Advance before the supply of goods

- Advance for services yet to be delivered

- Partial payments received prior to invoicing

Timing:

A receipt voucher should be issued immediately on receipt of the advance amount. Delays may lead to GST liability without proper documentation.

Exceptions:

- Exempted supplies

- Non-taxable transactions

- Small-value advances below threshold

Mandatory Contents of a Receipt Voucher

As per Rule 50 of CGST Rules, a receipt voucher must include the following:

- Name, address, and GSTIN of the supplier

- Voucher serial number

- Date of issue

- Recipient’s name, address, and GSTIN (if registered)

- Description of goods/services

- Advance amount received

- Tax rate and amount (CGST/SGST/IGST)

- Place of supply and state code

- Signature or digital signature of the supplier or authorized representative

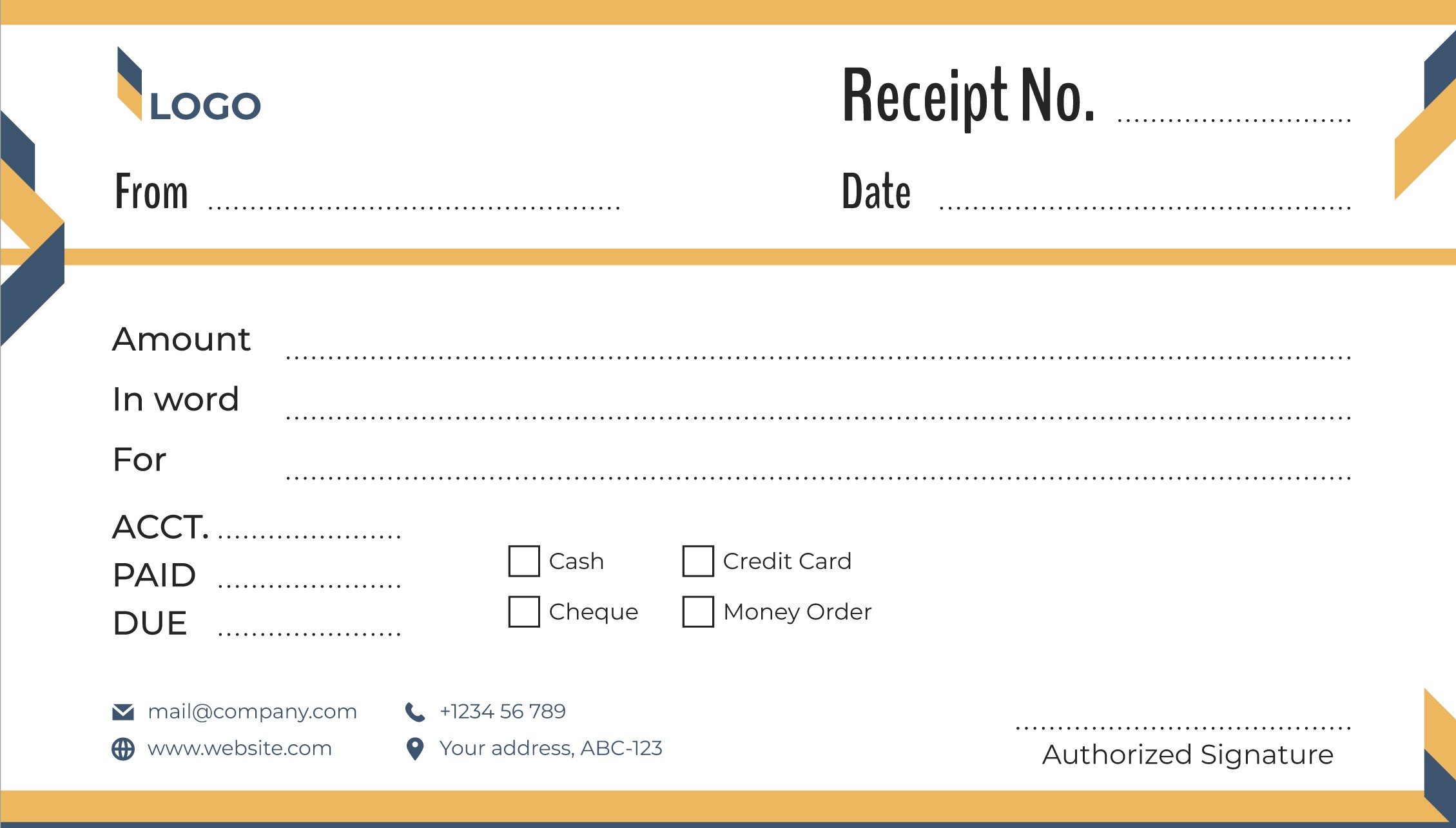

Receipt Voucher Format (Sample Template)

| Receipt Voucher | |

|---|---|

| Voucher No: | RV/2025/001 |

| Date: | 01-Aug-2025 |

| Supplier Name: | ABC Traders |

| GSTIN: | 29ABCDE1234F1Z1 |

| Recipient Name: | XYZ Pvt. Ltd. |

| Recipient GSTIN: | 27XYZDE4321K1Z2 |

| Description: | Advance for furniture order |

| Amount Received: | Rs 50,000 |

| CGST @9%: | Rs 4,500 |

| SGST @9%: | Rs 4,500 |

| Total: | Rs 59,000 |

| Place of Supply: | Mumbai (27) |

| Authorized Signatory: | Digitally Signed |

Rules and Compliance Aspects

Rule 50 of CGST Rules provides a detailed prescription for issuing receipt vouchers.

Format and Validity:

- Must be signed manually or digitally

- Should follow a unique serial number format for each financial year

- Can be issued electronically or in paper format

Record Retention:

Receipt vouchers must be retained for a period of 6 years from the date of filing of annual returns. These are critical for audits and tax reconciliations.

Treatment of Tax in Receipt Voucher

GST must be paid at the time of advance receipt, even if the actual supply occurs later.

Adjustment in Invoice:

The tax paid on the advance should be deducted while issuing the final tax invoice.

Refund or Cancellation:

In case the order is cancelled and the advance is refunded, a Refund Voucher must be issued, and GST should be reversed in returns.

Input Tax Credit (ITC):

ITC cannot be availed by the recipient on the basis of a receipt voucher. Only after receiving the supply and a proper tax invoice can ITC be claimed.

Practical Use Cases

- Bulk Orders: A manufacturer receives Rs 2 lakh in advance and issues a receipt voucher, later linked to the tax invoice for reconciliation.

- Event Services: A wedding planner collects 50% advance and documents it using a receipt voucher.

- Real Estate: Builder collects Rs 5 lakh booking amount and pays GST on advance via voucher.

- E-commerce: Online retailer collects deposit and issues a compliant receipt voucher.

- Exports: Exporter receives foreign advance and issues voucher showing INR value and zero-rated tax.

Common Errors to Avoid

- Missing GSTIN of recipient in B2B cases

- Omitting tax rate or place of supply

- Failing to reverse tax on advance refund

- Confusing receipt voucher with payment voucher

Receipt Voucher vs Other GST Vouchers

| Basis | Receipt Voucher | Payment Voucher | Refund Voucher | Advance Invoice |

|---|---|---|---|---|

| Purpose | Document advance receipt | Document payment made | Record refund of advance | Record supply before actual delivery |

| Payment Direction | Incoming | Outgoing | Outgoing | Incoming |

| GST Effect | Tax liability arises | No tax implication | Tax reversal | Tax becomes due |

FAQs on Receipt Voucher in GST

Q1. Is it mandatory to issue receipt voucher for full or partial advance?

Yes, it is mandatory for both full and partial advances under taxable supplies.

Q2. Is receipt voucher needed for exempted supplies?

No, it is not required if the supply is fully exempt.

Q3. Can multiple advances be combined?

Yes, if they relate to the same order or transaction. However, proper documentation is essential.

Q4. Can a receipt voucher be edited?

No direct edits are allowed. Cancel the original and issue a new one with updated details.

Q5. Is receipt voucher applicable in exports?

Yes, and it must mention the currency conversion rate, amount in INR, and treat it as zero-rated supply.

Receipt vouchers are critical for maintaining compliance in advance payment scenarios under GST. They help track advance receipts, manage GST liability, and prepare for audits.

Businesses are advised to use GST-compliant tools like VyapaarKHATA to automate voucher creation and maintain accurate records. VyapaarKHATA is a powerful yet simple accounting solution for managing invoices, billing, inventory, expenses, GST filing, and more.

Timely issuance and linking of receipt vouchers with tax invoices ensure full compliance and financial clarity in GST operations.