In the modern Indian business environment, maintaining clear and accurate invoicing practices is essential. Whether you are a small trader, a manufacturer, a freelance consultant, or a GST-registered service provider, issuing the correct type of invoice directly impacts your compliance, credibility, and tax obligations.

This guide will help you understand the key differences between a standard invoice and a tax invoice, their legal significance, and how VyapaarKHATA Invoice simplifies invoicing for businesses across India.

What is a Standard Invoice?

A standard invoice is a basic commercial document issued by sellers to buyers for goods or services provided, without any tax components like GST. It is typically used by businesses not registered under GST.

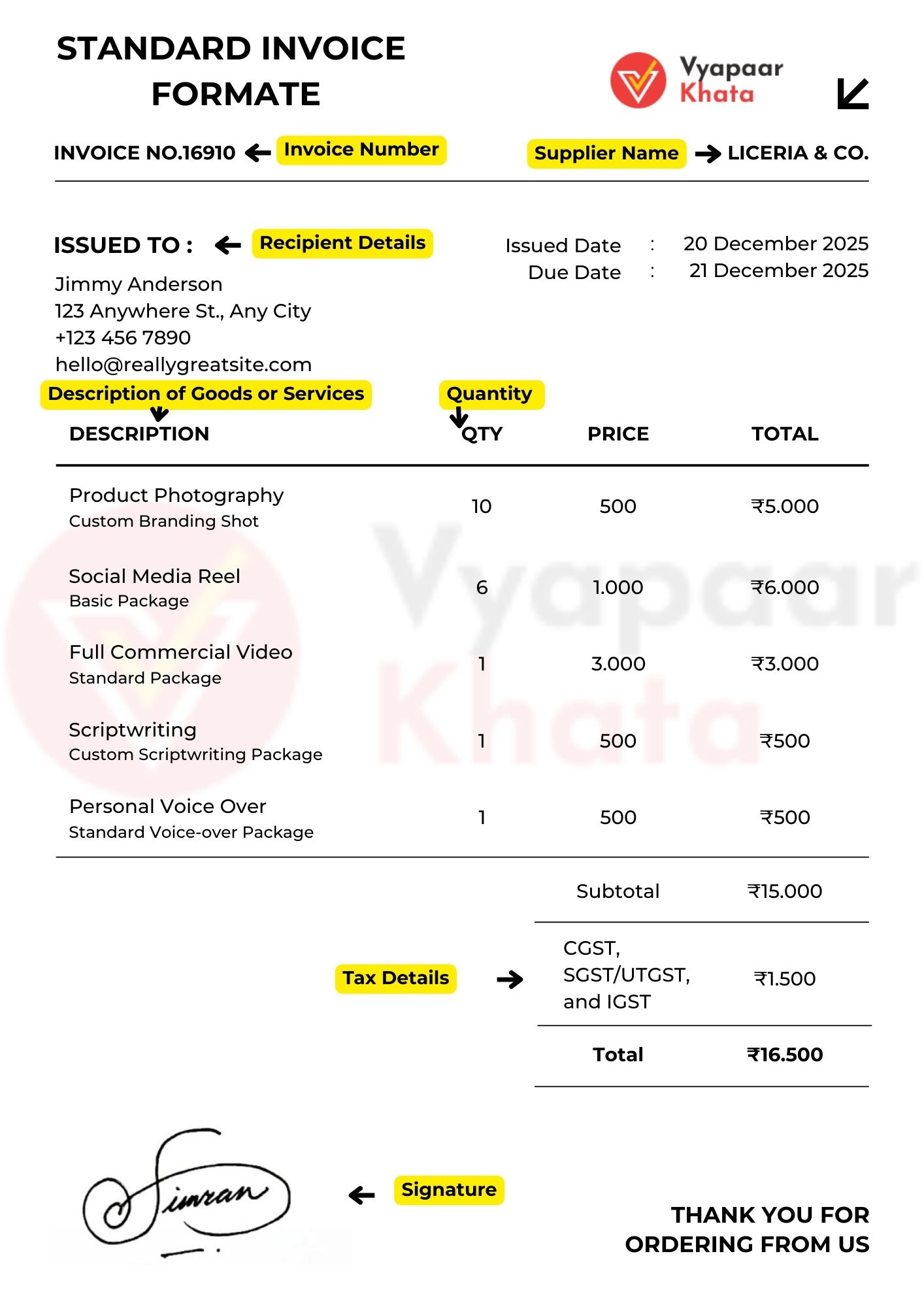

Key Features:

- No GSTIN or tax breakup.

- Basic details such as buyer and seller names, item description, quantity, price, and total amount.

- Primarily used for B2C transactions or by freelancers and unregistered vendors.

- Cannot be used to claim Input Tax Credit (ITC).

Example: A freelancer charging Rs. 10,000 for branding services may issue a standard invoice without GST.

VyapaarKHATA Benefit:

VyapaarKHATA allows businesses to generate professional, customizable standard invoices with logo support, terms and conditions, and reusable templates, making invoicing quick and hassle-free.

What is a Tax Invoice?

A tax invoice is a legally recognized document issued by GST-registered businesses that includes a tax breakup. It is essential for B2B transactions and enables the buyer to claim Input Tax Credit (ITC).

Mandatory Components:

- Seller and buyer names, addresses, and GSTINs.

- Invoice number and date.

- Description of goods/services.

- HSN/SAC codes.

- Taxable value and applicable tax rates (CGST, SGST, IGST).

- Total invoice amount with tax.

- Signature or digital authentication.

Example: A wholesaler in Delhi selling smartphones to a GST-registered retailer in Mumbai must issue a tax invoice including IGST.

VyapaarKHATA Advantage:

VyapaarKHATA automates tax invoice generation with GST compliance, autofill fields, HSN/SAC code selection, and multi-rate GST support. It also provides GST reports for easy return filing.

Standard vs Tax Invoice: Key Comparisons

The table below helps to clarify the invoice comparisons. The comparison will helps to take the decision which types of the invoice is perfect for what fulfill your needs

| Particulars | Standard Invoice | Tax Invoice |

|---|---|---|

| Applicability | Used by non-GST registered businesses | Used by GST-registered businesses |

| Includes GST | No | Yes |

| GSTIN Requirement | Not required | Required for both buyer and seller |

| Input Tax Credit (ITC) | Cannot be claimed | Eligible for claim by the buyer |

| HSN/SAC Code | Not applicable | Mandatory to include |

| Tax Components | None | Includes CGST, SGST, or IGST |

| Purpose | For basic sale documentation | For legal and GST-compliant transactions |

| Use Case | Freelancers, small vendors, B2C | B2B businesses, inter-state supply, wholesalers |

| Format and Fields | Basic details only | Detailed fields with tax breakdown |

Legal Requirements for Tax Invoices under GST

Under the CGST Act, 2017, a registered business must issue a tax invoice:

- Before or at the time of delivery of goods.

- Within 30 days from the date of supply for services.

Not issuing a tax invoice on time can lead to penalties, denial of ITC, and legal issues.

VyapaarKHATA ensures compliance with invoice validation, format checks, and instant tax calculation, reducing the risk of non-compliance.

When to Use Standard vs Tax Invoice?

Use a Standard Invoice When:

- You are not registered under GST.

- You are billing individual customers without charging GST.

- You are a small vendor or freelancer below the GST threshold.

Use a Tax Invoice When:

- You are a GST-registered business.

- You are selling to another GST-registered business.

- Your buyer needs ITC.

- You deal in taxable goods or services.

VyapaarKHATA provides options to toggle between standard and tax invoices based on your business status and customer type.

Common Invoicing Mistakes to Avoid

- Issuing a standard invoice instead of a tax invoice for GST transactions.

- Missing GSTIN or HSN/SAC codes.

- Delays in issuing invoices.

- Incorrect GST rates applied.

VyapaarKHATA provides real-time alerts and suggestions to help you avoid these common invoicing errors.

How VyapaarKHATA Simplifies Invoicing for Indian Businesses

VyapaarKHATA is designed for Indian SMEs, traders, freelancers, and enterprises. It helps streamline invoicing with:

- Standard and tax invoice creation with dynamic templates.

- Auto GST calculation and multi-rate tax handling.

- Custom branding options (logo, color, footer notes).

- Cloud-based access across devices.

- Secure data storage and encryption.

- Built-in GST reports for faster return filing.

- Multiple customer and product list support.

- Invoice sharing via email, WhatsApp, and PDF download.

Supports VyapaarKHATA Users

For VyapaarKHATA users, it offers exposure to a larger network of potential clients and partners. By integrating with VyapaarKHATA, users can manage leads, quotes, and invoices from one unified platform. With VyapaarKHATA you can help your business grow efficiently, while handles seamless and compliant invoicing.

Conclusion

Understanding the differences between a standard invoice and a tax invoice is crucial for business success in India. The correct invoicing method ensures compliance with GST regulations and builds trust with clients and partners.

VyapaarKHATA Invoice empowers Indian businesses to manage all types of invoicing—standard or tax—accurately, efficiently, and professionally. It’s the perfect tool for those seeking compliance, clarity, and business growth in today’s competitive market.

Get started with VyapaarKHATA today and take control of your invoicing with confidence.

Frequently Asked Questions

1. Can a GST-registered business issue a standard invoice?

No. GST-registered businesses must issue a tax invoice for all taxable supplies.

2. Is a tax invoice required for B2C sales?

Not always. For small-value retail transactions, simplified invoices may be used, but a tax invoice is preferred for high-value or inter-state B2C sales.

3. Does VyapaarKHATA support GST filing?

Yes. VyapaarKHATA generates reports for GSTR-1, GSTR-3B, and other return formats to simplify GST filing.

4. Can freelancers use VyapaarKHATA?

Yes. Freelancers can use standard invoices and switch to tax invoices if they become GST-registered.

5. Can I convert a standard invoice into a tax invoice on VyapaarKHATA?

Yes. VyapaarKHATA allows you to easily convert invoice types while retaining data.