International trade involves a wide range of documentation, and one of the most important among them is the commercial invoice. It serves as both a legal record of the transaction and a vital document for customs clearance and payment processing. Whether you're a seasoned exporter or a business just entering global markets, understanding commercial invoices is key to seamless and compliant trading.

What Is a Commercial Invoice?

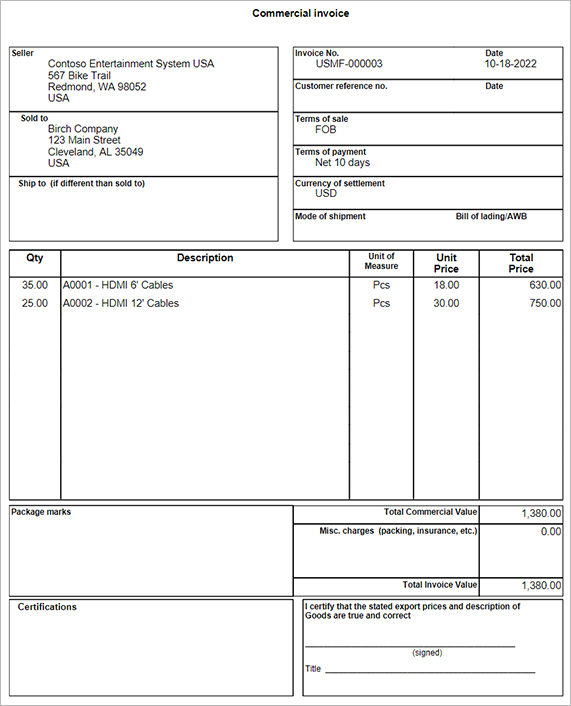

A commercial invoice is an official document issued by the seller (exporter) to the buyer (importer) in cross-border transactions. It outlines detailed information about the goods sold, such as quantity, unit price, total value, description, and shipping terms. Unlike a standard invoice, a commercial invoice has legal and regulatory importance, as it is often used by customs authorities to determine the duties and taxes applicable to imported goods.

Why Is a Commercial Invoice Important in Global Trade?

- Customs Clearance: Customs officers rely on commercial invoices to verify the classification, value, and origin of the goods. Accurate invoices speed up the clearance process and prevent penalties.

- Proof of Sale: The invoice acts as evidence of a completed commercial transaction between buyer and seller.

- Payment Documentation: The buyer uses it to arrange payment through bank transfers, letters of credit, or other financial instruments.

- Dispute Resolution: Should disagreements arise over quality, quantity, or price, the invoice serves as a binding document that defines agreed terms.

- Statistical Reporting: Governments use data from commercial invoices for monitoring and analyzing trade flows.

Essential Components of a Commercial Invoice

To be legally valid and accepted for international shipping and customs clearance, a commercial invoice must include the following elements:

- Exporter and Importer Details: Full legal names, addresses, countries, and contact information of both parties involved in the transaction.

- Invoice Number and Date: A unique invoice reference number along with the issue date to ensure traceability and proper filing.

- Description of Goods: Clear product names, specifications, grades, model numbers, quantity, and packaging information.

- HS Code (Harmonized System Code): A standardized code used internationally to classify goods for customs and tariff purposes.

- Value of Goods: Unit price and total value of the goods in the agreed currency, clearly showing how the final amount is calculated.

- Country of Origin: The nation where the goods were manufactured or assembled, which may impact tariffs and trade agreements.

- Terms of Sale (Incoterms): Defines who is responsible for freight, insurance, and customs duties. Common examples include FOB, CIF, and DDP.

- Shipping Details: Information like method of transport (air, sea, land), shipping date, port of loading and discharge, and delivery address.

- Payment Terms: Specifies the agreed mode and timing of payment (e.g., advance payment, net 30 days, letter of credit).

- Declaration and Signature: A signed statement certifying that the details provided in the invoice are accurate and true.

When Is a Commercial Invoice Required?

The commercial invoice is typically required during the following stages:

- Pre-Shipment: For arranging export licenses, bookings, and insurance.

- Shipping: Acts as a reference for freight forwarders and transport carriers.

- Customs Clearance: Mandatory for both the exporting and importing countries' customs checks.

- Payment Processing: Used by financial institutions and buyers to process and release payments.

Common Mistakes to Avoid When Creating a Commercial Invoice

- Missing or Incorrect HS Codes: Leads to misclassification and incorrect tax calculation.

- Vague Product Descriptions: Lack of clarity can cause customs delays or disputes.

- Mismatch with Packing List: All details must align with the packing list and other documents like the bill of lading.

- Wrong Incoterms: Using outdated or incorrect delivery terms can lead to misunderstandings.

- Lack of Signature or Declaration: An unsigned invoice can be rejected by customs.

Transition from Paper to Digital: The Rise of E-Invoicing

Many businesses today are shifting toward electronic commercial invoices for speed, accuracy, and convenience. Benefits include:

- Faster Processing: E-invoices can be instantly transmitted to customs, banks, and clients.

- Reduced Errors: Automated systems help eliminate manual input mistakes.

- Cost-Efficient: Saves printing and courier costs.

- Eco-Friendly: Cuts down paper waste and carbon footprint.

- Legally Accepted: Many customs authorities now accept digitally signed commercial invoices as legally valid.

How VyapaarKHATA Simplifies the Commercial Invoice Process

VyapaarKHATA is an advanced digital invoicing and accounting platform designed to help Indian exporters and businesses effortlessly manage their international trade documentation — especially commercial invoices. Here's how it can streamline your business operations:

- Smart Invoice Generation: VyapaarKHATA allows users to generate custom commercial invoices with pre-defined templates that automatically include all required international trade fields such as HS code, Incoterms, currency, and product details.

- Compliance Built-In: Every invoice generated complies with major international trade standards, reducing the risk of customs rejection and ensuring smooth cross-border transactions.

- Digital Signatures: Users can digitally sign invoices, making them legally accepted and ready for submission to banks, buyers, and customs authorities worldwide.

- Easy Integration with Packing Lists and Bills of Lading: The platform allows for seamless connection between invoices, packing lists, and other export documentation — reducing errors and duplication.

- Multi-Currency and Multi-Language Support: VyapaarKHATA supports multiple currencies and can translate invoices for international clients, enhancing professionalism and global reach.

- Real-Time Tracking and Alerts: Get notified when an invoice is viewed, approved, or paid. Track document status at every step of the trade lifecycle.

- Cloud Storage and Backup: Automatically backs up all documents securely, providing easy retrieval, auditing, and sharing options when needed.

- GST and Tax Ready: Generates compliant tax invoices for domestic and international sales with GST fields, export codes, and refund-ready formats.

Whether you're exporting a single shipment or managing hundreds of transactions every month, VyapaarKHATA simplifies and automates the process, allowing you to focus on business growth instead of paperwork.

Quick Commercial Invoice Checklist

- Seller and buyer contact details

- Unique invoice number and date

- Accurate HS code and product description

- Declared value and total invoice amount

- Country of origin and Incoterms

- Payment and shipping terms

- Declaration and authorized signature

Commercial invoices are essential to successful and compliant international trade. They serve as legal, financial, and logistical documents that support customs clearance, payment release, and contractual transparency. By ensuring accuracy, completeness, and timely issuance of commercial invoices — and using tools like VyapaarKHATA to manage them — businesses can save time, reduce errors, and achieve smoother global operations.