Accounts receivable (AR) refers to the money a business is owed by its customers for goods or services delivered on credit. Efficient management of AR is crucial for maintaining healthy cash flow and financial stability. In recent years, businesses have increasingly turned to invoice automation to streamline this process. AR invoice automation leverages technology to generate, send, and track invoices without manual intervention, reducing errors and delays. As we move into 2026, with digital transformation accelerating, adopting automated invoicing has become more relevant than ever, helping businesses save time, enhance accuracy, and improve overall financial efficiency.

What is Accounts Receivable Invoice Automation?

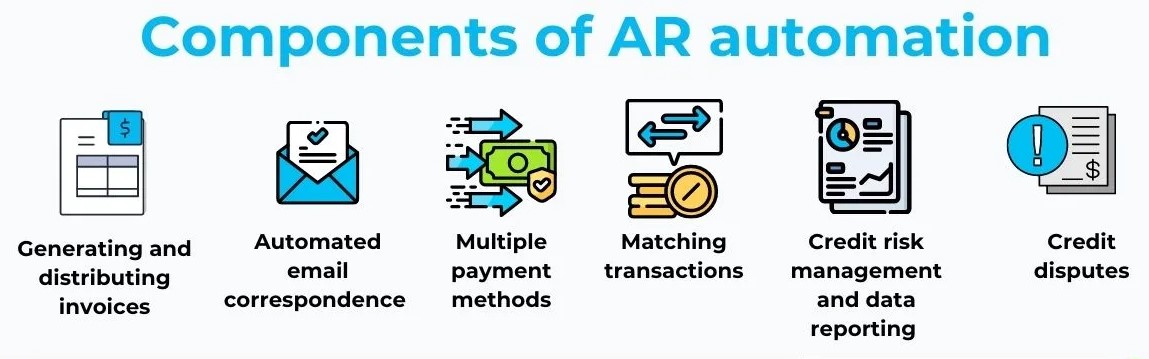

Accounts receivable invoice automation is the process of using technology to automatically create, send, and manage invoices for customers. Unlike traditional invoicing, which relies heavily on manual data entry, paper documents, and repetitive follow-ups, automated invoicing streamlines the workflow, reduces human errors, and ensures faster processing. Modern AR automation often involves AI-driven analytics, cloud-based platforms, and ERP system integrations, enabling seamless tracking of payments, automated reminders, and real-time reporting. By digitizing the invoicing process, businesses can maintain accurate financial records, monitor outstanding payments efficiently, and enhance overall productivity, freeing up staff to focus on strategic financial planning rather than routine administrative tasks.

The Purpose of Invoice Automation

The primary purpose of accounts receivable invoice automation is to optimize billing and collection processes. By reducing manual data entry, businesses can minimize errors, ensuring invoices are accurate and compliant with accounting standards and regulatory requirements. Automation speeds up invoice generation and delivery, enabling faster payment cycles and improved cash flow management. It also enhances financial reporting, providing real-time insights into outstanding receivables, payment trends, and customer behavior. Beyond efficiency, automated invoicing fosters better relationships with clients by offering timely and professional communications. In 2026, as businesses face increasing financial complexity, invoice automation serves as a strategic tool to maintain accuracy, compliance, and liquidity while reducing operational costs.

Key Features of AR Invoice Automation

Accounts receivable invoice automation comes packed with features designed to streamline billing and collections:

- Automated Invoice Creation and Sending: Generate invoices automatically based on sales orders or contracts, reducing manual entry and speeding up the billing process.

- Integration with Accounting and ERP Systems: Seamlessly connect with existing financial systems to maintain accurate records and avoid data duplication.

- Real-Time Tracking of Payments and Outstanding Invoices: Monitor payment status instantly, helping businesses stay on top of receivables.

- Automated Reminders and Follow-Ups: Send scheduled notifications to clients for overdue invoices, reducing late payments.

- Reporting and Analytics: Access dashboards and reports to gain insights into payment trends, customer behavior, and cash flow, supporting informed business decisions.

These features collectively enhance efficiency, accuracy, and financial control, making AR management smarter and faster.

How Businesses Benefit from AR Invoice Automation

Implementing AR invoice automation brings significant advantages to businesses:

- Efficiency & Time Savings: Automation reduces manual tasks like data entry, calculations, and invoice dispatch, freeing employees to focus on strategic initiatives.

- Improved Cash Flow: Faster invoice generation and automated reminders lead to quicker collections, ensuring steady cash flow.

- Enhanced Accuracy: Minimizing human involvement lowers the risk of errors such as duplicate invoices, incorrect amounts, or missed payments.

- Customer Satisfaction: Timely and professional invoices enhance client experience, building trust and stronger business relationships.

- Data Insights: Advanced analytics provide real-time visibility into outstanding receivables, payment patterns, and forecasted revenue, aiding better financial planning and decision-making.

Overall, AR invoice automation transforms accounts receivable from a manual, error-prone process into a streamlined, data-driven system that supports growth and operational efficiency.

Challenges Businesses Might Face

While AR invoice automation offers many benefits, businesses may encounter certain challenges:

- Initial Cost: Investing in automation software can be expensive, especially for small businesses.

- Staff Training and Change Management: Employees need guidance to adapt to new systems and processes.

- Integration with Existing Systems: Ensuring compatibility with current accounting or ERP software can be complex.

- Security and Data Privacy Concerns: Handling sensitive financial data digitally requires robust cybersecurity measures.

Awareness of these challenges allows businesses to plan proactively and implement automation successfully.

Best Practices for Implementing AR Invoice Automation

To maximize the benefits of AR invoice automation, businesses should follow these best practices:

- Choose the Right Software: Select a solution that aligns with your business size, industry, and specific needs.

- Ensure Seamless Integration: Connect the automation tool with your ERP or accounting systems to maintain accurate financial data.

- Standardize Invoice Formats and Processes: Consistency reduces errors and simplifies compliance.

- Provide Adequate Training: Equip staff with the knowledge to operate the system effectively and confidently.

- Monitor and Optimize Workflows: Regularly review performance metrics and refine processes to achieve continuous improvement.

Following these steps ensures a smooth transition to automated invoicing, enhancing efficiency, accuracy, and overall financial management.