In business transactions, invoices serve as formal documents that record the sale of goods or services between a seller and a buyer. Accurate invoicing is crucial, not only for ensuring correct payments but also for maintaining transparent financial records and complying with tax regulations. One essential element of an invoice is the UOM, or Unit of Measure. UOM indicates the standard unit in which products or services are quantified, helping both buyers and sellers understand the exact amount being billed. Proper use of UOM ensures clarity, prevents disputes, and streamlines inventory and accounting processes.

What Is UOM in an Invoice?

UOM, short for Unit of Measure, is a key component in invoices that defines how goods or services are quantified. It specifies the standard unit used to measure each item, such as pieces, kilograms, liters, meters, or even hours for services. By clearly stating the UOM, invoices provide precise information about the quantity being billed, reducing confusion for buyers and sellers. Typically, the UOM appears alongside the quantity and item description columns in an invoice, making it easy to identify how each product or service is measured. Accurate UOM usage helps in inventory management, billing, and compliance with accounting and taxation standards.

Types of UOM Commonly Used

Invoices use different types of UOM depending on the nature of the product or service.

- Pieces or Units are used for countable items like pens, chairs, or mobile phones.

- Kilograms or Grams measure weight-based goods, such as rice, flour, or spices.

- Liters or Milliliters are applied to liquids like milk, oils, or beverages.

- For services, Hours or Days are commonly used to track the duration of work, such as consulting, cleaning, or tutoring.

Choosing the correct UOM ensures that the invoice clearly communicates the quantity and makes it easier for both sellers and buyers to understand and verify the billing.

Importance of UOM in Invoices

UOM plays a vital role in invoices by ensuring precise billing and avoiding errors in customer charges. By clearly defining how goods or services are measured, it helps businesses maintain accurate inventory records and efficiently track stock levels. Using the correct UOM also prevents misunderstandings or disputes regarding quantities, rates, or pricing, promoting transparency in business transactions. Additionally, UOM is critical for tax calculation and compliance, as many tax rules require standardized units for reporting. Overall, incorporating UOM in invoices not only streamlines billing and accounting but also strengthens trust between buyers and sellers, ensuring smooth financial operations.

Benefits of Using UOM in Invoices

Using UOM in invoices offers several advantages for both businesses and customers. It provides clarity by clearly indicating the quantity and type of items or services being billed, preventing misunderstandings. Accurate UOM usage enhances accounting precision, ensuring that financial records reflect actual transactions. It also streamlines order processing and reporting, making it easier to track sales, inventory, and deliveries. For businesses engaged in international trade, standardized UOMs facilitate smoother transactions by aligning with global measurement standards. Additionally, proper UOM usage reduces errors in pricing and taxation, helping companies comply with tax regulations and avoid disputes. Overall, UOM improves transparency, efficiency, and reliability in business operations.

Common Mistakes to Avoid with UOM

While UOM is essential, errors can lead to confusion and financial discrepancies. One common mistake is using inconsistent or incorrect UOM across invoices, which can cause mismatches in billing. Failing to align UOM with the inventory system can disrupt stock tracking and reporting. Businesses may also confuse similar units, such as kilograms versus grams or liters versus milliliters, leading to miscalculations. Another pitfall is ignoring UOM during tax or discount calculations, which can result in inaccurate charges. Avoiding these mistakes ensures invoices are precise, reduces disputes, and maintains smooth operations across sales, inventory, and accounting systems.

How to Choose the Right UOM

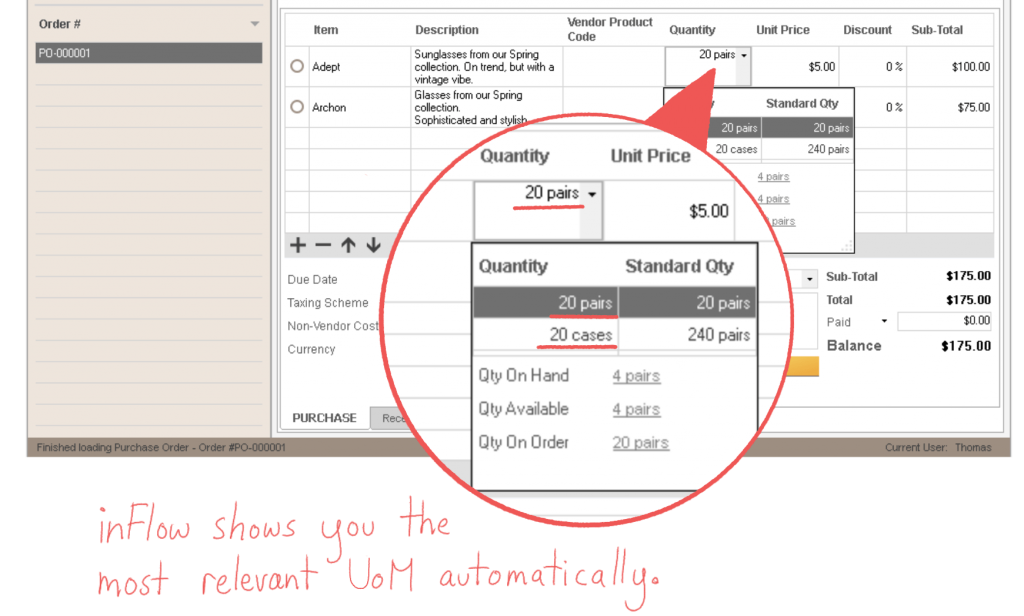

Selecting the correct UOM for your invoices is crucial for accuracy and consistency. Start by considering the nature of your product or service—countable items require units, while liquids or bulk goods need weight or volume measurements. Align your UOM with industry standards and regulatory requirements to ensure compliance and avoid disputes. Consistency is key, so use the same UOM across invoices and inventory management systems. Additionally, consult your accounting software or ERP system, which often provides standardized UOM options, making it easier to maintain uniformity and streamline billing, reporting, and stock tracking.

UOM plays a vital role in making invoices clear, accurate, and reliable. Using the correct unit of measure not only ensures precise billing and inventory tracking but also builds trust with customers. By standardizing UOM practices, businesses can improve operational efficiency, reduce errors, and maintain compliance. Implementing proper UOM in every invoice is a small step that delivers significant benefits for smooth and professional business transactions.

Why Choose Vyapaarkhata for Your Business

Vyapaarkhata is a simple yet powerful business management and invoicing solution designed specifically for small and medium enterprises. It helps you generate professional GST?compliant invoices and bills, manage customers, track inventory, and record purchases and expenses all in one place, saving time and reducing manual errors. Learn more.

- Create and send invoices instantly via WhatsApp, email, or PDF, improving customer communication and speeding up payments. Read how.

- Maintain accurate records of payments, invoices, and ledgers without complex accounting knowledge. Details here.

- Automate reminders for pending payments and manage your finances effortlessly. Learn more.

Ready to start?

Create Your Account Download App

Vyapaarkhata’s intuitive design makes it ideal for entrepreneurs, retailers, freelancers, and service providers who want efficient billing and accounting at their fingertips. More info.