Cash flow is the lifeblood of any business. Without it, even profitable companies can struggle to meet day-to-day operational expenses. Businesses often face delays in receiving payments from clients or buyers, which can disrupt operations, procurement, and growth plans. This is where short-term financing tools such as invoice discounting and bill discounting come into play. Both methods allow businesses to unlock cash tied up in receivables, but they serve different purposes and operate in unique ways.

In this blog, we will explore what invoice discounting and bill discounting are, how they work, their key differences, benefits, and when to use each. By the end, you will have a clear understanding of which option best suits your business needs.

What is Invoice Discounting?

Invoice discounting is a financial arrangement where businesses can receive immediate cash by using their unpaid invoices as collateral. The business sells the invoices to a financial institution or bank at a discount, allowing the company to free up working capital. Typically, a business can receive 70%–90% of the invoice value upfront, with the remaining amount paid after deducting fees when the client settles the invoice.

Invoice discounting is widely used by service-based companies, SMEs, and subscription-based businesses that generate invoices regularly. It is particularly useful for companies that have long payment cycles but need liquidity for payroll, inventory, or other operational expenses.

How Invoice Discounting Works (Step by Step)

- Invoice Creation: Your business issues an invoice to a client for products or services delivered.

- Submission to Bank: You submit the invoice to a bank or financial institution offering invoice discounting services.

- Advance Payment: The bank advances a percentage of the invoice value (usually 70–90%).

- Client Payment: The client pays the invoice directly to your business or the bank, depending on the agreement.

- Final Settlement: The remaining invoice amount, minus fees and interest, is released to your business.

Benefits of Invoice Discounting

- Confidentiality: Clients are usually unaware of the arrangement, preserving your professional relationships.

- Improved Liquidity: Provides immediate access to cash without waiting for invoice due dates.

- Flexibility: You can choose which invoices to discount based on cash needs.

- Risk Management: Reduces dependency on late payments affecting operations.

Example: A digital marketing agency with multiple corporate clients often waits 60–90 days for payments. By using invoice discounting, it can access funds immediately to pay salaries, run ad campaigns, or invest in software tools.

What is Bill Discounting?

Bill discounting is a financing method where a business sells a bill of exchange to a bank at a discount before its maturity date. A bill of exchange is a legal instrument where the buyer promises to pay the seller a specific amount on a set date. By discounting the bill, the seller receives immediate cash from the bank, while the bank collects payment from the buyer on the due date.

Bill discounting is more common in goods-based businesses and trade transactions. It allows sellers to maintain liquidity, meet working capital requirements, and reduce the risk of non-payment from buyers.

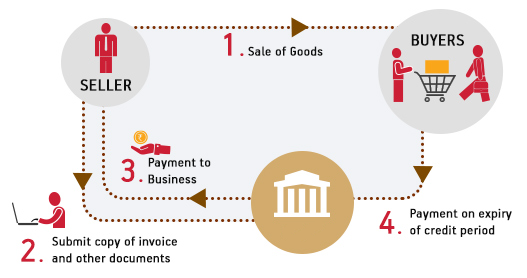

How Bill Discounting Works

- Issuing a Bill: The seller delivers goods and issues a bill of exchange to the buyer.

- Submission to Bank: The seller submits the bill to a bank for discounting.

- Advance Payment: The bank pays the seller the bill amount minus a discounting fee.

- Payment Collection: On the maturity date, the buyer pays the bank directly.

- Settlement: Any residual payment after fees is settled with the seller.

Benefits of Bill Discounting

- Immediate Cash Flow: Converts trade bills into liquid funds before the maturity date.

- Reduced Credit Risk: The bank assumes the risk of the buyer defaulting.

- Supports Trade Operations: Helps businesses manage procurement, production, and bulk orders.

- Faster Growth: Allows companies to leverage working capital for expansion and operational efficiency.

Example: A textile exporter sells goods to an overseas buyer with payment terms of 90 days. By discounting the bill with a bank, the exporter receives cash immediately to fund new orders and operations without waiting for the buyer to pay.

Key Differences Between Invoice Discounting and Bill Discounting

Both methods provide working capital solutions, but they differ significantly in terms of application, confidentiality, and risk. The following table summarizes the main differences:

| Feature | Invoice Discounting | Bill Discounting |

|---|---|---|

| Definition | Businesses sell unpaid invoices to a financial institution to get immediate cash. | Businesses sell bills of exchange before maturity to a bank at a discount. |

| Confidentiality | Usually confidential; clients are unaware. | Buyer is typically notified; less confidential. |

| Documentation | Invoices | Bills of exchange |

| Risk | Minimal risk; tied to invoice collection. | Depends on buyer’s creditworthiness; bank assumes some risk. |

| Use Case | Service-oriented businesses, SMEs, subscription-based models. | Trade businesses, exporters, suppliers of goods. |

| Cost Structure | Discounting fee or percentage of invoice value. | Interest or discount calculated based on bill maturity. |

| Flexibility | High; choose invoices to discount. | Moderate; based on bills generated. |

Additional insights:

- Invoice discounting is ideal for businesses that need discretion and quick liquidity from ongoing invoices.

- Bill discounting is more structured and suits goods-based transactions with formal payment instruments.

- Businesses may combine both methods depending on diverse cash flow needs.

Benefits of Both Financing Methods

Both invoice and bill discounting improve cash flow, but their advantages extend beyond immediate liquidity. Let’s explore the benefits in detail:

1. Improved Cash Flow Management

Delayed payments from clients can disrupt operations. By using these discounting methods, businesses convert receivables into cash quickly, ensuring that operational and strategic expenses are met without delays.

2. Optimized Working Capital

Accessing immediate cash allows companies to manage payroll, buy raw materials, invest in marketing campaigns, and pay suppliers on time. This helps maintain smooth business operations without relying solely on internal funds.

3. Reduced Risk

Bill discounting shifts the credit risk to the bank, while invoice discounting ensures the company has funds regardless of delayed client payments. Both mechanisms reduce the impact of late payments on the business.

4. Business Growth Opportunities

Immediate access to funds enables businesses to seize growth opportunities, such as expanding into new markets, investing in new technology, or increasing inventory to meet demand spikes.

5. Flexible Financing

Invoice discounting provides flexibility in choosing which invoices to discount, while bill discounting provides structured financing for trade transactions. Both methods can be tailored to match business requirements.

Which Option Should You Choose?

Choosing between invoice and bill discounting depends on multiple factors, including business type, confidentiality requirements, risk appetite, and cost considerations.

- Service Businesses: Invoice discounting is preferable as it is confidential and provides flexible cash flow solutions.

- Goods-Based Businesses: Bill discounting is more suitable, especially in trade transactions with formal bills of exchange.

- Risk Management: Consider who bears the credit risk. Invoice discounting keeps risk with the business, while bill discounting often shifts it to the bank.

- Cost Efficiency: Compare fees and interest rates to select the cheaper and more efficient option.

Scenario Example: A software development company with recurring B2B clients may benefit from invoice discounting, while a textile exporter selling bulk orders internationally may prefer bill discounting.

FAQs

- 1. What is the main difference between invoice discounting and bill discounting?

- Invoice discounting is confidential and involves selling unpaid invoices for cash, whereas bill discounting involves selling bills of exchange, often requiring buyer notification.

- 2. Is invoice discounting confidential?

- Yes, it is generally confidential, and clients are usually unaware that the invoices have been financed.

- 3. Can startups use bill discounting?

- Yes, startups with bills of exchange for trade transactions can use bill discounting if they meet the bank’s eligibility criteria.

- 4. Which option is cheaper for short-term funding?

- The cost depends on fees, interest, and duration. Invoice discounting offers flexibility, while bill discounting cost depends on bill maturity.

- 5. How quickly can I access funds through invoice discounting?

- Typically within 24–72 hours of submitting invoices, depending on the financial institution.

- 6. Can I use both methods simultaneously?

- Yes, some businesses use invoice discounting for service invoices and bill discounting for trade transactions, depending on cash flow requirements.

- 7. Are there any limitations on invoice discounting?

- Some banks may limit the total invoice value, industry type, or require a minimum number of clients for eligibility.

- 8. Does bill discounting affect client relationships?

- Since buyers are usually notified, it may slightly impact relationships, so clear communication is essential.

Invoice discounting and bill discounting are effective solutions to improve liquidity and manage working capital. While invoice discounting is flexible, confidential, and ideal for service-oriented businesses, bill discounting is structured, suitable for goods-based trade, and often shifts credit risk to the bank. Understanding the differences, benefits, and practical use cases helps businesses choose the financing method that best fits their operational and strategic goals. Always evaluate your business needs, cash flow requirements, and risk tolerance before making a decision. Consulting a financial advisor or exploring options with banks can help you select the most efficient and cost-effective solution.

How Vyapaarkhata Helps You

Vyapaarkhata is a smart business accounting app that helps you manage invoices, receipts, bills, and payments efficiently. Stay organized, track your transactions, and grow your business seamlessly.