Invoicing is a crucial part of any business operation, acting as the formal request for payment from a buyer to a seller. Beyond just a billing tool, invoices help maintain accurate financial records, ensure timely payments, and support compliance with tax regulations.

Businesses generally operate under two models: B2B (Business-to-Business) and B2C (Business-to-Consumer). While both involve the sale of goods or services, the way transactions are structured and billed differs significantly between them.

Understanding these differences is essential for businesses to manage cash flow, maintain compliance, and build strong relationships with clients and customers. This article aims to break down the key distinctions between B2B and B2C invoicing, highlighting how businesses can adapt their invoicing practices for each model effectively.

Overview of B2B Invoicing

B2B invoicing refers to the process of billing transactions between two businesses. Typically, it involves supplying products or services to another company rather than directly to individual consumers.

Common Scenarios:

- A manufacturer providing raw materials to a production company.

- A wholesale distributor selling bulk goods to retailers.

- A service provider offering software, marketing, or consulting services to a corporate client.

Characteristics of B2B Invoices:

- Bulk Orders and Recurring Billing:

B2B transactions often involve large quantities or repeat orders, requiring invoices that accurately reflect bulk pricing, discounts, and recurring schedules. - Payment Terms (Net 30, Net 60, etc.):

Unlike B2C, where payments are usually immediate, B2B invoices may allow extended payment terms, giving buyers 30, 60, or even 90 days to settle the bill. These terms are often negotiated between businesses. - Detailed Invoices with Purchase Orders and Tax Information:

B2B invoices are typically comprehensive, including itemized products or services, purchase order references, taxes (like GST or VAT), and company details. This ensures transparency and aids in accounting and compliance.

By incorporating these elements, B2B invoices not only facilitate payment but also strengthen professional relationships and trust between companies.

Overview of B2C Invoicing

B2C invoicing refers to billing transactions directly between a business and individual consumers. The process is generally simpler, reflecting smaller, one-time purchases rather than bulk orders.

Common Scenarios:

- A retail store selling clothing to customers.

- An e-commerce platform processing online orders.

- Service providers offering personal services, like salon appointments or online courses.

Characteristics of B2C Invoices:

- Smaller, One-Time Transactions:

B2C purchases are usually single transactions for personal use, making invoices shorter and more straightforward. - Immediate or Short-Term Payment Methods:

Payments are generally completed at the point of sale using methods like credit/debit cards, digital wallets, or cash. Short-term installment plans may also apply, but extended credit periods are rare. - Simplified Invoices/Receipts:

Unlike B2B invoices, B2C invoices are often simplified receipts that contain only the essential information: item purchased, price, taxes, and payment confirmation.

The simplicity of B2C invoicing ensures a quick, seamless transaction experience for consumers, aligning with the need for convenience and speed in retail and online shopping environments.

Key Differences Between B2B and B2C Invoicing

Understanding the nuances of B2B and B2C invoicing is critical for businesses to streamline payments, maintain compliance, and optimize customer satisfaction. While both involve billing for goods or services, the structure, terms, and approach differ significantly.

Invoice Structure

- B2B:

In B2B invoicing, the structure is typically detailed and formal. Invoices often include:- Line items: Each product or service is listed with quantity, unit price, and total.

- Purchase order references: Many businesses use POs to authorize purchases, which must appear on the invoice.

- Tax details: GST, VAT, or other applicable business taxes are clearly mentioned.

- Additional details: Shipping information, payment terms, and company registration numbers.

This level of detail ensures transparency and facilitates accounting, auditing, and tax compliance for both parties.

- B2C:

B2C invoices are designed for simplicity and quick comprehension. They usually contain:- Minimal line items: Often just the purchased product/service, price, and tax.

- Basic tax info: Applicable sales tax or VAT is shown without complex documentation.

- Payment confirmation: Receipts or confirmation numbers for immediate processing.

The focus is on clarity and speed rather than exhaustive details.

Payment Terms

- B2B:

Payment in B2B transactions often involves negotiated schedules, allowing buyers time to manage cash flow. Common terms include:- Net 30, Net 60, or Net 90 (payment due in 30, 60, or 90 days).

- Partial payments or installment-based agreements for large orders.

- Late payment clauses and discounts for early settlement.

These flexible terms reflect the business-to-business relationship, often built on trust and long-term partnerships.

- B2C:

In contrast, B2C payments are generally immediate or short-term:- Credit/debit card payments at checkout.

- Digital wallet or online payment confirmations.

- Occasional short-term installment options for high-value products.

Speed and convenience are prioritized to ensure a seamless consumer experience.

Taxation and Compliance

- B2B:

Businesses must adhere to strict tax compliance requirements, which include:- Valid GST/VAT registration numbers.

- Properly formatted invoices meeting government regulations.

- Tax documentation for input and output credits.

- B2B invoices play a crucial role in legal compliance and allow businesses to claim tax benefits.

- B2C:

For consumer transactions:- Only applicable sales tax or VAT is generally included.

- No complex tax documentation is required.

- Receipts serve as proof of purchase for customers and for minor accounting needs.

- The simplified approach reduces friction for the consumer while remaining legally compliant.

Automation and Software Use

- B2B:

Due to large volume and recurring invoices, B2B businesses often rely on ERP systems, accounting software, or automated invoicing platforms. These tools:- Generate recurring invoices automatically.

- Track payment history and outstanding balances.

- Integrate with inventory and procurement systems for efficiency.

- B2C:

B2C businesses often use simple invoicing tools, POS systems, or e-commerce platforms:- Quick invoice generation for each sale.

- Automatic email receipts.

- Minimal manual intervention, suitable for high-volume, low-value transactions.

Automation in both cases enhances efficiency, but the scale and complexity differ.

Customer Relationship and Communication

- B2B:

B2B invoicing often involves personalized communication:- Emails or calls to confirm invoice receipt.

- Negotiation of terms or discounts.

- Follow-ups on pending payments to maintain long-term relationships.

- The human touch is important as transactions are typically larger and ongoing.

- B2C:

B2C invoicing relies on standardized communication:- Automated receipts via email or SMS.

- Minimal customer follow-up unless there’s an issue.

- Focus on speed and convenience rather than negotiation.

Invoice Frequency and Volume

- B2B:

- Typically deals with larger, recurring invoices.

- Often tied to contracts, bulk orders, or subscriptions.

- Requires detailed tracking of payments, credits, and adjustments over time.

- B2C:

- Handles one-time, high-volume transactions.

- Each customer may generate a small-value invoice.

- Simplicity and speed are prioritized to manage a high number of sales efficiently.

B2B vs B2C Invoicing

| Feature | B2B Invoicing | B2C Invoicing |

|---|---|---|

| Invoice Structure | Detailed line items, POs, taxes, company info | Simplified, minimal line items, basic tax info |

| Payment Terms | Extended, negotiated (Net 30/60/90) | Immediate or short-term |

| Tax Compliance | Requires GST/VAT, tax IDs, documentation | Basic sales tax/VAT only |

| Automation | ERP or invoicing software for recurring/bulk | POS or e-commerce tools for single sales |

| Customer Communication | Personalized, follow-ups, negotiation | Standardized, automated confirmations |

| Invoice Frequency & Volume | Large, recurring invoices | High-volume, one-time small-value invoices |

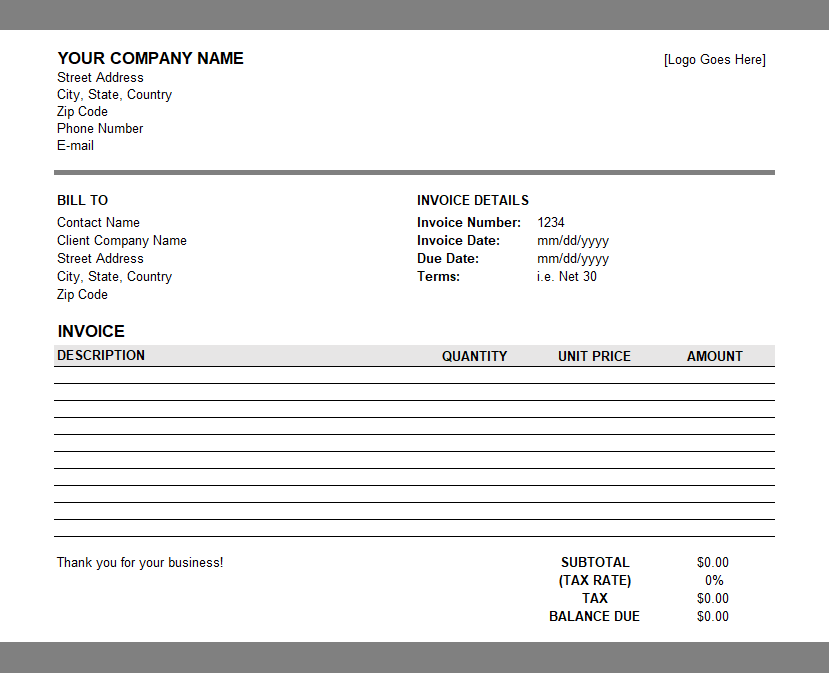

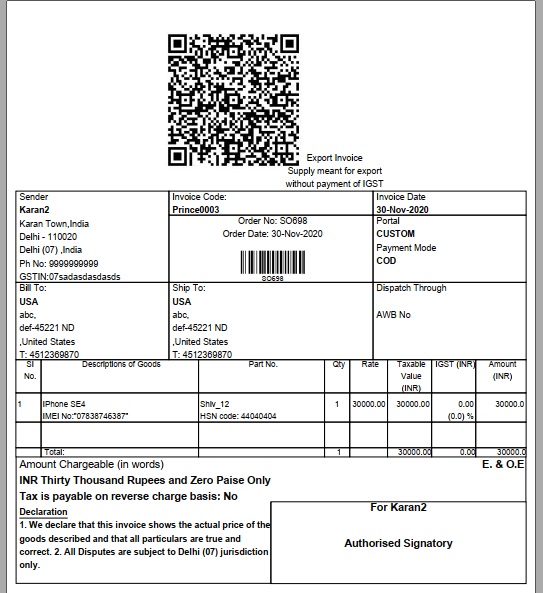

Examples of B2B and B2C Invoices

1. Sample B2B Invoice

A software development company provides annual subscription services to a corporate client. You can create any types of Invoice with out inovative tool Vyapaarkhata that helps you to create the attarctive Invoices. Create Account

| Field | Details |

|---|---|

| Invoice Number | B2B-2025-001 |

| Invoice Date | 08-Oct-2025 |

| Due Date | 07-Nov-2025 |

| Customer Name | ABC Enterprises Pvt. Ltd. |

| Customer GST/VAT ID | 27ABCDE1234F1Z5 |

| Purchase Order Number | PO-98765 |

| Description | Annual subscription for software suite |

| Quantity | 10 licenses |

| Unit Price | Rs 15,000 |

| Total | Rs 1,50,000 |

| Tax (18% GST) | Rs 27,000 |

| Grand Total | Rs1,77,000 |

| Payment Terms | Net 30 |

Key Features:

- Detailed line items with quantity, unit price, and total.

- Includes customer tax ID and purchase order reference.

- Extended payment terms (Net 30).

- Professional format suitable for accounting and tax compliance.

2. Sample B2C Invoice

Scenario: An e-commerce platform sells a smartphone to an individual consumer.

| Field | Details |

|---|---|

| Invoice Number | B2C-2025-015 |

| Invoice Date | 08-Oct-2025 |

| Customer Name | Rahul Sharma |

| Description | XYZ Smartphone Model A1 |

| Quantity | 1 |

| Unit Price | Rs 25,000 |

| Tax (18% GST) | Rs 4,500 |

| Total Amount Paid | Rs 29,500 |

| Payment Method | Credit Card |

Key Features:

- Simple layout with essential details only.

- Payment is immediate and confirmed at checkout.

- Tax included, but no detailed tax documentation needed.

- Designed for speed and convenience.

Best Practices for B2B vs B2C Invoicing

B2B Invoicing Best Practices:

- Clear Payment Terms: Specify due dates, late fees, and early payment discounts.

- Automated Reminders: Use accounting or ERP software to send reminders for overdue invoices.

- Accurate Tax Compliance: Include GST/VAT numbers and ensure proper tax calculations.

- Detailed Documentation: Attach purchase orders, contracts, and delivery confirmations if applicable.

- Professional Presentation: Maintain consistent branding, logos, and formal structure for credibility.

B2C Invoicing Best Practices:

- Quick Processing: Ensure invoices are generated instantly at the point of sale.

- Easy Payment Options: Include multiple payment methods like cards, wallets, or UPI.

- Mobile-Friendly Invoices: Many customers view invoices on mobile devices; ensure readability.

- Simplified Layout: Include only essential information: product, price, taxes, and payment confirmation.

- Automated Delivery: Send invoices via email or SMS automatically for efficiency.

B2B and B2C invoicing serve the same purpose—requesting payment—but they differ in structure, terms, complexity, and automation requirements.

- B2B invoices are detailed, formal, and often involve extended payment terms and tax documentation.

- B2C invoices are simple, immediate, and focused on speed and convenience.

By understanding these differences, businesses can tailor their invoicing processes to improve cash flow, ensure compliance, and enhance customer satisfaction. Leveraging technology such as automated invoicing platforms, ERP systems, and mobile-friendly tools ensures efficiency and minimizes errors in both B2B and B2C contexts.

FAQ Section:

-

Can a B2C business adopt B2B invoicing practices?

Yes, but it is usually unnecessary unless dealing with corporate clients or bulk orders. B2C businesses benefit more from speed and simplicity. -

What is the easiest way to automate B2B invoices?

Use ERP software or cloud-based invoicing platforms that allow recurring invoice generation, automated reminders, and tax compliance integration. -

How to handle tax differences in B2B vs B2C invoices?

B2B invoices require GST/VAT numbers and proper documentation for tax credits, while B2C invoices generally only include applicable sales tax without complex reporting.