In the fast-paced world of retail, maintaining proper documentation for sales is essential for smooth business operations, legal compliance, and customer trust. Every sale, whether it involves cash or credit, needs to be accurately recorded, not just for accounting purposes but also for inventory management, taxation, and future reference.

Two commonly used documents in retail transactions are Retail Invoices and Cash Memos. While they may seem similar at first glance, each serves a distinct purpose and follows different protocols. Understanding the differences between them is crucial for retailers, buyers, and accountants alike.

This article aims to clarify what retail invoices and cash memos are, highlight their key features, and explain when and why each should be used. By the end, you’ll have a clear understanding of how to handle these documents properly, ensuring compliance, transparency, and smooth retail operations.

What is a Retail Invoice?

A retail invoice is a formal document issued by a seller to a buyer, recording the sale of goods or services. It can be issued for both cash and credit sales, providing a detailed record of the transaction. Retail invoices not only serve as proof of purchase for the buyer but also act as an important record for the seller for accounting and tax purposes.

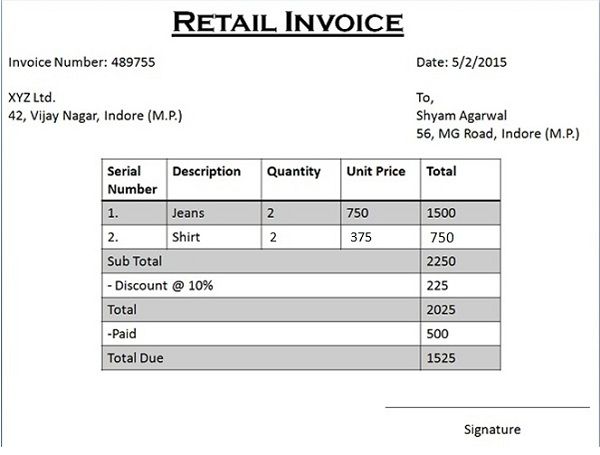

Key Features of a Retail Invoice

A retail invoice is more than just a receipt—it contains detailed information that helps both parties track the transaction accurately. Its key features include:

- Seller and Buyer Details: Names, addresses, GST or tax identification numbers (if applicable).

- Itemized List of Products/Services: Each product or service sold is listed individually.

- Quantity, Rate, and Total Price: Clearly mentions the number of items, their price per unit, and the total amount.

- Taxes: Applicable taxes such as GST, VAT, or other regional taxes are included and clearly mentioned.

- Invoice Number and Date: A unique invoice number and date help in tracking transactions for accounting and legal purposes.

When is a Retail Invoice Used?

- Cash and Credit Sales: Retail invoices are suitable for both immediate cash payments and deferred credit transactions.

- Legal Documentation: It serves as an official record for accounting, taxation, and auditing.

Example Illustration

| Invoice No | Date | Customer Name | Item Description | Qty | Unit Price | Total | GST (%) | Total Amount |

|---|---|---|---|---|---|---|---|---|

| INV-1001 | 08-10-2025 | Mr. Rajesh Kumar | LED Bulb | 10 | ?50 | ?500 | 18 | ?590 |

This sample shows how detailed and organized a retail invoice is, making it suitable for record-keeping and compliance.

What is a Cash Memo?

A cash memo is a simpler document issued to a customer at the time of a cash transaction. Unlike a retail invoice, it is primarily used to confirm that payment has been received immediately for the goods or services provided.

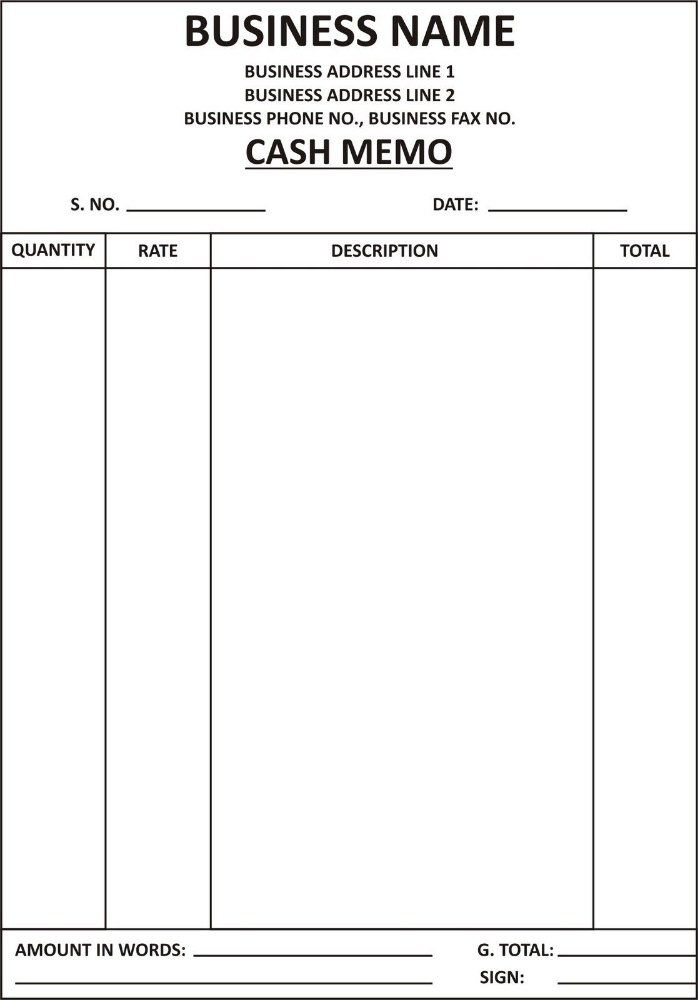

Key Features of a Cash Memo

Cash memos are usually less detailed than invoices but still serve as proof of purchase. Their key features include:

- Simplicity: Contains only the essential details, making it quick to generate.

- Transaction Details: Lists the products or services sold, along with quantity, price, and total amount.

- No Credit Terms: Since the payment is immediate, it does not include payment terms or credit information.

When is a Cash Memo Used?

- Immediate Cash Sales: Cash memos are issued when the customer pays at the time of purchase.

- Proof of Purchase: Acts as evidence for customers in case of returns, exchanges, or warranty claims.

Example Illustration

| Cash Memo No | Date | Item Description | Qty | Price per Unit | Total |

|---|---|---|---|---|---|

| CM-2025-001 | 08-10-2025 | LED Bulb | 5 | ?50 | ?250 |

This simple format is sufficient for cash transactions and quick customer verification.

Key Differences Between Retail Invoice and Cash Memo

While retail invoices and cash memos are both used to document sales transactions, they differ significantly in purpose, structure, and legal relevance. Understanding these differences helps businesses maintain accurate records, ensures compliance with tax regulations, and provides clarity to customers.

1. Purpose

- Retail Invoice: A retail invoice can be issued for both cash and credit sales, making it a versatile document for all types of transactions. It serves as a formal request for payment in credit sales or a confirmation of sale in cash transactions.

- Cash Memo: A cash memo is exclusively used for immediate cash transactions. Its purpose is to confirm that the customer has paid the full amount at the time of purchase.

2. Details Provided

- Retail Invoice: Offers a detailed breakdown of the transaction. This includes the list of products or services sold, quantity, unit price, applicable taxes (like GST or VAT), discounts, total amount, and payment terms. Such details are essential for accounting, tax filing, and inventory tracking.

- Cash Memo: Contains basic information such as the item name, quantity, price per unit, and total cost. It does not typically include tax details or payment terms because the transaction is settled immediately.

3. Legal Use

- Retail Invoice: Considered a legal document for accounting purposes. It can be used for GST or VAT filing, audits, and official record-keeping. The invoice number and seller details make it a critical document for both tax authorities and the business itself.

- Cash Memo: Primarily serves as a proof of purchase for the customer. While it is helpful for returns, exchanges, or warranty claims, it is generally not sufficient for GST filing unless it includes all tax details.

4. Issued To

- Retail Invoice: Can be issued to any customer, whether the sale is cash or credit. Businesses often provide invoices to corporate clients, bulk buyers, or retail customers.

- Cash Memo: Issued only to customers making cash payments at the time of purchase. It is generally used in retail stores, small shops, or quick-sale scenarios.

5. Complexity

- Retail Invoice: More comprehensive and complex. It includes multiple fields such as taxes, discounts, payment terms, invoice numbers, and buyer-seller details, making it suitable for accounting and compliance.

- Cash Memo: Simple and quick. It focuses on immediate transaction details without additional fields, making it faster to generate for quick sales.

6. Payment Terms

- Retail Invoice: Can include credit terms, such as payment due within 30, 60, or 90 days. This makes it suitable for transactions where the buyer does not pay immediately.

- Cash Memo: Immediate cash payment is required. There are no credit terms, as the transaction is settled instantly.

Comparison Table

| Feature | Retail Invoice | Cash Memo |

|---|---|---|

| Purpose | Can be for cash or credit sale | Only for cash sale |

| Details | More detailed (taxes, payment terms) | Basic details (items, price) |

| Legal Use | Can be used for accounting & GST filing | Mainly proof of purchase |

| Issued To | Customer (any sale) | Customer (cash sale only) |

| Complexity | More complex | Simple and quick |

| Payment Terms | Credit terms possible | Immediate cash only |

Why the Difference Matters

Understanding the distinction between a retail invoice and a cash memo is not just a technicality—it has real-world implications for businesses, customers, and regulatory authorities.

1. For Businesses

- Accounting Accuracy: Retail invoices provide a detailed record of every transaction, including taxes and payment terms. This helps businesses maintain accurate books of accounts, track revenue, and avoid discrepancies during audits.

- GST Compliance: For businesses registered under GST, invoices are mandatory for credit or cash sales where tax needs to be recorded. Cash memos without tax details may not be sufficient for GST filing.

- Inventory Tracking: Detailed invoices allow businesses to monitor stock levels, identify popular products, and plan procurement efficiently. Cash memos, while simpler, can also help track daily sales but offer less analytical insight.

2. For Customers

- Proof of Purchase: Both invoices and cash memos serve as proof that a customer has made a payment, but invoices provide more comprehensive information, especially for warranty claims or corporate reimbursements.

- Warranty and Returns: A retail invoice often contains product serial numbers, warranty details, and purchase date, making it easier for customers to claim replacements or repairs. Cash memos, while sufficient for basic returns, may lack detailed information for warranty claims.

- Refunds: Accurate documentation ensures smooth refunds or exchanges without disputes. Customers can rely on invoices or memos as legal evidence of their purchase.

3. For Tax Authorities

- Differentiating Sales Types: Tax authorities often require businesses to clearly differentiate between cash and credit sales. Retail invoices record both, while cash memos indicate immediate cash collection. This distinction is critical for auditing and compliance.

- Tax Reporting: Proper invoices ensure GST/VAT is correctly calculated and filed, reducing the risk of penalties.

Common Confusions

Even experienced retailers sometimes mix up terms, leading to compliance or customer issues.

- Retail Invoice vs Cash Receipt:

- A cash receipt is proof that money was received but may not include itemized details.

- A cash memo functions both as a proof of payment and an itemized list of products sold. Retail invoices are more formal and detailed than both.

- Misuse of Terms in Small Businesses:

- Some small shops issue “invoices” for cash sales but omit tax details, which can cause compliance issues.

- Similarly, calling a cash memo an invoice can confuse customers and create problems during audits.

Practical Tips for Retailers

- When to Issue a Retail Invoice vs a Cash Memo:

- Issue a retail invoice for credit sales or transactions where detailed records are required.

- Issue a cash memo for quick, immediate cash sales where simplicity is preferred.

- Software Solutions for Automated Billing:

- Use accounting software or billing apps that can automatically generate both retail invoices and cash memos.

- Features like GST calculation, invoice numbering, and digital records reduce manual errors and save time.

- Maintaining Records for Audits:

- Keep copies of both invoices and cash memos for at least 5–7 years, as required by law.

- Digital storage can simplify retrieval during audits and help in inventory and financial analysis.

In summary, while both retail invoices and cash memos serve as proof of a sale, their purpose, level of detail, and legal relevance differ significantly.

- Retail invoices are detailed, suitable for cash and credit sales, and critical for tax compliance.

- Cash memos are simpler, used only for immediate cash transactions, and primarily serve as proof of purchase.

Adopting the correct documentation practices ensures smooth business operations, legal compliance, and strengthens customer trust. Proper billing also reduces disputes, improves accounting accuracy, and simplifies audits.

Frequently Asked Questions (FAQs)

Can a cash memo include taxes?

Yes, a cash memo can include taxes, but it must clearly mention the tax amount. Otherwise, it may not be valid for GST or VAT filing.

Is a retail invoice mandatory for every sale?

For registered businesses, invoices are mandatory for credit sales and cash sales above a certain threshold, as per GST or local tax rules.

Can small businesses use only cash memos?

Small businesses can use cash memos for everyday cash transactions, but for credit sales or tax compliance, retail invoices are necessary.

How to convert a cash memo into an invoice if required?

Many accounting software solutions allow you to generate a full invoice from an existing cash memo by adding additional details like tax, invoice number, and payment terms.