Freelancers and consultants often work on multiple projects simultaneously, handling various clients with different scopes of work. Unlike salaried employees, their income is directly tied to the hours they work or the value they provide. This makes accurate billing not just a necessity but a cornerstone of financial stability for independent professionals.

One of the most effective ways to ensure proper compensation is through timesheet invoices. These invoices allow freelancers and consultants to bill clients based on the actual hours worked, providing transparency and professionalism.

This blog will guide you through understanding timesheet invoices, how to track your hours efficiently, and how to structure invoices to ensure you get paid accurately and on time.

Understanding Timesheet Invoices

A timesheet invoice is a document that records hours worked for a client and translates them into billable amounts. Unlike a standard fixed-price invoice, which charges a predetermined amount for a project, a timesheet invoice calculates payment based on hourly work.

This type of invoice usually includes:

- Detailed breakdown of tasks performed.

- Hours spent on each task.

- Hourly rate and total payable amount.

By providing clear documentation of time spent, timesheet invoices help clients understand the work delivered and why the charges are calculated the way they are.

Why Timesheet Invoices Are Essential

Timesheet invoices are crucial for several reasons:

- Accurate Payment: They ensure you are compensated fairly for the actual time spent on a project, preventing underpayment.

- Transparency: Detailed records build trust with clients by showing exactly what work was performed.

- Dispute Avoidance: Having a documented account of hours worked minimizes misunderstandings or disputes regarding billing.

- Professionalism: Timesheet invoices show you are organized and serious about your freelance or consulting work.

Common Uses

Timesheet invoices are widely used in:

- Freelance projects: Graphic design, content writing, web development, or digital marketing projects.

- Consulting services: Business consulting, IT consulting, HR advisory, and other professional services.

- Part-time contracts: Temporary or hourly-based jobs where work is performed intermittently.

How to Track Time Effectively

Accurate timesheet invoices depend on precise tracking of your work hours. There are several methods:

1. Manual Timesheets

You can track your time manually using:

- Spreadsheets (Google Sheets, Excel)

- Paper logs

Pros: Simple, low-cost, no software required.

Cons: Time-consuming, prone to errors, difficult to summarize for multiple clients or projects.

2. Digital Time Tracking Tools

Modern freelancers often use apps to track time automatically. Some popular tools include:

- Toggl – Easy-to-use with reporting features.

- Harvest – Integrates time tracking with invoicing.

- Clockify – Free plan with multi-project tracking.

Benefits:

- Automation reduces human error.

- Generates detailed reports ready for invoicing.

- Many tools integrate directly with invoicing software for a seamless workflow.

3. Best Practices

To maximize efficiency and accuracy:

- Record time in real-time: Avoid estimating hours later; start the timer when you begin work.

- Categorize tasks: Break down your work into clear categories (e.g., research, design, client meetings) to make your invoice more transparent.

- Review daily: Regularly check your entries to ensure no hours are missed.

Structuring Your Timesheet Invoice

A well-structured timesheet invoice improves clarity and ensures timely payment.

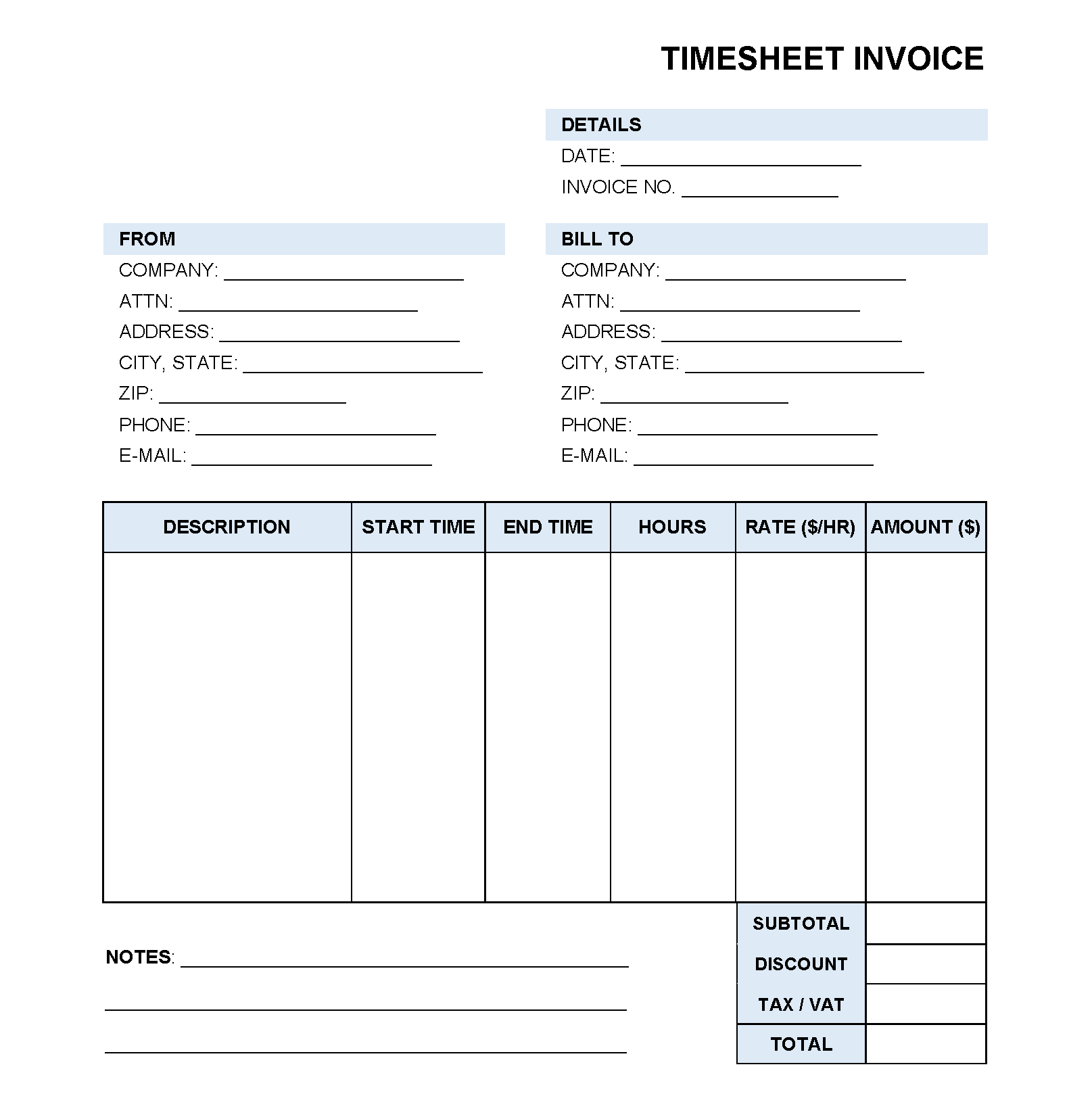

1. Essential Components

Your timesheet invoice should include the following:

- Freelancer/Consultant Info: Name, business name, contact details, and address.

- Client Information: Name, company, and contact details.

- Invoice Number and Date: Unique identifier and issue date for record-keeping.

- Project Name or Description: Brief summary of the work completed.

- Hourly Rate: Clearly stated rate for your services.

- Hours Worked: Total time spent on each task or project component.

- Total Amount Due: Multiply hours worked by the hourly rate.

- Payment Terms: Include due date and acceptable payment methods.

2. Optional Components

Adding extra details can enhance professionalism:

- Notes on Work Completed: A short description of deliverables or milestones achieved.

- Attachments: Include a detailed timesheet or screenshots of work as proof of hours.

- Tax Details: If applicable, mention GST, VAT, or other taxes for compliance.

- Step-by-Step Guide to Creating a Timesheet Invoice

Creating a professional timesheet invoice doesn’t have to be complicated. Follow these steps to ensure accuracy and clarity:

- Choose a Format

Decide whether you want to use a Word document, Excel spreadsheet, Google Docs/Sheets, or dedicated invoicing software. Each has its benefits:- Word/Google Docs: Simple, customizable layouts.

- Excel/Google Sheets: Automatic calculations for hours × rate.

- Invoicing Software: Streamlines recurring invoices, integrates payment options, and tracks unpaid invoices.

- Fill in Your Personal and Client Details

Clearly include your name, business name, contact details, and the client’s information. Add the invoice number and date to maintain organized records. - Log Hours Worked and Hourly Rate

Break down the work by date or task. Include the number of hours worked for each task and your agreed hourly rate. This helps clients understand the value delivered. - Calculate Totals (Hours × Rate)

Multiply the hours worked by your hourly rate for each task. Sum up the amounts to get the subtotal. If your invoice includes multiple projects or phases, provide a grand total. - Add Any Applicable Taxes or Discounts

Include GST, VAT, or service tax if applicable. Also, add any discounts agreed upon with the client. Clearly label these to avoid confusion. - Include Payment Instructions and Due Date

Mention your preferred payment method (bank transfer, PayPal, UPI, etc.) and specify the payment due date. You may also include late fees for overdue payments. - Review and Send Professionally

Double-check all calculations, spelling, and client information. Send the invoice as a PDF to maintain formatting and prevent edits. A professional email message accompanying the invoice can also improve client relations.

Tips for Billing by the Hour

Billing accurately requires more than just logging hours. Here are essential tips:

- Communicate Rates Clearly Before Starting Work

Always ensure your client knows your hourly rate upfront to avoid misunderstandings. Include this in your contract or proposal. - Round Time Entries Consistently

Track your hours in consistent increments, such as 15-minute blocks, to simplify calculations and maintain fairness. - Include a Buffer for Revisions or Extra Work

Factor in small contingencies for revisions, client feedback, or unexpected tasks. This prevents underbilling. - Keep Detailed Records in Case of Disputes

Store timesheets, screenshots, or work logs securely. They provide proof if a client questions billed hours. - Automate Reminders for Unpaid Invoices

Use invoicing software or calendar reminders to follow up on late payments. Timely reminders reduce delays in receiving your dues.

Common Mistakes to Avoid

Even experienced freelancers make mistakes that can delay payment or confuse clients. Avoid these pitfalls:

- Forgetting to Track Time Daily – Relying on memory often leads to inaccurate billing.

- Not Specifying Hourly Rate or Scope Clearly – Always mention the rate and describe what the billed work covers.

- Sending Invoices Without Supporting Timesheet Details – Clients appreciate transparency; without it, disputes may arise.

- Late Billing – Delaying invoicing can confuse clients and delay cash flow. Send invoices promptly after work completion.

Sample Timesheet Invoice Template

Here’s a simple example you can use as a reference:

| Date | Task Description | Hours Worked | Hourly Rate | Subtotal |

|---|---|---|---|---|

| 10/10/2025 | Website design | 5 | Rs 500 | Rs 2,500 |

| 11/10/2025 | Client meeting & review | 2 | Rs 500 | Rs 1,000 |

| 12/10/2025 | Content creation | 3 | Rs 500 | Rs 1,500 |

Total: Rs 5,000

Taxes (GST 18%): Rs 900

Grand Total: Rs 5,900

Payment Instructions: Bank transfer to [Account Details]

Due Date: 25/10/2025

Tools and Software Recommendations

Using the right tools makes tracking time and creating invoices easier:

- Invoicing Tools for Freelancers:

- Wave: Free, user-friendly, and suitable for small businesses.

- FreshBooks: Offers time tracking, automated invoicing, and reporting.

- QuickBooks: Comprehensive accounting with invoicing and tax management.

- Time-Tracking Tools:

- Toggl Track: Simple and intuitive for freelancers.

- Harvest: Combines time tracking with invoicing.

- Clockify: Free option with robust tracking and reporting features.

These tools help you save time, reduce errors, and maintain professional records.

Timesheet invoices are essential for freelancers and consultants who bill by the hour. They ensure accurate payment, transparency, and professionalism. By consistently tracking your hours, structuring invoices clearly, and following best practices, you can improve client trust and streamline your billing process.

Start implementing timesheet invoices today to track your hours effectively, bill accurately, and get paid on time. A small effort in record-keeping today ensures a smoother cash flow and better client relationships tomorrow.