E-invoicing, or electronic invoicing, is transforming the way businesses manage billing and compliance. While B2B (business-to-business) e-invoicing has received significant attention in India, B2C (business-to-consumer) e-invoicing is equally important for streamlining retail and consumer-facing transactions.

B2C e-invoicing digitizes invoices generated for consumers, improving transparency, compliance, and efficiency. With the government pushing for wider adoption, understanding its workings, benefits, and challenges is crucial for businesses of all sizes.

What is B2C E-Invoicing?

B2C e-invoicing refers to the process of generating, storing, and transmitting invoices for sales made directly to consumers in a digital format. Unlike B2B transactions where invoices are shared between registered businesses, B2C invoices are typically issued to unregistered entities or individual consumers.

Key Features of B2C E-Invoicing:

- Digital creation and storage of invoices

- Generation of a unique Invoice Reference Number (IRN) for traceability

- Compliance with government regulations under GST

- Integration with accounting and ERP software for automation

Transactions Covered:

- Retail sales to unregistered consumers

- E-commerce consumer purchases

- Direct sales in offline stores to individual customers

Applicability

B2C e-invoicing is applicable to:

- Businesses making retail sales to consumers (unregistered under GST)

- E-commerce transactions where products are sold directly to end customers

- Offline sales in stores to individual buyers

- Service providers issuing invoices to individual consumers

Note: Currently, B2C e-invoicing is optional for small businesses but may become mandatory as per future GST notifications.

Effective Date

The government of India has mandated e-invoicing in phases, primarily focusing on B2B transactions first.

Key Dates for B2C E-Invoicing:

- B2C e-invoicing is gradually being encouraged from FY 2024-25 for businesses above a certain turnover threshold.

- Full compliance for all businesses is expected as the GST Council expands the scope.

Requirements for B2C E-Invoicing

To generate a B2C e-invoice, businesses must ensure the following:

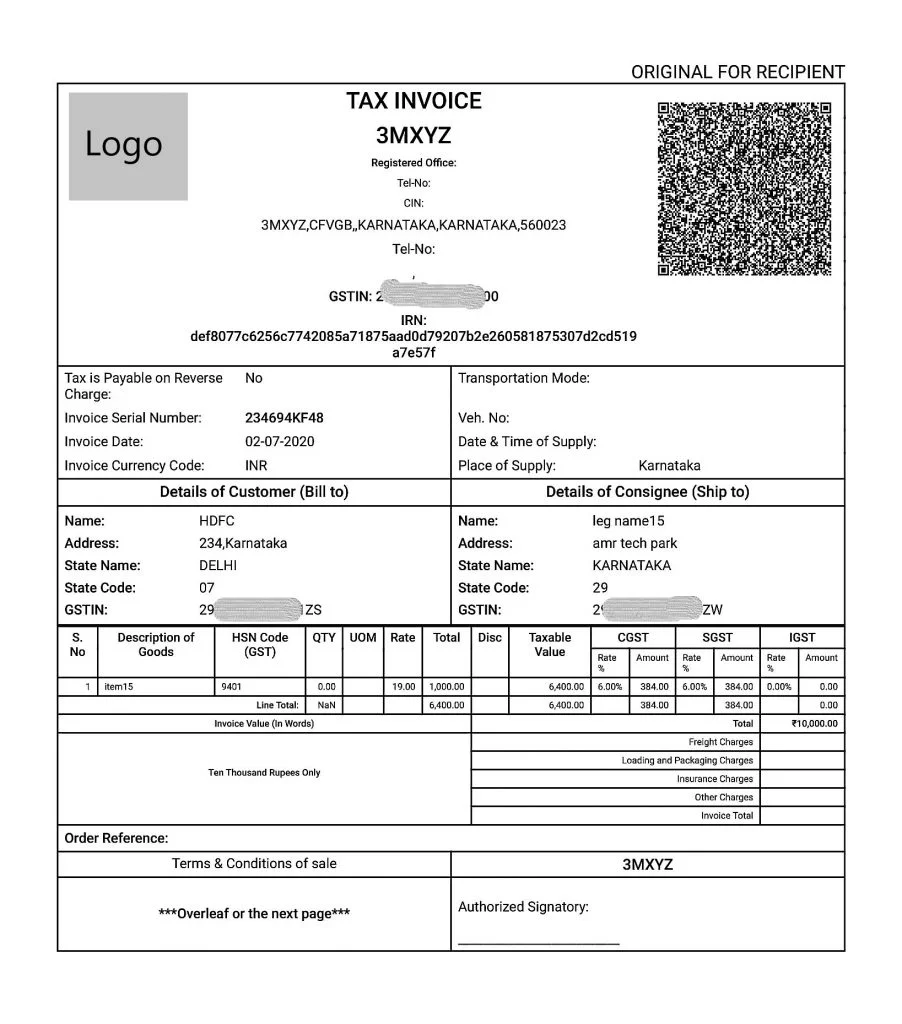

Mandatory Details:

- Supplier name, GSTIN, and address

- Consumer name (if available) and address

- Invoice number and date

- HSN/SAC codes of products or services

- Quantity, rate, taxable value

- GST rate and total invoice value

- Unique Invoice Reference Number (IRN) issued by the government portal

Software Requirements:

- Integration with accounting, ERP, or POS systems

- GST-compliant e-invoice generation tools

- Ability to digitally store and share invoices

Turnover Limit / Threshold

The threshold for B2C e-invoicing applicability varies:

- B2B: Mandatory for businesses with turnover > ?10 crore (already implemented)

- B2C: Currently optional, typically recommended for businesses with high retail volumes

- Future notifications may introduce specific turnover limits for mandatory B2C e-invoicing

Tip: Businesses below the threshold can adopt e-invoicing voluntarily to streamline operations.

Examples of B2C E-Invoicing

Here are practical examples to understand B2C e-invoicing:

- Retail Sale: A clothing store sells a shirt to a walk-in customer and generates an e-invoice via POS.

- E-commerce Sale: An online platform sells a mobile phone to a customer and generates a GST-compliant digital invoice.

- Service Transaction: A beauty salon issues an e-invoice to a client for services availed, with GST included.

- Pharmacy Sale: A medical store sells medicines to an individual customer and creates a B2C e-invoice digitally.

Key Point: In all cases, the invoice is digitally recorded, IRN generated, and shared with the customer, ensuring compliance and easier bookkeeping.

Legal and Compliance Requirements

B2C e-invoicing is governed by GST regulations in India. While B2B e-invoicing is mandatory for businesses above a certain turnover threshold, B2C e-invoicing compliance is gradually being expanded.

Key Compliance Points:

- Invoice must contain GSTIN if the customer is registered, otherwise basic invoice details suffice

- Mandatory fields include supplier details, invoice number, date, item details, taxable value, GST rate, and total amount

- IRN generation ensures the invoice is recorded in the GST system, reducing errors and fraud

- Exemptions may apply for small businesses or transactions below a threshold

Benefits of B2C E-Invoicing

- Faster and Accurate Billing: Automated invoice generation eliminates manual calculations, ensuring faster and accurate billing.

- Error and Fraud Reduction: Digital storage and IRN verification prevent tampering or duplication of invoices.

- Transparency and Traceability: Every B2C transaction is recorded digitally, making audits and reconciliations easier.

- Integration with Accounting Systems: E-invoices can automatically update accounting and ERP systems, reducing manual entry.

- Improved Customer Experience: Professional, timely digital invoices enhance consumer trust.

Challenges in Implementing B2C E-Invoicing

Despite its benefits, businesses may face challenges while adopting B2C e-invoicing:

- Technological Barriers: Small businesses may lack the technical resources to implement e-invoicing software.

- System Integration: Existing POS, billing, or ERP systems may require upgrades or integration.

- Compliance Knowledge: Keeping up with GST updates, thresholds, and exemptions can be complex.

- Consumer Awareness: Many individual consumers may not fully understand e-invoices, requiring businesses to educate them.

How B2C E-Invoicing Works

Here’s a step-by-step process:

- Invoice Creation: Using software or POS systems, the invoice is created with all mandatory details.

- Data Validation: Invoice details are validated against GST norms to ensure compliance.

- IRN Generation: A unique Invoice Reference Number (IRN) is generated by the government portal.

- Invoice Transmission: The e-invoice is digitally sent to the consumer via email, SMS, or app.

- Accounting Integration: The e-invoice automatically updates the business’s accounting system.

Mandatory Fields for B2C E-Invoices:

- Supplier GSTIN and address

- Consumer details (if available)

- Invoice number and date

- HSN/SAC codes of products or services

- Quantity, rate, taxable value

- GST amount and total invoice value

Vyaaparkhata – B2C E-Invoicing Simplified

Vyaaparkhata is an advanced invoice creation and management software designed to simplify B2C e-invoicing for businesses of all sizes. It allows businesses to generate GST-compliant e-invoices, manage records efficiently, and ensure seamless compliance with government regulations.

Key Features of Vyaaparkhata for B2C E-Invoicing:

- Automated Invoice Generation: Create B2C e-invoices quickly with all mandatory GST fields pre-populated.

- IRN Generation & Verification: Instantly generate Invoice Reference Numbers (IRN) verified with the GST portal.

- Accounting Integration: Sync invoices directly with your accounting and ERP systems to reduce manual entries.

- User-Friendly Dashboard: Monitor, track, and manage all invoices from a single interface.

- Compliance & Audit Ready: Maintain records digitally for audits, reducing errors and ensuring transparency.

- Cloud-Based Access: Access your invoices securely from anywhere, anytime, making it ideal for businesses with multiple locations.

Why Choose Vyaaparkhata for B2C E-Invoicing:

- Reduces manual errors and saves time in generating invoices

- Ensures compliance with GST rules and government standards

- Simplifies record-keeping and financial reporting

- Improves customer experience with timely, professional invoices

Vyaaparkhata is especially suitable for small and medium-sized businesses looking for a reliable, automated solution to handle B2C invoicing efficiently while staying compliant with GST regulations.

Best Practices for Businesses

- Plan and Implement Gradually: Start with high-volume or digital transactions.

- Educate Staff: Ensure employees understand the software and compliance requirements.

- Audit Regularly: Conduct internal checks to ensure accurate invoicing and GST reconciliation.

- Backup and Secure Data: Maintain secure cloud or offline backups to prevent data loss.

- Keep Abreast of Regulations: Monitor GST updates, exemptions, and government notifications.

Future of B2C E-Invoicing

The future of B2C e-invoicing is evolving rapidly:

- Wider Adoption: The government aims to extend e-invoicing to smaller businesses in the near future.

- Integration with Emerging Technologies: AI and blockchain could make B2C invoices more secure and predictive.

- Enhanced Analytics: Businesses will leverage e-invoice data for sales insights, demand forecasting, and customer behavior analysis.

B2C e-invoicing is no longer optional—it is becoming a critical part of digital business operations. From compliance and efficiency to customer trust and transparency, the advantages far outweigh the challenges. Adopting B2C e-invoicing ensures that businesses stay ahead in a digitally-driven marketplace.

FAQs About B2C E-Invoicing

Is B2C e-invoicing mandatory for all businesses?

Currently, only businesses above certain thresholds are mandated, but adoption is encouraged for all.

How is B2C e-invoicing different from B2B e-invoicing?

B2C invoices are issued to unregistered consumers, while B2B invoices are for GST-registered businesses.

What are the penalties for non-compliance?

Penalties may include fines under GST provisions and delayed input tax credit claims.

Can small businesses benefit from B2C e-invoicing?

Yes, it improves accuracy, efficiency, and prepares businesses for future compliance.

How long is an e-invoice valid?

E-invoices are valid indefinitely but must be stored digitally for a minimum of 8 years for GST audits.

Can e-invoices be edited after generation?

Minor corrections are allowed through credit/debit notes, but the original IRN cannot be changed.

Does B2C e-invoicing reduce GST filing workload?

Yes, it automates reporting, reduces errors, and simplifies filing returns.

How secure is B2C e-invoicing data?

Highly secure, as IRNs are verified through government portals and data is encrypted.

What is the future trend of e-invoicing in India?

Gradual expansion to all businesses, integration with AI and blockchain, and enhanced analytics for consumer behavior.