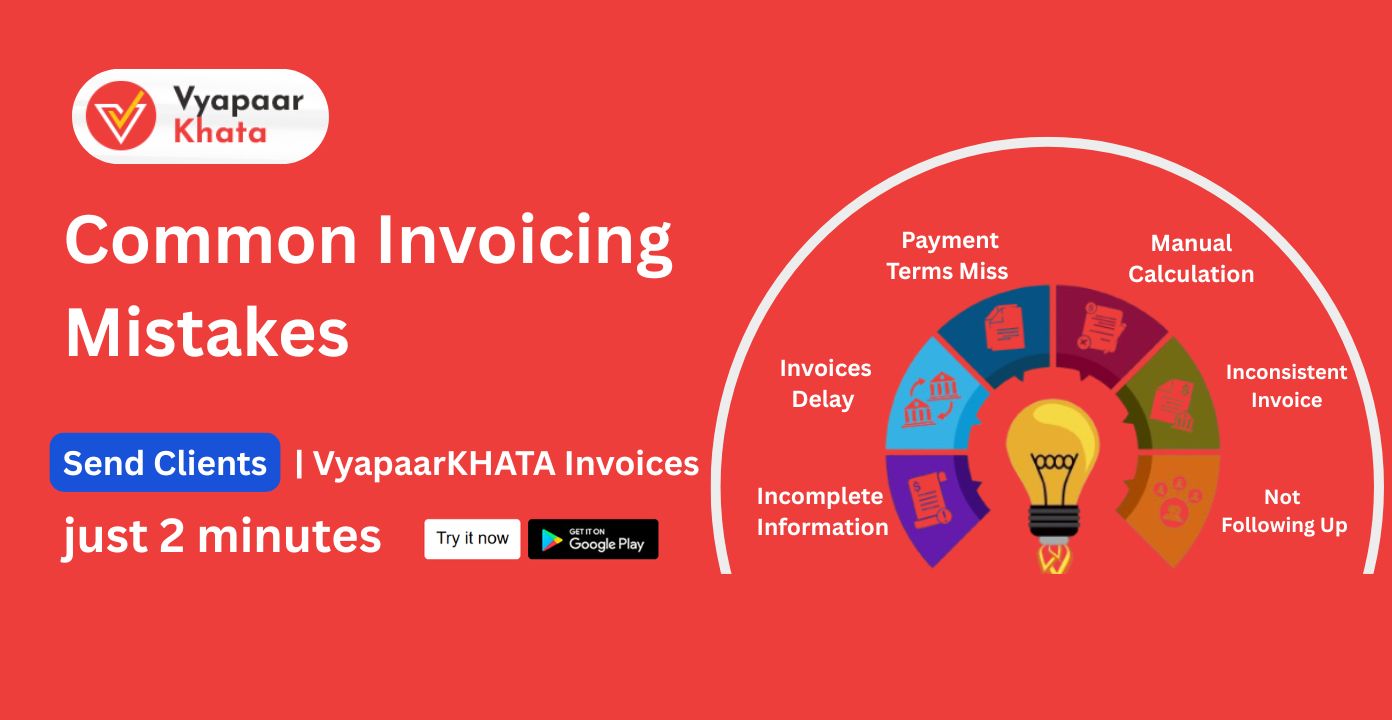

Invoicing is the heartbeat of every business transaction. Yet, many small businesses and freelancers unknowingly make costly invoicing mistakes that result in payment delays, accounting errors, and compliance issues. Whether you run a shop, provide professional services, or manage a wholesale business, understanding the common pitfalls in invoicing can save you time, money, and stress.

In this blog, we’ll explore the top invoicing mistakes, practical ways to avoid them, and how VyaaparKhata, a smart invoicing and business management app, can make your billing process seamless and professional.

1. Missing or Incomplete Information on Invoices

Common Mistake: Sending invoices that lack important details such as:

- Invoice number

- Invoice date

- Customer details (Name, GSTIN, address)

- Item/service description

- Applicable taxes (GST/IGST/SGST)

- Total payable amount

- Payment due date

Why It’s a Problem:

Incomplete invoices create confusion, appear unprofessional, and may be rejected by clients or tax authorities.

Solution: Use a structured invoice template with all mandatory fields clearly defined.

With VyaaparKhata,

- Every invoice is pre-formatted with GST-compliant fields.

- Auto-fill options for repeat customers and products.

- Customizable fields to suit your business needs.

2. Delay in Sending Invoices

Common Mistake: Many business owners postpone invoicing due to workload or lack of time, sometimes for days or even weeks.

Why It’s a Problem:

- Late invoicing leads to late payments, disrupted cash flow, and affects monthly revenue cycles.

Solution: Send invoices immediately after product delivery or service completion.

With VyaaparKhata:

- Generate invoices on-the-go via mobile or desktop.

- Share instantly through WhatsApp, email, or direct PDF download.

- Set invoice reminders to never miss billing a client.

3. Not Specifying Clear Payment Terms

Common Mistake: Many invoices don’t mention when the payment is due, or lack clarity about late payment fees and acceptable payment modes.

Why It’s a Problem: Unclear payment terms lead to unnecessary delays and disputes.

Solution:

Mention standard payment terms like “Net 15”, “Net 30”, or “Due on Receipt” along with late fee clauses (if applicable).

With VyaaparKhata:

- Add standard or custom payment terms with every invoice.

- Set automatic follow-up reminders for overdue payments.

- Accept payments via UPI, bank transfer, or other preferred methods.

4. Manual Calculation Errors

Common Mistake: Manually calculating item totals, GST, and discounts can lead to mistakes, especially in bulk billing or multiple tax slabs.

Why It’s a Problem:

Even small calculation errors reduce trust and may cause legal or tax-related issues.

Solution:

Use invoicing software that automatically calculates line-item totals, taxes, and discounts.

With VyaaparKhata:

- Auto-calculates totals, SGST/CGST/IGST as per your location.

- Apply discounts (per item or overall) with one click.

- Real-time GST summary and tax reports available.

5. Inconsistent Invoice Formats

Common Mistake: Using different formats or layouts across clients shows lack of professionalism and may lead to misunderstandings.

Why It’s a Problem:

A non-standard invoice can confuse clients, look unprofessional, and cause delays in processing payments.

Solution: Use a consistent invoice format with your brand logo and company information.

With VyaaparKhata:

- Choose from professional invoice templates.

- Add your business logo, signature, terms & conditions, and footer notes.

- Create a consistent brand image with every invoice.

6. Not Following Up on Unpaid Invoices

Common Mistake: Many small businesses forget or hesitate to follow up on unpaid invoices due to fear of upsetting clients.

Why It’s a Problem:

Unfollowed invoices lead to unpaid dues, account mismanagement, and business losses.

Solution: Set up a system to track due dates and follow up professionally.

With VyaaparKhata:

- Real-time dashboard showing pending, paid, and overdue invoices.

- Automatic payment reminders via SMS or WhatsApp.

- Easily generate aging reports and payment summaries.

7. Poor Invoice Record Management

Common Mistake: Storing invoices in physical folders or scattered across devices makes it hard to retrieve them during audits or tax filing.

Why It’s a Problem:

Missing records can cause legal penalties, GST issues, and difficulty in tracking income and expenses.

Solution:

Digitally store and organize all your invoices in a centralized system.

With VyaaparKhata:

- All invoices are backed up securely on cloud.

- Search and retrieve past invoices in seconds.

- Export reports for GST filing and financial audits.

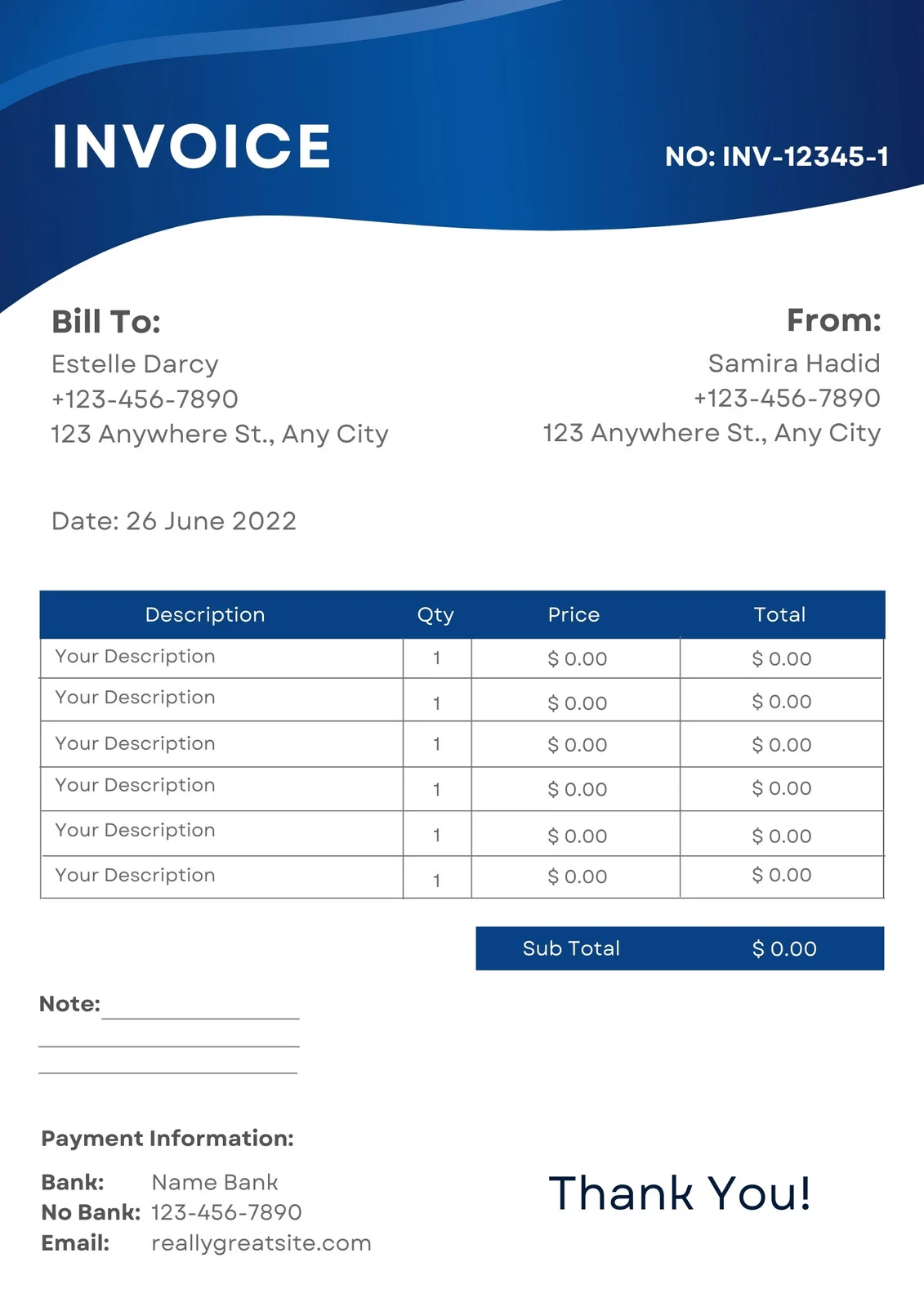

Best Invoice Format

Use VyaaparKhata for Professional, Error-Free Billing

VyaaparKhata is an all-in-one business management app built for Indian entrepreneurs, traders, retailers, and professionals. It simplifies the entire billing process while ensuring compliance and professionalism.

Key Features:

- GST & Non-GST Invoice Creation

- Customizable Templates with Your Logo

- Auto-Calculations for GST, Discounts, and Totals

- Instant Invoice Sharing via WhatsApp, Email & Print

- Automatic Payment Tracking and Reminders

- Cloud Backup and Data Security

- Multi-language Support & Mobile-Friendly Interface

- Inventory Management, Expense Tracking & Reports

Invoicing mistakes are more common than you think, but they are also easy to fix with the right tools. Don’t let poor invoicing practices slow down your business or affect your professional image.

Switch to VyaaparKhata and experience a smarter, faster, and more efficient way to create, manage, and track invoices—anytime, anywhere.

Industries That Can Avail VyaaparKhata

VyaaparKhata is a versatile invoicing and business accounting solution designed to serve a wide range of industries across India. Whether you are running a small retail shop or managing a large-scale manufacturing unit, VyaaparKhata adapts to your business needs with ease.

Here are the key industries that can benefit from using VyaaparKhata:

1. Retail & Wholesale Businesses

- Kirana stores

- Electronic showrooms

- Garment shops

- FMCG distributors

- Grocery and general stores

Manage inventory, generate GST/non-GST bills, track daily sales, and record customer payments with ease.

2. Manufacturing Units

- Food & Beverage

- Machinery and tools

- Chemical and pharma

- Packaging & printing

- Textile and garment production

Track raw materials, automate billing, manage purchase orders, and create job work invoices with batch-wise tracking.

3. Service Providers

- Electricians, plumbers, carpenters

- Digital marketing and advertising

- Freelancers & consultants

- Repair services and maintenance

- Travel & tour operators

VyaaparKhata helps to Issue professional invoices for services, set payment due dates, and send automated reminders

4. Traders and Distributors

- Hardware and building material traders

- Automobile parts dealers

- Mobile & accessories sellers

- Medical and pharma distributors

VyaaparKhata Helps to Track purchases and dispatches, maintain vendor accounts, and generate customized invoices for bulk orders.

5. Agriculture & Agro-based Businesses

- Fertilizer and seed shops

- Dairy and poultry suppliers

- Agri tool dealers

- Organic produce sellers

VyaaparKhata Helps to Maintain records of farmer transactions, track goods in transit, and manage multi-location stock.

6. Construction & Real Estate

- Contractors and sub-contractors

- Interior designers

- Real estate brokers

- Cement, steel, and hardware suppliers

VyaaparKhata Generate work progress invoices, maintain site-wise material logs, and track client receivables.

7. Education & Coaching Centers

- Private tutors

- Coaching institutes

- Training academies

- EdTech service providers

How VyaaparKhata Helps: Bill students, manage monthly fee records, issue receipts, and generate financial reports

8. Beauty, Wellness & Healthcare

- Salons and spas

- Ayurvedic product sellers

- Clinic and diagnostic centers

- Supplement retailers

How VyaaparKhata Helps: Create detailed service invoices, manage customer visits, and track product sales.

9. Home-based & Cottage Industries

- Handmade crafts and decor

- Tiffin and catering services

- Online sellers on Instagram, Meesho, etc.

- Tailors and boutique owners

How VyaaparKhata Helps: Create invoices on mobile, manage small inventories, and share bills via WhatsApp.

VyaaparKhata Is Built for Every Indian Business

No matter what your business type is, if you need to:

- Generate accurate invoices

- Manage customers or vendors

- Manage Quotations

- Stay GST-compliant

Then VyaaparKhata is your go-to solution.

Get Started Today – It’s Easy, Fast & Free!