In today’s fast-paced business environment, accuracy and efficiency are more important than ever. One area that often causes unnecessary delays and costly errors is manual invoicing. Fortunately, digital invoicing is no longer just an option—it’s a necessity. If you’re still relying on paper invoices or clunky spreadsheets, it’s time to switch to a smarter, more streamlined solution.

VyapaarKHATA is designed to simplify your invoicing process, reduce manual errors, and save valuable time. In this blog, we’ll explore why switching to digital invoicing with VyapaarKHATA can transform the way you manage your business finances.

What is Digital Invoicing?

Digital invoicing, or e-invoicing, is the process of generating, sending, receiving, and managing invoices in an electronic format. Unlike traditional paper-based invoicing, which is time-consuming and prone to human error, digital invoicing automates key steps and enhances accuracy.

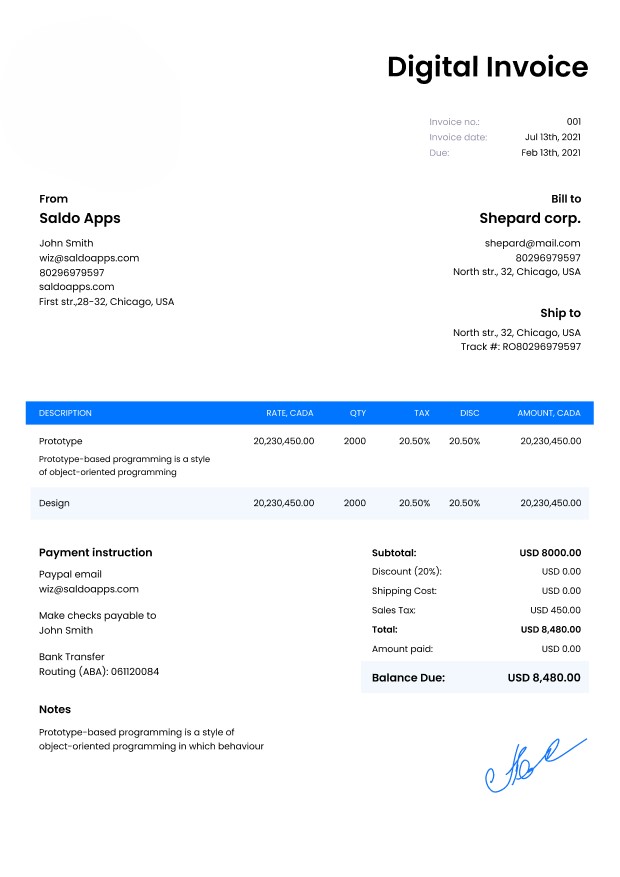

With VyapaarKHATA, businesses can create and send professional invoices in just a few clicks, directly from their mobile device or desktop, making the entire process faster, smarter, and more reliable. Below is the basic overview of Digital Invoice

Difference between: Digital Invoice and Electronic Invoice

- Digital Invoice: A digitally created invoice in formats like PDF, Excel, or Word, usually shared via email or WhatsApp. It replaces paper-based invoices but may not follow any legal or government format.

- Electronic Invoice (e-Invoice): A structured invoice file (typically in JSON or XML) that is created and submitted to a government-approved system like the Invoice Registration Portal (IRP) under India’s GST framework. It generates an IRN (Invoice Reference Number) and QR code.

Purpose & Use Case

- Digital Invoice: Ideal for general business transactions. Used for billing customers, sending estimates, and tracking payments—especially by small businesses.

- e-Invoice: Designed for regulatory compliance. Mandatory for businesses exceeding specific turnover thresholds under Indian GST rules. Must be submitted to IRP before it's considered valid.

Format & Structure

- Digital Invoice: Free-form layout. Can be personalized and created using invoice software, Word, Excel, or accounting tools like VyapaarKHATA.

- e-Invoice: Follows a standardized format as per GST guidelines. Must include predefined fields such as HSN code, GST rate, IRN, etc., and is machine-readable (JSON/XML).

Government Validation

- Digital Invoice: Not submitted to any tax authority. It’s internal to your business.

- e-Invoice: Must be validated and registered on the IRP. Only after registration does it become legally valid under the GST regime.

Key Features

Examples

- Digital Invoice: A PDF invoice created via VyapaarKHATA and emailed to a customer.

- e-Invoice: An invoice uploaded to the GST portal in JSON format, which returns an IRN and digitally signed invoice with a QR code.

Top Benefits of Digital Invoicing with VyapaarKHATA

1. Time-Saving Efficiency

Manual invoice creation takes time—especially when you're generating multiple bills daily. VyapaarKHATA automates this process, enabling users to:

- Generate GST-compliant invoices within seconds

- Send invoices via email or WhatsApp instantly

- Set up recurring invoices for regular customers

- Track due payments and reminders automatically

This saves hours of administrative work each month and allows you to focus on growing your business.

2. Reduced Errors

Manual data entry can lead to small mistakes that cost big money. VyapaarKHATA reduces these risks by:

Offering pre-filled templates

- Ensuring automatic tax calculations (GST, discounts, etc.)

- Storing customer and product details for quick access

- Allowing users to preview invoices before sending

This minimizes the chances of typos, calculation errors, and billing disputes.

3. Improved Recordkeeping & Organization

With VyapaarKHATA, all your invoices are stored in one secure digital dashboard. No more searching through files or folders. You can:

Instantly view invoice history

- Filter by date, customer, payment status, or product

- Export reports for tax filing or business review

This not only improves organization but also supports better financial decision-making.

4. Cost Savings

Traditional invoicing involves paper, printing, postage, and storage. VyapaarKHATA helps cut these costs by:

- Eliminating the need for physical materials

- Reducing time spent chasing payments

- Lowering the risk of lost invoices and delayed payments

Whether you're a small business owner or a growing enterprise, digital invoicing translates to tangible savings.

5. Enhanced Security and Compliance

VyapaarKHATA is built with security in mind. It offers:

- Cloud-based backups

- Secure login and data encryption

- GST-ready formats to ensure compliance with Indian tax laws

This gives peace of mind knowing your data is safe and you're always audit-ready.

Choosing the Right Digital Invoicing Tool

When selecting a digital invoicing solution, look for one that offers:

- User-friendly interface

- GST-compliance

- Mobile access

- Customization options

- Strong data security

VyapaarKHATA ticks all these boxes and more, making it an ideal solution for Indian businesses of all sizes.

How to Switch to Digital Invoicing with VyapaarKHATA

Making the switch is easier than you think. Here's a simple roadmap:

Step 1: Sign Up

Create a free account on VyapaarKHATA using your mobile number or email.

Step 2: Set Up Your Business Profile

Add your company details, GSTIN, logo, and payment terms.

Step 3: Add Products and Customers

Input or import your product/service list and customer details.

Step 4: Start Creating Invoices

Use VyapaarKHATA’s ready-made templates to generate and send invoices in seconds.

Step 5: Track, Report, and Optimize

View reports, track payments, and send reminders—all from one dashboard.

Common Concerns—Solved by VyapaarKHATA

The Future of Invoicing is Digital

India is moving toward full e-invoicing mandates for medium and large businesses, and small enterprises will follow soon. Features like QR codes, payment integration, and AI-powered analytics are becoming the norm.

VyapaarKHATA is ready for this future—with a platform that adapts as your business grows.

Switching to digital invoicing is not just about saving time—it’s about working smarter. VyapaarKHATA helps you:

- Simplify your workflow

- Eliminate manual errors

- Accelerate payments

- Stay compliant with Indian tax regulations

Bonus: Digital Invoicing Checklist

- Business GST details updated

- Customer database imported

- Products/services listed

- Invoice template selected

- Automatic reminders enabled

- Mobile app downloaded for on-the-go access

When it comes to efficient, error-free, and professional invoicing, VyapaarKHATA stands out as the go-to solution for Indian businesses.

With VyapaarKHATA, you can create invoices in just a few simple steps—no technical knowledge required! Its user-friendly interface, intuitive dashboard, and customizable invoice formats make it ideal for businesses of all sizes.

Why Choose VyapaarKHATA?

- Simple to Use: Clean layout and step-by-step invoice creation make billing fast and hassle-free.

- Multiple Invoice Types: Supports various formats including GST invoices, non-GST invoices, proforma invoices, and estimates.

- Tax & Non-Tax Invoices: Whether you're billing with GST or without, VyapaarKHATA adapts to your needs with smart logic built in.

- Professional Output: Generate print-ready invoices with branding, logos, and legally compliant fields.

- Time-Saving Features: Reuse past invoice data, auto-calculate taxes, and manage your client list effortlessly.

Get Started Today

Switch to VyapaarKHATA and experience the easiest way to create professional, accurate, and compliant invoices—digitally.

Sign up now and simplify your billing like never before!