Choosing the right type of invoice is essential for smooth business operations, accurate record-keeping, and maintaining healthy cash flow. At VyapaarKHATA, we help you to get customizable invoicing solutions tailored to meet diverse business needs. Here's a comprehensive guide to various invoice types and their ideal applications:

20 Invoice Format:

At VyapaarKHATA, we understand the diverse invoicing needs of businesses. Our platform offers customizable templates for all the above invoice types, ensuring compliance and professionalism. Whether you're a freelancer, a small business, or an enterprise, our solutions are designed to streamline your billing process efficiently.

Highly Used Invoice

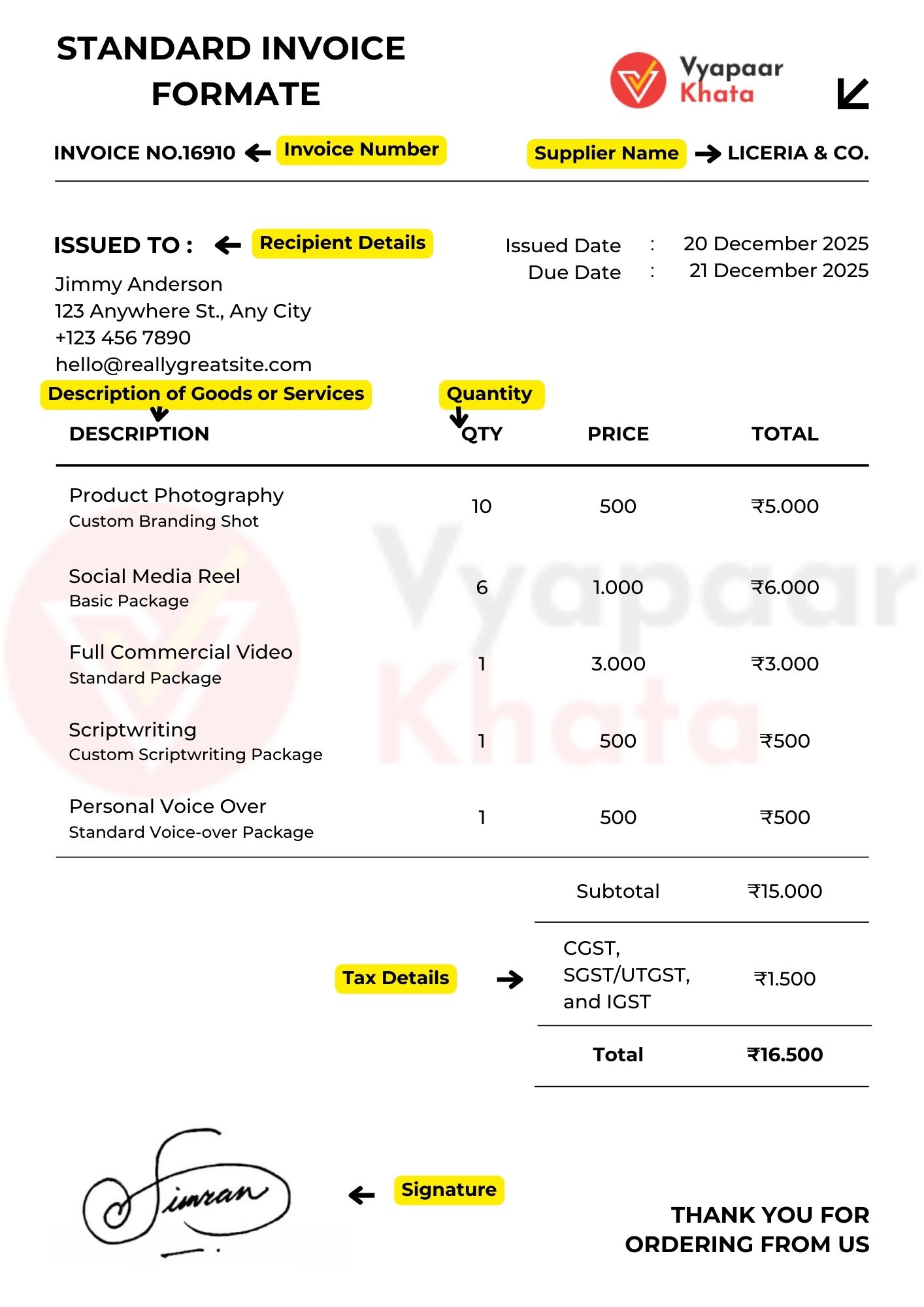

The Standard Invoice is the most widely used invoicing format across various industries and business sizes. Its versatility and straightforward structure make it the go-to choice for billing clients after delivering goods or services.

Why the Standard Invoice is Widely Used

Versatility: Suitable for a broad range of industries, including retail, services, manufacturing, and freelancing.

Simplicity: Contains essential details such as:

Business and client contact information

- Unique invoice number

- Itemized list of products or services provided

- Total amount due

- Payment terms and due date

Professionalism: Presents a clear and organized request for payment, enhancing the business's credibility.

Legal Documentation: Serves as a formal record of the transaction, useful for accounting and legal purposes.

Ideal Use Cases

- Freelancers: Billing clients for completed projects or hourly work.

- Retailers: Requesting payment for sold goods.

- Service Providers: Charging for services rendered, such as consulting, maintenance, or design work.

- Manufacturers: Invoicing distributors or retailers for bulk orders.

Which Industry Needs What Types of Invoices?

Different industries require different types of invoices based on the nature of their business, compliance needs, and billing practices. Here's a breakdown of which industry typically uses what types of invoices:

1. Retail Industry

- Tax Invoice: Includes GST/VAT for goods sold.

- Cash Invoice: For walk-in customers who pay immediately.

- Pro Forma Invoice: Often used to confirm pricing before sale.

2. Manufacturing Industry

- Tax Invoice: For business-to-business transactions.

- Pro Forma Invoice: Before dispatching goods.

- Commercial Invoice: For export shipments.

- Packing List (attached to invoice): To describe goods in detail.

3. Construction & Real Estate

- Progress/Interim Invoice: Based on project milestones.

- Retention Invoice: For holding a percentage until project completion.

- Final Invoice: Once the full job is complete.

- Pro Forma Invoice: For estimating large contracts.

4. Freelancers & Service Providers (IT, Design, Consulting)

- Service Invoice: With hourly or fixed charges.

- Recurring Invoice: For monthly retainers.

- Timesheet Invoice: Based on time logs.

- Pro Forma Invoice: Used for upfront approvals.

5. Export & Import Industry

- Commercial Invoice: Includes shipment value, customs info.

- Customs Invoice: Required by customs departments.

- Packing List: Often accompanies commercial invoice.

- Pro Forma Invoice: For advance payments and documentation.

6. Healthcare Industry

- Medical Invoice/Bill: Patient-wise treatment breakdown.

- Insurance Invoice: For claims and reimbursements.

- Pharmacy Tax Invoice: For medicine sales.

7. Hospitality Industry (Hotels, Restaurants)

- Guest Invoice/Bill: Itemized charges per stay/meal.

- Tax Invoice: For GST-compliant sales.

- Folio Invoice: For consolidated hotel bills.

8. Logistics & Transportation

- Freight Invoice: For shipping goods.

- Bill of Lading (not exactly an invoice): Acts as a shipping contract.

- Fuel Surcharge Invoice: If applicable.

- Pro Forma Invoice: For estimated transport charges.

9. Education & Training

- Tuition Invoice: For course or semester fees.

- Recurring Invoice: For monthly or quarterly payments.

- Admission Fee Invoice: One-time charges.

At VyapaarKHATA, we offer customizable standard invoice templates that cater to your specific business needs. Our user-friendly platform ensures that creating and managing invoices is efficient and compliant with industry standards.

If you require assistance in selecting the appropriate invoice type or customizing templates to align with your business requirements, feel free to reach out. We're here to support you in optimizing your invoicing process.