In the world of business, managing credit efficiently is crucial for maintaining healthy cash flow and strong customer relationships. Companies often deal with situations where invoices need adjustments due to returns, billing errors, or post-sale discounts. This is where credit management tools, such as credit notes and credit invoices, come into play.

Understanding the difference between a credit note and a credit invoice is essential for business owners, accountants, and finance professionals. Not only does it help ensure accurate bookkeeping, but it also prevents disputes with customers and simplifies tax compliance.

In this blog, we’ll break down the concepts of credit notes and credit invoices, highlight their differences, and provide practical examples to help you apply them in real-world scenarios.

What is a Credit Note?

A credit note is an official document issued by a seller to a buyer, indicating that a certain amount has been credited to the buyer’s account. Essentially, it reduces the amount payable by the buyer for goods or services previously invoiced.

Purpose of a Credit Note:

- Correct Billing Errors: If the seller overcharges or miscalculates, a credit note rectifies the amount.

- Return of Goods: When goods are returned due to defects, damages, or other reasons, a credit note adjusts the payable amount.

- Discounts or Rebates After Invoicing: If a seller offers a discount after issuing the original invoice, the credit note communicates the revised amount.

Key Features of a Credit Note:

- Issued Post-Sale: It is generated after the original invoice has been issued.

- References the Original Invoice: Clearly mentions which invoice it is adjusting.

- Reduces Buyer’s Liability: Decreases the amount the buyer owes to the seller.

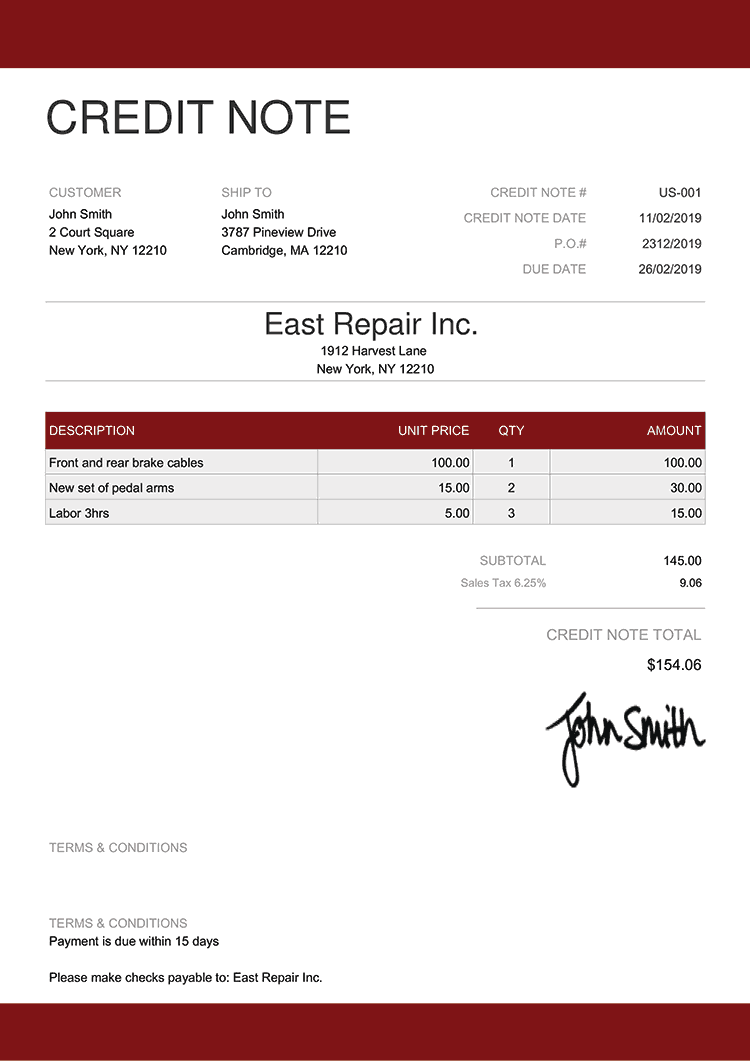

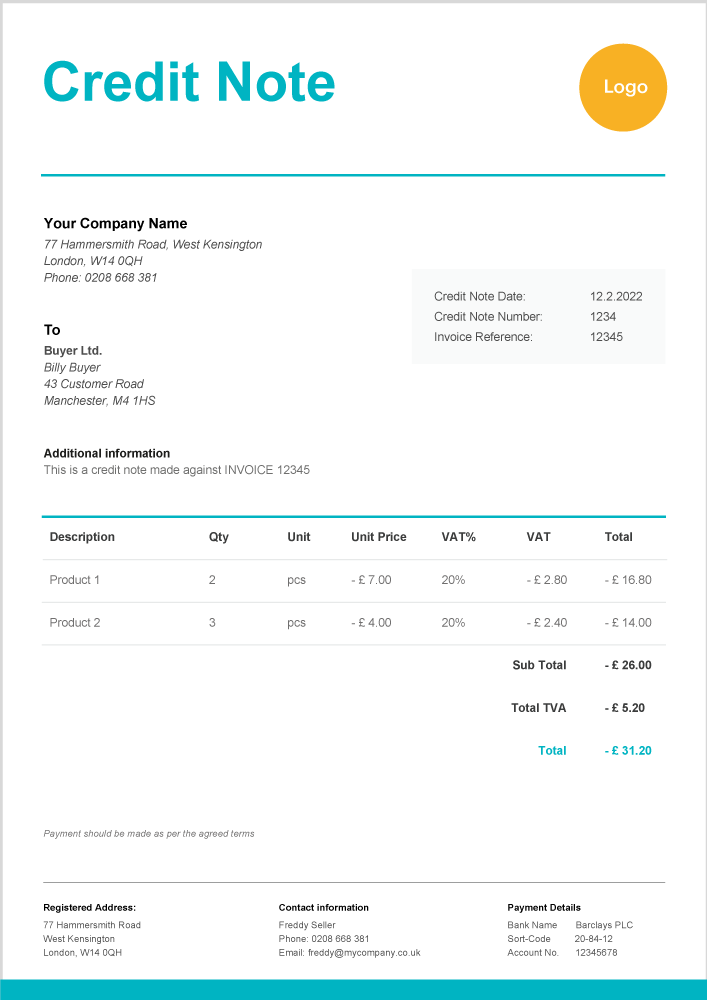

Components of a Credit Note

A well-structured credit note contains the following elements:

- Seller and Buyer Details: Name, address, and contact information for clarity.

- Credit Note Number and Date: Unique identifier and issuance date for record-keeping.

- Original Invoice Reference: Links the credit note to the original invoice for easy tracking.

- Reason for Issuance: Clearly states why the credit is being issued (e.g., returned goods, billing error).

- Amount Credited: Total amount being credited, including taxes if applicable.

- Terms and Conditions: Any specific terms regarding the use of the credit or its validity.

These components ensure that the credit note is transparent, legally valid, and easy to reconcile in accounting records.

What is a Credit Invoice?

A credit invoice is a type of invoice issued by a seller to notify a buyer that a credit has been granted to their account. It serves as an official document indicating that the buyer’s outstanding payable amount has been adjusted or reduced due to certain circumstances.

In some regions, particularly in Europe and parts of Asia, a credit invoice is also referred to as a “negative invoice”, because the amounts are recorded as negative values in accounting systems to offset previous charges.

Purpose of a Credit Invoice:

- Record Reduction in Payable Amount: Clearly documents the adjustment in the buyer’s outstanding balance.

- Accounting Adjustments: Used as a formal record to correct invoices, return transactions, or provide post-sale discounts.

While a credit note typically responds to a specific past invoice, a credit invoice can either reference a previous invoice or be issued independently to reflect a credit transaction. This distinction is important for accurate bookkeeping and financial reporting.

Key Differences Between Credit Note and Credit Invoice

| Feature | Credit Note | Credit Invoice |

|---|---|---|

| Definition | Document reducing buyer’s payable amount | Invoice showing credit or adjustment |

| Timing of Issue | After the original invoice | Can be issued at the time of adjustment |

| Accounting Impact | Reduces accounts receivable | Adjusts sales ledger or accounting entries |

| Reference | Refers to original invoice | May or may not reference original invoice |

| Common Usage | Returns, discounts, billing errors | Credit transactions, accounting adjustments |

Summary of Differences:

- Credit notes are primarily used to correct or adjust past invoices, often after goods are returned or billing errors are discovered.

- Credit invoices are more flexible and can be used proactively or retroactively to reflect adjustments in the accounts, sometimes without referencing a specific original invoice.

Understanding these differences ensures that businesses maintain accurate financial records and avoid disputes with customers or tax authorities.

Practical Examples

Example 1: Return of Goods

- Scenario: A buyer returns damaged goods worth $500.

- Action: The seller issues a credit note for $500, reducing the buyer’s payable amount.

- Impact: Accounts receivable decreases by $500, and the buyer’s outstanding balance is updated.

Example 2: Discount After Billing

- Scenario: A seller decides to offer a 10% discount after the invoice has been issued.

- Action: A credit note is issued for the discount value, e.g., $100 on a $1,000 invoice.

- Impact: The buyer pays $900 instead of $1,000, and the reduction is officially documented.

Example 3: Accounting Adjustment with Credit Invoice

- Scenario: An invoice was overcharged due to a calculation error.

- Action: The seller issues a credit invoice to adjust the overcharged amount.

- Impact: The sales ledger is updated to reflect the correct revenue, ensuring accurate financial reporting.

How to Issue a Credit Note

Issuing a credit note may seem straightforward, but doing it correctly ensures accurate accounting and legal compliance. Here’s a step-by-step guide:

- Identify the Reason for Issuance

Determine why the credit note is required — it could be a return of goods, billing error, or post-invoice discount. - Reference the Original Invoice

Mention the invoice number and date that the credit note is adjusting. This helps both seller and buyer track the transaction. - Fill in Seller and Buyer Details

Include complete names, addresses, and contact information for clarity and record-keeping. - Specify the Amount Credited

Clearly state the total amount being credited, including taxes if applicable. - Include Taxes and Adjustments

Ensure that any GST, VAT, or other applicable taxes are correctly adjusted in the credit note. - Send to Buyer and Update Accounting Records

Share the credit note with the buyer and make the necessary entries in your accounting system to reflect the adjustment.

Following these steps ensures transparency, prevents disputes, and maintains clean financial records.

Importance of Credit Notes in Business

Credit notes are more than just a financial formality; they play a crucial role in business operations:

- Maintain Accurate Accounting Records: Helps track all adjustments to invoices and outstanding balances.

- Legal Compliance for Taxation: Ensures GST/VAT or other taxes are properly accounted for, reducing the risk of penalties.

- Build Trust with Customers: Demonstrates professionalism and accountability, strengthening customer relationships.

- Prevent Disputes: Provides official documentation for returns, discounts, or corrections, avoiding misunderstandings.

By issuing credit notes systematically, businesses can streamline credit management and maintain a professional image.

Q1: Can a credit note exceed the original invoice amount?

No, a credit note typically cannot exceed the original invoice amount. If adjustments exceed the original invoice, a separate agreement or document is required.

Q2: Is a credit note mandatory for returns?

While not always legally mandatory, issuing a credit note is considered best practice for returns, ensuring transparency and proper accounting.

Q3: Can a credit invoice and credit note be the same document?

In some systems or regions, a credit invoice serves the same function as a credit note, but technically, a credit note specifically references an existing invoice, while a credit invoice may not.

Q4: How do credit notes impact GST/VAT reporting?

Credit notes reduce the taxable amount in GST/VAT reporting, reflecting the adjustment in sales and output tax. Accurate documentation is crucial for compliance.

Credit notes and credit invoices are essential tools for managing financial adjustments in business. Understanding their differences, proper issuance, and accounting impact ensures:

- Accurate bookkeeping

- Legal compliance

- Strong customer relationships

- Smooth dispute resolution

Businesses are encouraged to implement a proper credit management system to simplify transactions and maintain transparency.

For seamless credit and invoice management, download the Vyaaparkhata App here: Vyaaparkhata on Google Play.