In the world of business, financial documents play a crucial role in ensuring smooth transactions and maintaining transparency. Documents like invoices, receipts, and bills are essential for tracking payments, managing accounts, and meeting taxation requirements. While these terms are often used interchangeably, each serves a distinct purpose in the business process.

An invoice is typically a request for payment, a receipt confirms that a payment has been made, and a bill often indicates the amount owed for goods or services. Understanding the differences between these documents is vital not only for accurate accounting but also for avoiding disputes, improving cash flow management, and ensuring compliance with legal and financial regulations.

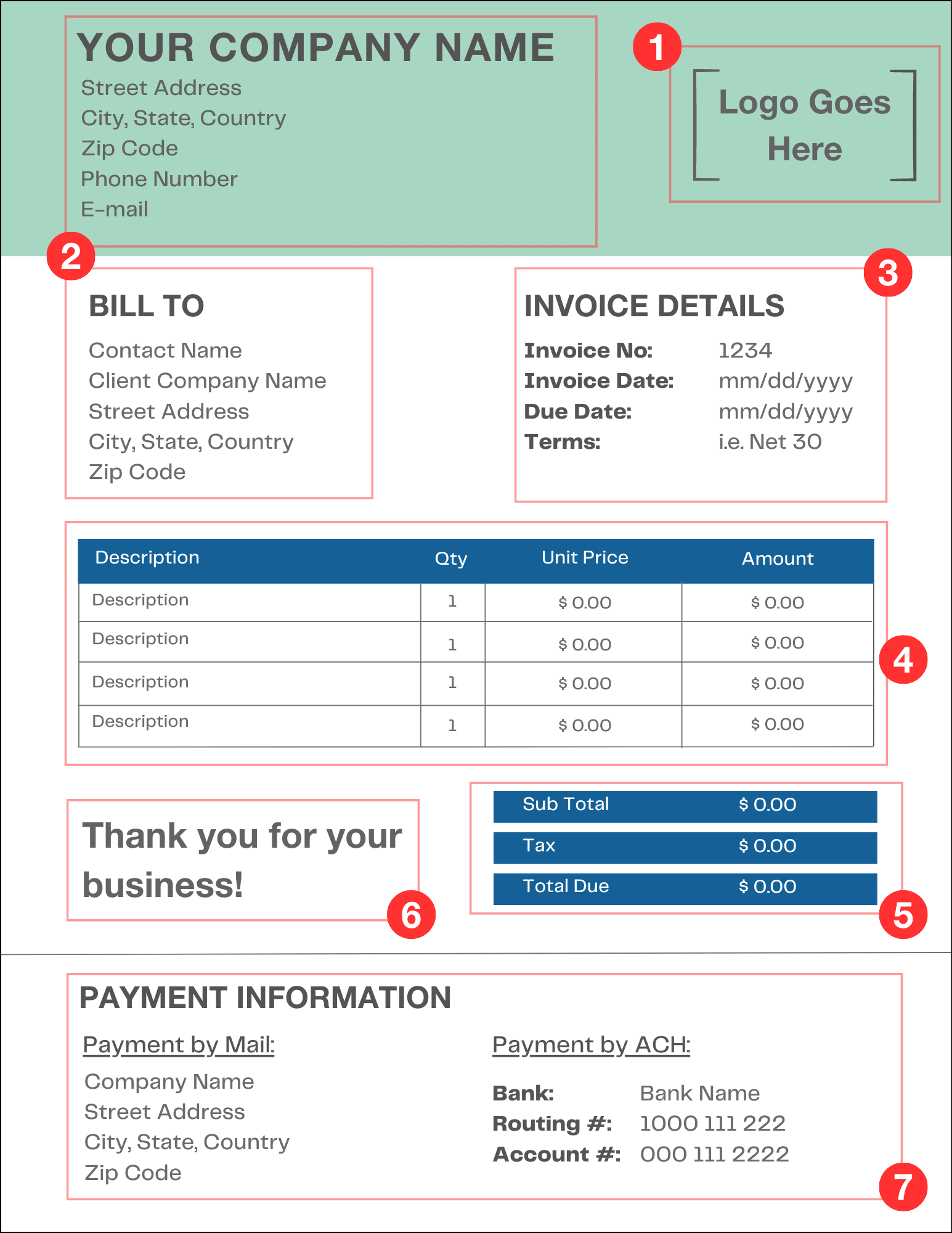

Invoice = formal document issued by a seller to a buyer, requesting payment for goods or services provided. It serves as a detailed record of the transaction, including the quantity, price, and payment terms. Invoices are typically issued before payment is made and are essential for accounting, taxation, and financial record-keeping. Businesses use invoices in scenarios like supplying raw materials, offering professional services, or delivering products on credit. Legally, invoices can serve as evidence of a transaction and help ensure timely payments while maintaining transparency in business operations.

Receipt = document that confirms a payment has been made by the buyer to the seller. It is usually issued after payment is received and serves as proof of the completed transaction. Receipts are commonly used in retail stores, restaurants, service centers, and online purchases. They detail the items or services purchased, payment amount, date, and mode of payment. Receipts are important for record-keeping, warranty claims, and tax purposes, providing both the buyer and seller with legal documentation of the payment.

Bill = statement of money owed for goods or services received. While it is similar to an invoice in requesting payment, a bill is often more informal and commonly used in everyday transactions like utilities, restaurants, and retail stores. Bills can be issued before or at the time of payment, depending on the context. They serve as a reminder of pending payments and help in tracking expenses. Bills play an important role in daily life by ensuring that both parties are aware of the amount due and facilitating smooth financial exchanges.

Key Differences Between Invoice, Receipt, and Bill

| Feature | Invoice | Receipt | Bill |

|---|---|---|---|

| Purpose | An invoice is a formal request for payment issued by the seller to the buyer, specifying the amount due for goods or services provided. | A receipt serves as proof of payment, confirming that the buyer has paid the seller. | A bill is a statement of amount owed, reminding the customer of pending payment for goods or services received. |

| Timing | Invoices are issued before payment, usually to request or schedule payment. | Receipts are generated after payment, documenting the completion of the transaction. | Bills are generally issued before payment but can also be presented at the time of consumption, like in restaurants. |

| Legal Importance | Invoices are crucial for accounting, taxation, and legal record-keeping, helping businesses track receivables. | Receipts act as evidence of the transaction, useful for audits, warranties, and tax purposes. | Bills are usually informal requests for payment, with less legal weight but essential for daily transactions and reminders. |

| Required Details | Must include customer info, items or services, amount, and due date to ensure clarity and accountability. | Should list items, amount paid, and payment method, confirming what was settled. | Typically includes items, total amount, and due date, ensuring the customer knows what they owe. |

Common Elements of Each Document

Invoices, receipts, and bills share several common elements that help identify and track transactions. These include the date of the transaction, the amount involved, a description of the product or service, and the parties involved (buyer and seller). While these elements appear in all three documents, their purpose influences how they are used. Invoices emphasize the payment due, receipts focus on the payment completed, and bills highlight the amount owed, allowing businesses to maintain accurate records and ensuring transparency in every financial exchange.

Why Understanding the Differences Between Invoice, Receipt, and Bill is Essential

Ensures Accounting Accuracy

Using the right document helps businesses maintain precise financial records. An invoice tracks money owed, a receipt confirms payment, and a bill indicates pending charges. Misusing them can lead to errors in bookkeeping, misreported revenue, or missed payments.

Simplifies Tax Compliance

Invoices and receipts are crucial for tax reporting. Proper documentation helps businesses claim deductions, pay correct taxes, and avoid legal issues with tax authorities. Understanding each document ensures businesses remain compliant with financial regulations.

Strengthens Record-Keeping Practices

Well-maintained financial documents provide a clear trail of transactions. Receipts prove payment completion, while invoices and bills clarify pending or requested payments. Organized records help during audits, internal reviews, or future financial planning.

Prevents Payment Disputes

Confusion over payments can damage business relationships. Issuing the correct document at the right time—invoice before payment, receipt after payment, and bill as a statement of charges—reduces misunderstandings and provides clear evidence for resolving disputes.

Enhances Business Transparency and Trust

Clients and customers value transparency. By consistently using invoices, receipts, and bills correctly, businesses demonstrate professionalism, build credibility, and strengthen long-term relationships.

Mastering Invoices, Receipts, and Bills for Smooth Transactions

Clear Distinctions Make Operations Efficient

Invoices, receipts, and bills each serve unique purposes in business transactions. Knowing when and how to use them ensures accuracy, transparency, and smooth cash flow.

Promotes Professionalism and Trust

Proper financial documentation reflects a well-organized business. It reassures clients, reduces errors, and prevents disputes, creating a foundation of trust and credibility.

A Simple Step Toward Organized Business

By mastering these documents, businesses and customers alike can enjoy hassle-free transactions, seamless accounting, and a clear record of every financial interaction.

How Vyapaarkhata Helps You

Vyapaarkhata is a smart business accounting app that helps you manage invoices, receipts, bills, and payments efficiently. Stay organized, track your transactions, and grow your business seamlessly.

Download on Play Store Create Account