In the world of business transactions, both proforma invoices and tax invoices are essential documents, but they serve very different purposes. Knowing when to issue each invoice can help ensure smooth operations and compliance with financial regulations.

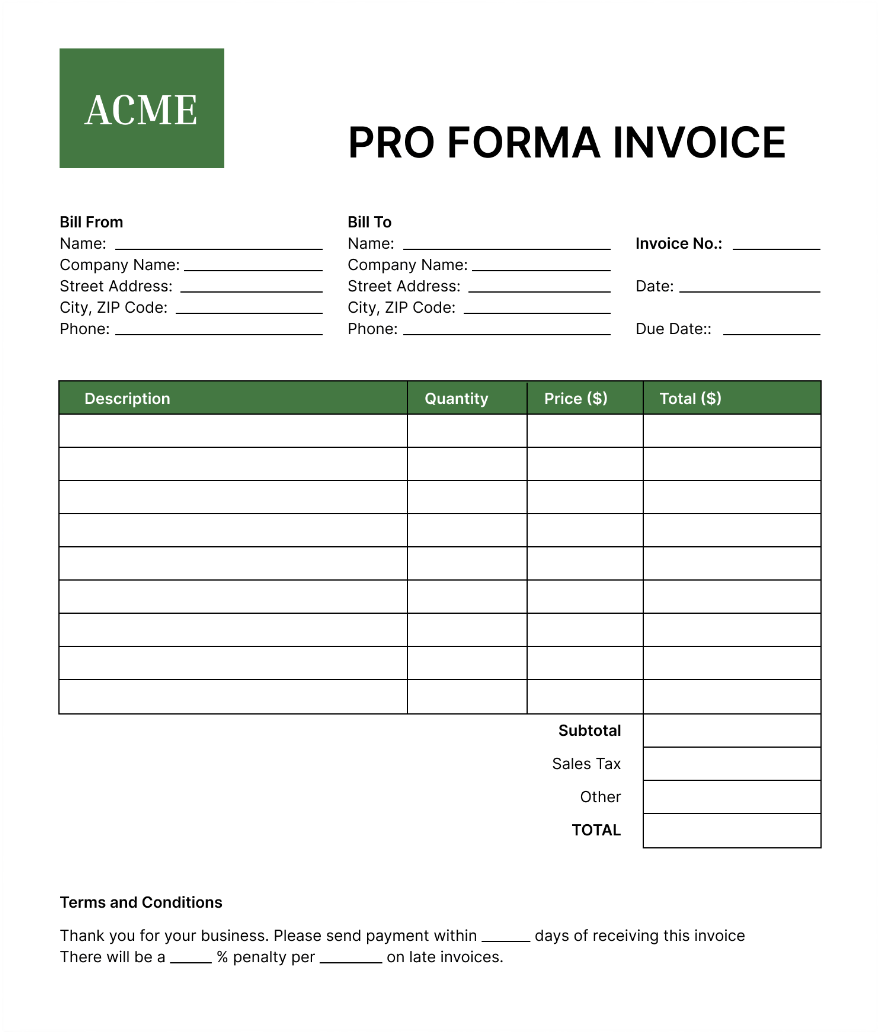

What is a Proforma Invoice?

A Proforma Invoice is a pre-sale document shared with a buyer to outline the proposed details of a transaction. It includes information such as item descriptions, pricing, quantity, and terms of sale, but is not a legally binding invoice.

Characteristics of a Proforma Invoice:

- Sent before goods or services are supplied

- Used for quotation or approval

- Carries no legal or tax weight

- Doesn’t require an accounting entry

- Common in international trade, advance billing, and approval processes

Ideal Scenarios for Proforma Invoice:

- When the buyer needs a quotation in invoice format

- To get internal or external approval before proceeding

- For customs purposes in international shipments

- When the buyer needs to apply for a Letter of Credit

- Before requesting advance payment

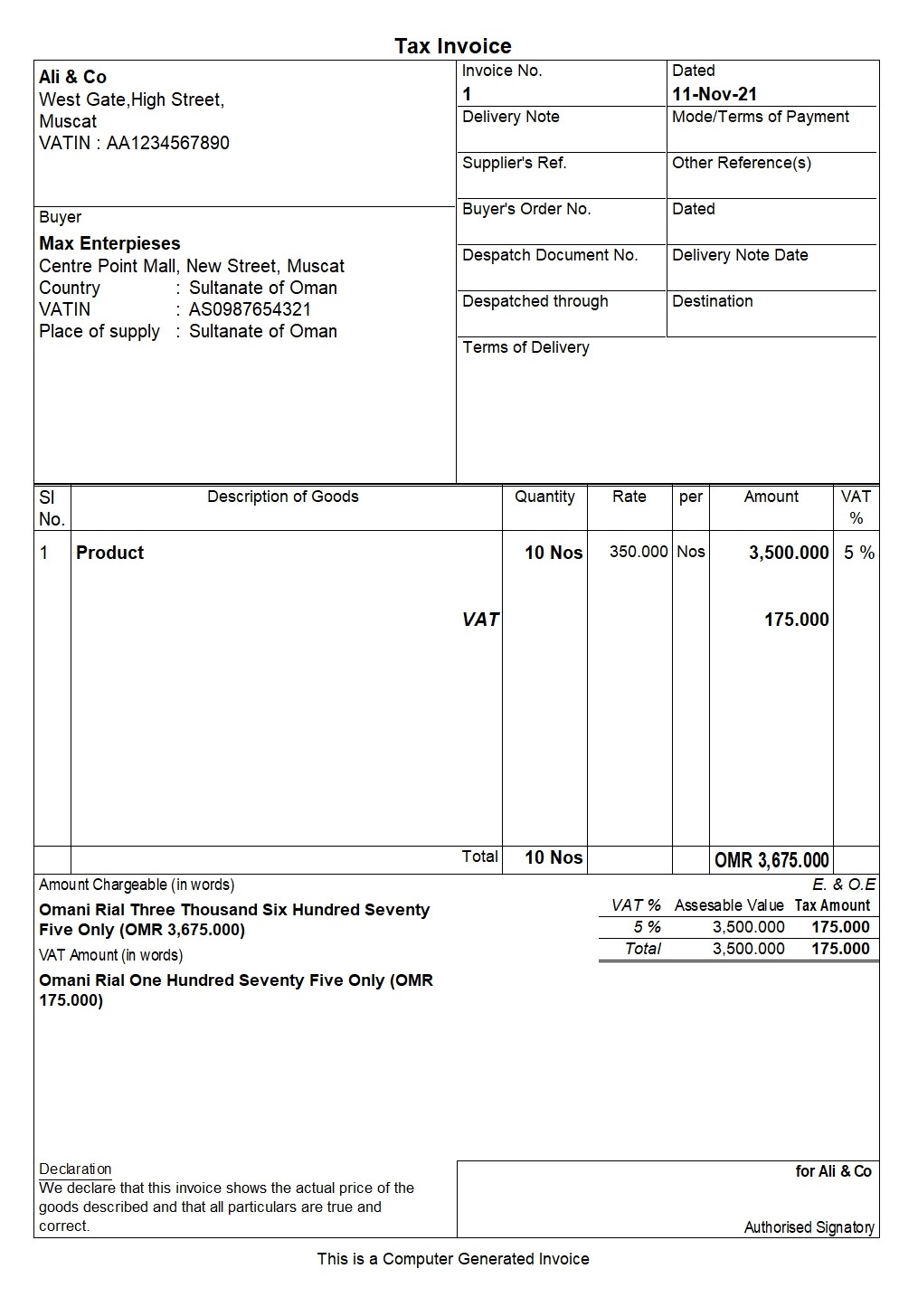

What is a Tax Invoice?

A Tax Invoice is a legal billing document issued once a sale is confirmed and goods or services are delivered. It includes all relevant tax components, such as GST, and serves as proof of the transaction.

Tax invoice format.

Characteristics of a Tax Invoice:

- Issued after the sale and delivery

- Includes applicable taxes (like GST or VAT)

- Legally required for tax filing and compliance

- Can be used by the buyer to claim Input Tax Credit (ITC)

- Must be recorded in the company’s financial books

Ideal Scenarios for Tax Invoice:

- Once the order is fulfilled and delivered

- To collect payment from the customer

- For GST compliance and tax returns

- When the buyer needs the document for ITC claims

Proforma Invoice vs. Tax Invoice: Side-by-Side Comparison

| Aspect | Proforma Invoice | Tax Invoice |

| Purpose | Serves as a quotation or estimate | Confirms a finalized sale |

| When Issued | Before sale confirmation | After delivery or service |

| Legal Status | Not legally binding | Legally enforceable |

| Tax Involvement | Taxes may be shown as a reference only | Taxes must be accurately detailed |

| Accounting Record | Not entered into books | Must be recorded |

| Input Tax Credit (ITC) | Not applicable | Applicable if GST is included |

Choosing the Right Invoice: A Quick Guide

| Situation | Document to Use |

| Providing a quote to a customer | Proforma Invoice |

| The sale is finalized and delivery is done | Tax Invoice |

| Seeking buyer approval before the sale | Proforma Invoice |

| Need to comply with GST rules | Tax Invoice |

| Exporting goods across borders | Proforma Invoice |

| Billing customers and collecting payments | Tax Invoice |

Some Other Types of Invoices

Invoice types are based on business transactions, as mentioned below.

Commercial Invoice

- Used in international trade

- Includes shipping details, HS codes, and customs info

Credit Invoice (Credit Note)

- Issued for refunds or to reduce the invoice amount

- Common in cases of product returns or overbilling

Debit Invoice (Debit Note)

- Used to increase the amount payable

- Often issued for underbilled items or extra charges

Recurring Invoice

- Sent at regular intervals (monthly, weekly, etc.)

- Ideal for subscriptions and ongoing services

Timesheet Invoice

- Based on hours worked

- Used by freelancers, consultants, and hourly workers

Interim Invoice

- Issued for partial payments during long-term projects

- Helps manage cash flow over project duration

Final Invoice

- Sent after project completion

- Reflects total cost after deducting interim or advance payments

Retainer Invoice

- Issued to request an upfront deposit

- Amount adjusted in the final billing

E-Invoice (Electronic Invoice)

- Digitally generated as per government regulations

- Mandatory under GST for businesses above a certain turnover

To summarize: use a Proforma Invoice when initiating a transaction and discussing terms. Opt for a Tax Invoice when the sale is complete and tax reporting is required. Each plays a vital role in the sales cycle and helps maintain clear, compliant, and professional business practices.

To start generating professional invoices for your clients, simply create an account on VyaaparKhata. Once registered, add your products and client details, and you’ll be ready to create and share customized invoices in just a few clicks. You can share it via mail, download in PDF format, or Image format.